20 Most Read Panjiva Research Reports in July

Consolidation returned to the logistics industry in July, with our readers’ most read articles including the state of the NVOCC and container-line sectors as well as COSCO Shipping’s bid for Orient Overseas. A focus on trade policy was inevitable, with the Trump administration considering its options in Venezuela for “strong and swift” action. U.S relations with both China and Russia soured later in the month after foregone opportunities to develop exports earlier in July. Our review of the Trump administration’s first six months showed delivery on commitments in dealmaking, but slow progress on imports. Initial NAFTA objectives could be easily met with a transactional deal. Elsewhere Japan pushed ahead with trying to deliver implementation of TPP while also reaching an agreement-in-principle for the EPA deal with the EU.

#1 Expeditors starts its fightback (July 13) Expeditors International was the only top 10 NVOCC to increase its shipments of U.S.-inbound containers in June, while DSV saw a drop in volumes on a year earlier when stripping out its UTi acquisition. Consolidation is a necessary evil in a sector that remains under-consolidated (as this week’s comments from DSV have shown).

Source: Panjiva

#2 Made in America week needed China focus (July 18) The Trump administration’s “Made in America” week had been expected to include action on steel and aluminum imports. In reality these were held up, possibly to avoid damaging Comprehensive Economic Dialogue talks with China during the same week.

#3 President Trump’s Venezuelan oil conundrum (July 27) The deteriorating political situation in Venezuela led President Trump to promise “strong and swift” sanctions. Our analysis showed that oil imports, worth $9 billion, provide the most leverage. However, the CLAP food program run by the military would suffer, thus harming the population at large. Food imports were already at December 2015 lows in May.

#4 TPP reboot faces alphabet of competition (July 10) Talks to restart the process of ratifying the Trans-Pacific Partnership hinged initially on technical, rather than policy, measures. Access to Japan is the main prize for the other signatories. However, they also have the RCEP deal to consider, while Japan also needs to spend political capital closing a deal with the EU.

#5 Ross yet to become the man of steel, tariffs (July 24) The long-awaited results from the section 232 review of the steel industry were presented to the House Ways & Means committee by Commerce Secretary Wilbur Ross. Our analysis of over 2,200 country-product pairs shows there are few areas that can be acted upon without also hurting Canada or other allies.

Source: Panjiva

#6 Trump at 0.5 – export action, import inaction (July 19) Our review of the first six months of the Trump administration’s trade policy shows it has made good on plans to abandon TPP, renegotiate NAFTA, conduct bilateral talks and persuade other countries to buy more U.S. exports. However, action on a slew of assessments of imports and causes of the trade deficit has been notably lacking.

#7 4% export hike could meet NAFTA objectives (July 18) The U.S. Trade Representative finally released the administration’s objectives in renegotiating NAFTA from August 16. They hinge around reducing the U.S. trade deficit. Our calculations show that, excluding energy and including services, the deficit could be wiped out by increasing goods exports by as little as 4%. That suggests a “transactional” renegotiation might be the best route to follow.

#8 COSCO’s Orient odyssey (July 10) Consolidation returned to the container-line industry with COSCO Shipping’s $6.3 billion bid for Orient Overseas. Regulatory issues around market share are likely to be the biggest block, while it is difficult to see the strategic synergies given route overlap between the two. Our calculations show the bid price is lower than Hapag-Lloyd’s UASC deal but well above Maersk’s bid for Hamburg Sud.

#9 Trudeau and Trump put transaction NAFTA at risk (July 26) Even before formal negotiations start, heads of state commentary puts a simple deal at risk. President Trump threatened to “terminate NAFTA” if the deal isn’t what the U.S. wants, while Prime Minister Trudeau demanded an updated dispute settlement process.

#10 Chipping away at China / U.S. talks (July 12) The final push in the 100 days of talks between the U.S and China in the Comprehensive Economic Dialogue could have brought some easy wins in semiconductors, our analysis showed. In the end the talks fizzled and relations worsened later in the month.

Source: Panjiva

#11 CNOOC could be Maduro’s sanctions sanctuary (July 19) As mentioned above, the U.S. spent much of the month mulling sanctions against the Maduro regime. We took a deep-dive into Venezuelan oil major PdVSA’s commercial operations, highlighting the risks to its U.S. refining operations and the importance of China as a refuge customer.

#12 The peakiness of the peak season (July 25) The start of the peak shipping season raises the question as to whether U.S. imports will continue previous years’ pattern. Our analysis of 2016 showed that while peak season was both “flatter” and later than before, that was likely due to Hanjin Shipping’s failure. This year’s pattern will likely rely more on importers’ desire to avoid tariffs.

