The U.S. and China have announced initial results from their 100 day trade dialogue. This was a key deliverable for the government following an initial meeting between President Donald Trump and President Xi Jinping, as outlined in Panjiva research of April 26. It is notable that only three of the 10 items relate to physical goods, while only two of those are focussed on U.S. exports.

The moves to increase exports of beef and liquefied natural gas were already flagged at the time of the original meeting as areas for progress. That seven of the 10 items relate to financial services and support for each others’ trade policies shows the complexity of international trade negotiations. A commitment to transforming the 100 day process into a one year process is therefore not a surprise.

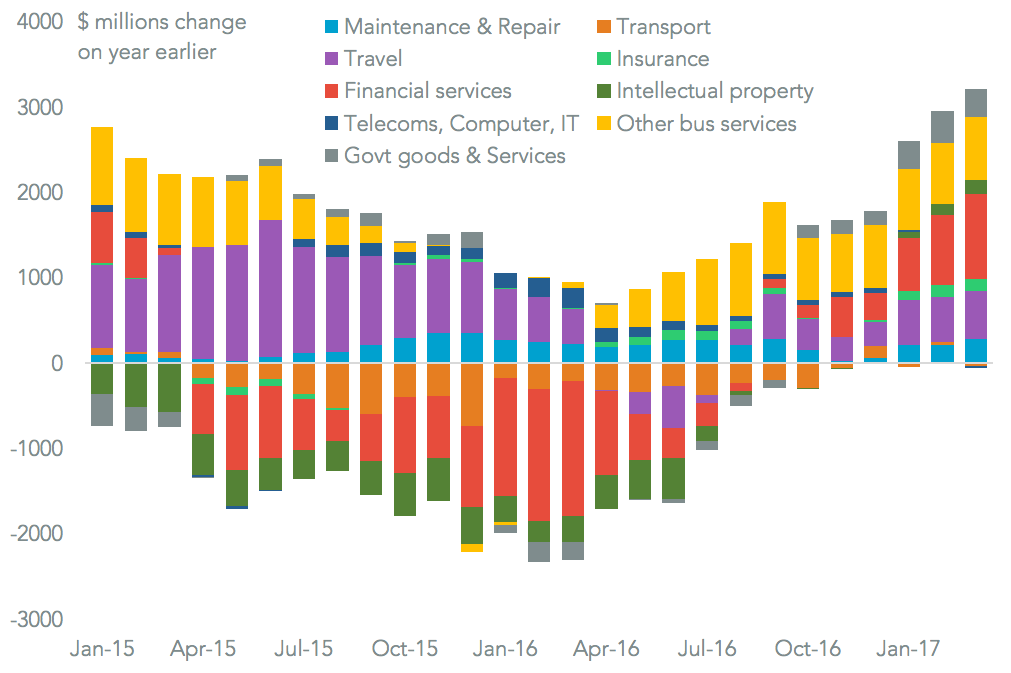

The Trump administration’s key metric for trade deal success is a lower trade deficit. Further growth in financial services exports will help here as it has done in the past seven months, Panjiva analysis shows.

