President Donald Trump has flagged the potential to provide tariff exemptions for Apple Inc., Reuters reports. While not specifying whether these relate to components – the comments were made while touring Apple’s computer assembly plant in Texas – or finished products such as the iPhone the President did indicate that “we made a great trade deal with South Korea – but we have to treat Apple on a somewhat similar basis as we treat Samsung“.

That may indicate a willingness to exempt completed products should tariffs be extended to cover laptop computers and phones from Dec. 15 – as flagged in Panjiva’s research of Nov. 13 talks with China may be faltering and not reach a “phase 1” conclusion by then.

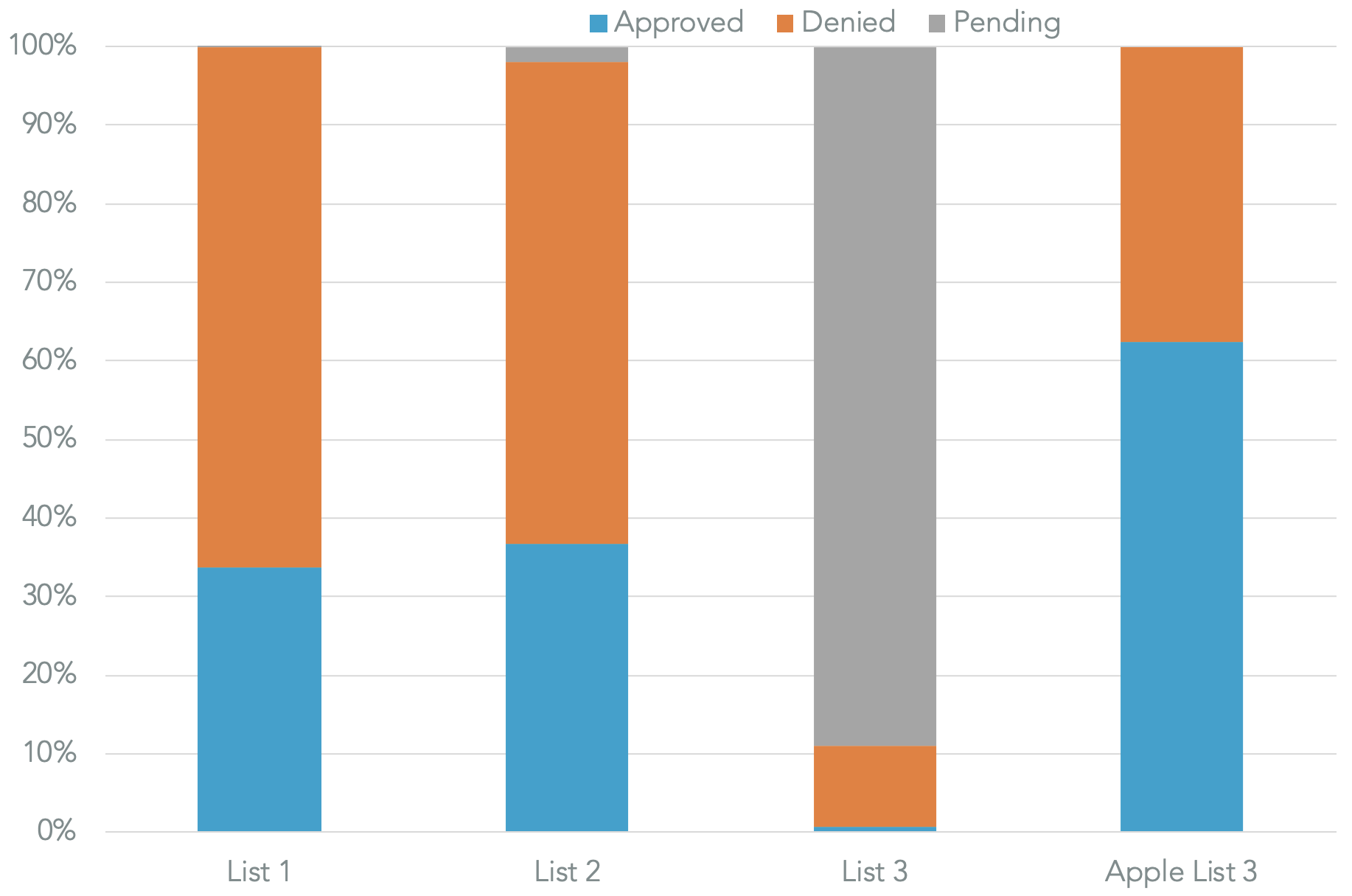

Panjiva’s analysis of U.S. Trade Representative filings shows that Apple has filed 26 section 301 tariff exemption requests. Of those 16 relate to list 3 tariff-lines with 10 having been approved and six – mostly generic PC parts – having been refused.

Apple’s 62.5% success rate is remarkable when compared to the average 5.9% rate achieved for a list 1 requests. It has also had all its cases reviewed compared to just 10.9% of list 3 requests in total that have been approved.

Source: Panjiva

In list 4A, Apple has already asked for exemptions for smart speakers (Homepod, Beats Pill), headphones (AirPods), wearables (Apple Watch) and the iMac computer as well as accessories such as charging cases and components including NAND storage and battery modules.