#13 Mexico readies its NAFTA food hedge (July 11) Mexico’s government has made no secret of its desire to cut its reliance on the U.S. as a grain supplier. Negotiations to buy Argentine wheat are a first step, though our analysis showed that corn imports are a much bigger issue.

#14 Argentina needs a bean bounce (July 25) Argentine agriculture needs more than wheat supplies to Mexico to recover after the country’s first June deficit since 2010. The state of trade of trade in the coming quarter will depend on soybean exports, where it faces significant competition for Chinese sales from U.S. farmers.

#15 Political gain, legislative pain for EPA (July 7) The EU and Japan reached a preliminary deal in the Economic Partnership Agreement, though the deal will only be completed later in the year. While making a political point at the G20 in the face of U.S. bilateralism, the legislative hurdles facing the deal are significant if a year-end completion is wanted.

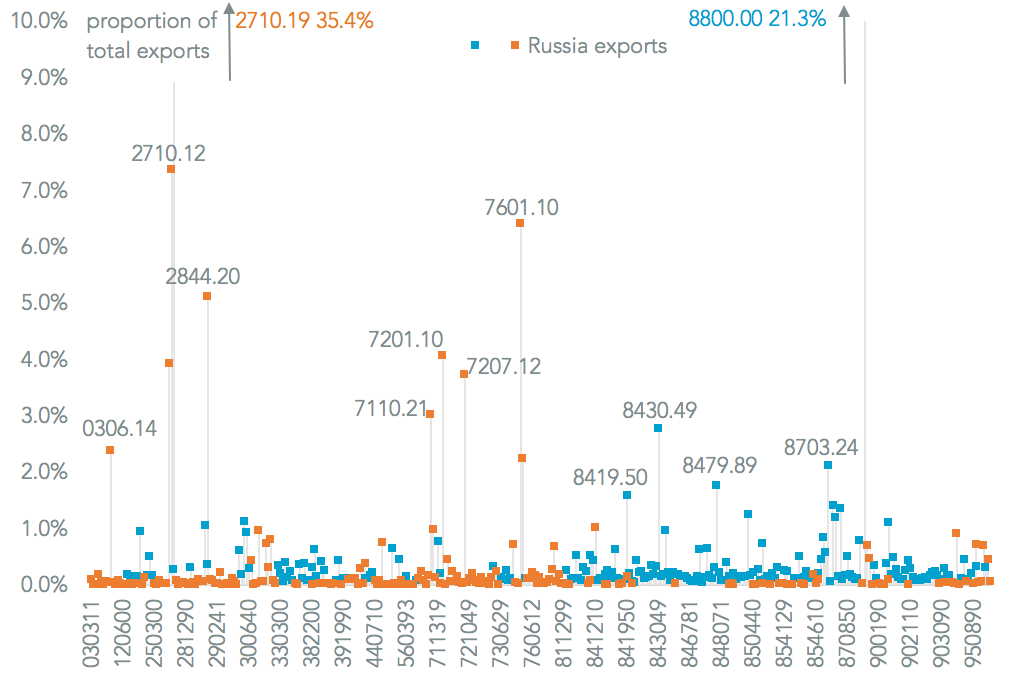

#16 Trump and Putin miss metals trade opportunity (July 6) The controversial first meeting between President Putin and President Trump could have, but didn’t, generated opportunities in trade. Metals should have been a topic, with our data showing Russia’s exports steadily increasing and boosting Russia’s trade surplus. As with China, relations soured later in the month.

Source: Panjiva

#17 Russia sanctions haunt EU/U.S. relations (July 24) The worsening U.S. / Russia relations relating to a new sanctions bill from the U.S. Congress looked set to have a knock-on effect on U.S. / EU trade relations. One area for U.S. sanctions could be energy exploration equipment.

#18 Foreign power problems for American aluminum (July 10) An indepth review of the U.S. aluminum industry requested last year by Congress finally reported. The U.S. ITC found that overseas subsidies for electricity production has been one of the biggest factors that have damaged the American aluminum industry.

#19 Slowing Indian trade needs U.S. deal (July 17) Our deep-dive analysis of India’s international trade finds the slowing rate of growth in exports needs a boost in manufacturing to correct. Increased access to the U.S. market, possibly via the “comprehensive review” of trade initiated by Prime Minister Modi and President Trump, would be a key part of that.

#20 Carriers tighten grip even before mergers (July 13) The top five container-lines on U.S> inbound traffic increased their market share to 31% in June. Once the current round of consolidation is complete – including the COSCO / Orient Overseas deal mentioned already – that will rise to 39%.

Source: Panjiva