Source: Panjiva

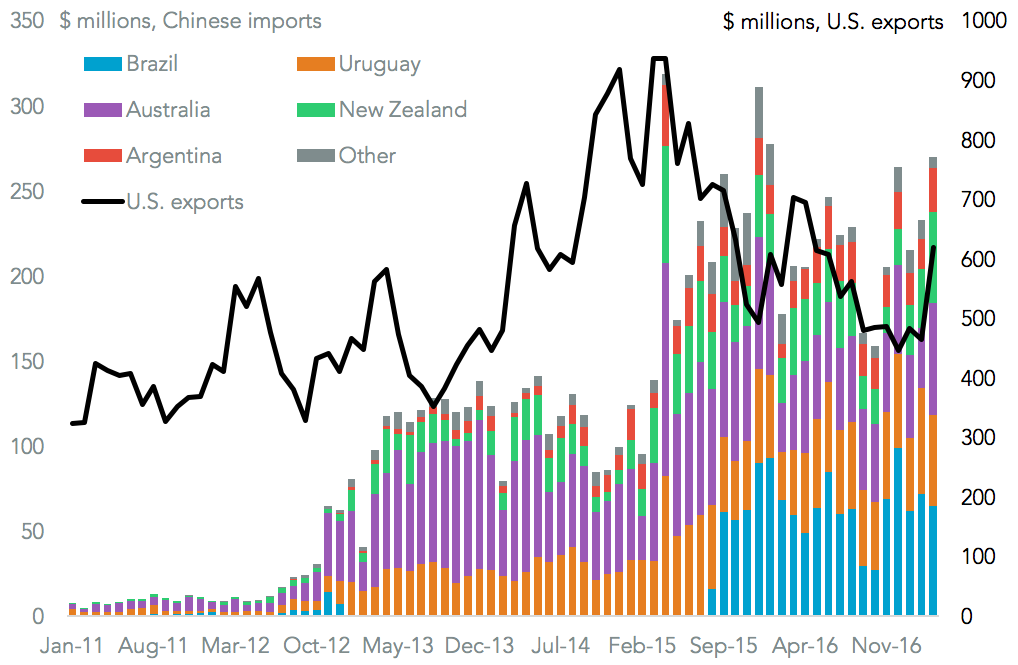

The agreement includes a commitment to increase U.S. exports of beef no later than July 16, the 100 day point after the Presidents’ meetings. Panjiva data shows Chinese beef imports increased 8.7% on a year earlier in the first quarter. That was led by a 36.3% increase in shipments from Uruguay and 23.6% from New Zealand, displacing shipments from Brazil. Those fell 10.0%, possibly as a result of fallout from the meat scandal there.

Global U.S. exports fell 16.1% in the first quarter on a year earlier. If U.S. exports took a 25% market share in China, based on the past 12 months values, that would add 10.2% to U.S. exports.

Source: Panjiva

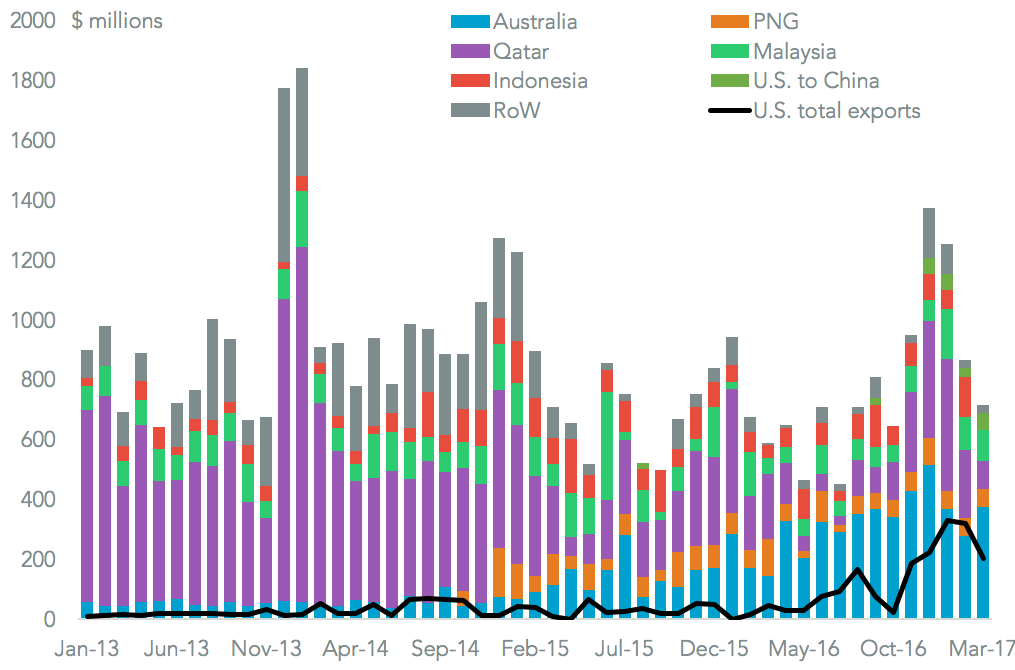

While there were not firm commitments to volumes of liquefied natural gas, or LNG, to be shipped the U.S. will “welcome” any contracts that are signed. That is because exports require permission if they are to be made to countries that the U.S. does not hold a free trade agreement with.

Chinese imports of LNG increased 28.5% in the first quarter compared to a year earlier, led by a 70.3% increase in shipments from Australia. The U.S. accounted for 16.8% of shipments. Assuming U.S. suppliers took 50% of incremental Chinese demand at a 30% growth rate, this could add 50% to U.S. LNG exports based on first quarter figures. That would rely, of course, on new volumes becoming available from existing and new LNG terminals.

In aggregate the increase in LNG and beef exports, worth around $tk million on the analysis above, would add $2.36 billion to U.S. exports to China. That’s equivalent to 2.0% growth in exports, and would cut the deficit with China by 0.6%.

Source: Panjiva