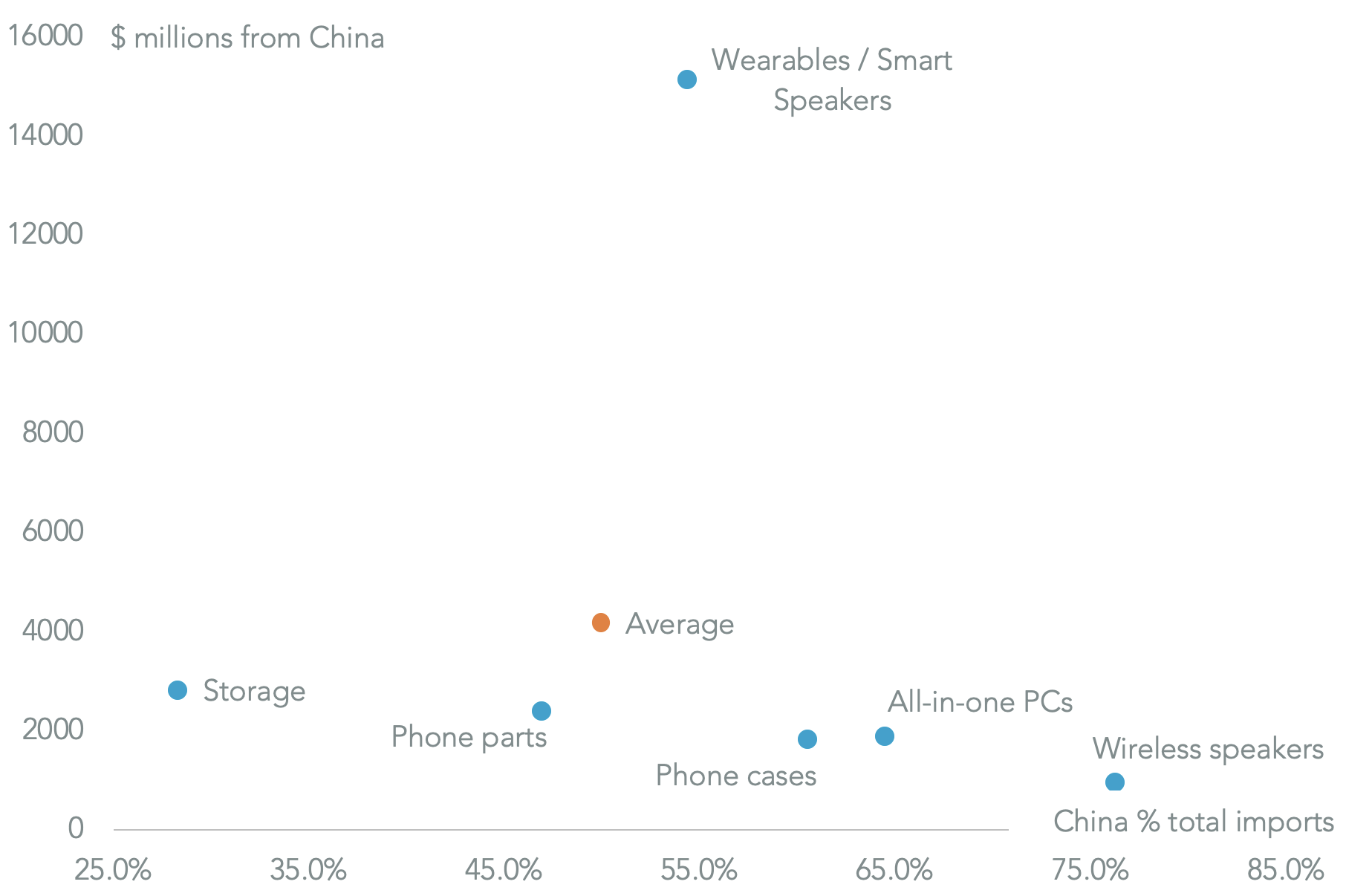

Panjiva’s data shows total U.S. imports of the products targeted by Apple for exemptions across all importers from China were worth $25.1 billion in the 12 months to Sept. 30, representing 49.9% of the total imports of those products from all countries.

The largest category was wearable tech and smart speakers where imports from China were worth $15.2 billion, of which 54.3% came from China. That was followed by NAND and SSD storage devices worth $2.84 billion, though only 28.3% came from China. The most exposed product category to China is wireless speakers – such as the Beats Pill+ – with 76.3% from China.

Given effectively half of all sourcing is from outside China, Apple must have made a convincing case that its supply chains cannot be restructured in either a timely or a cost effective manner. Active lobbying and access to top flight legal resources also likely helped compared to smaller exemption requesters.

Source: Panjiva

That would suggest that Apple may be successful in appealing tariffs if list 4B duties of 15% are applied to laptops and phones from Dec. 15. While 75.7% of all U.S. phones came from China, Samsung and LG have been able to diversify their supply chains to South Korea and Vietnam. The latter already accounted for 17.4% of all phone imports.

That may put pressure on Apple to make a similar move – as it has already done in moving manufacturing of the iPhone to India for sale in the Indian market. There have been few signs of a rush to beat tariffs, with U.S. imports from China having fallen by 3.7% in September after falling by 8.1% in the prior three months.

The situation for laptop computers is even more extreme, with 92.0% of laptops shipped to the U.S. by value coming from China. Given their use in business and education, as well as the significant additional cost of tariffs in dollar terms, leniency may be forthcoming for all manufacturers. Importers may have initially been concerned about tariffs, but have now become more relaxed – imports rose by just 0.1% in September after a 15.6% surge previously.

Source: Panjiva