An ongoing shortage of capacity to transport goods from Europe to Asia has led the European Shippers Council to issue a second complaint after goods began to experience an eight week delay in shipments. While no official action is being taken at the moment, the ESC has committed to meeting with the European Commission competition authorities in the early summer. The issue also comes at the same time that the EC is considering Maersk’s acquisition of Hamburg Sud through April 10, as discussed in Panjiva research of March 22 (the Maersk briefly suspended bookings in early march) and the “3J” merger is ongoing.

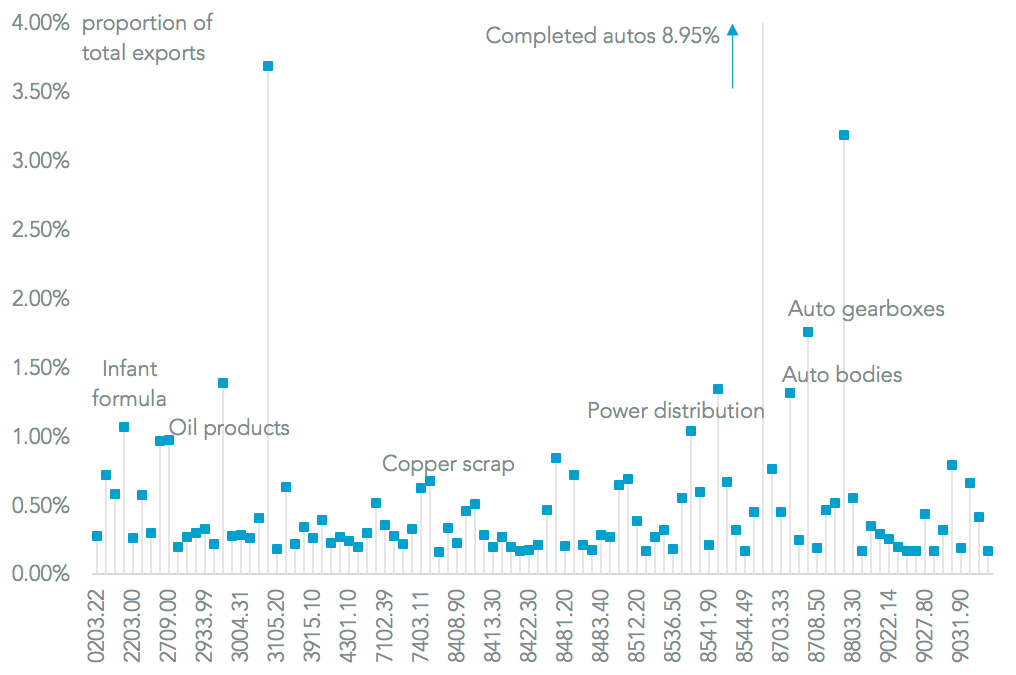

Panjiva analysis of the top 100 import lines from China shows the top products that tend to be shipped by sea from Europe to China include completed autos and parts, infant milk formula and power distribution equipment. That leaves the supply chains of companies as diverse as BMW and Daimler to Wyeth and Keller at risk.

Source: Panjiva