General Motors is shipping several of its light truck models without fuel management systems, Reuters reports, leading to higher fuel consumption and worse emissions, due to a shortage of semiconductors.

The latter had already led to production halts at several factories producing its cars, as discussed in Panjiva’s research of March 5, in common with most other major automakers globally, with our research already having flagged the risks to other electrical systems.

The removal of content appears to be a new strategy among the automakers for dealing with the shortage of components. It isn’t clear whether retrofits are possible or whether other areas of decontenting are possible / may become necessary,

Panjiva’s data shows General Motors was already scaling back its U.S. seaborne imports of automotive components with a 7.7% drop in February compared to a year earlier and a 21.6% drop versus the same month of 2019.

Much of that decline has been driven by a 4.7% dip in imports from Mexico and a 78.3% slide in shipments from Europe and the rest of the world. Shipments from Mexico and South Korea meanwhile improved by 15.0% and 64.0% respectively, indicating a restructuring of the firm’s supply chain after the sale of its European operations to Peugeot Citroen.

Source: Panjiva

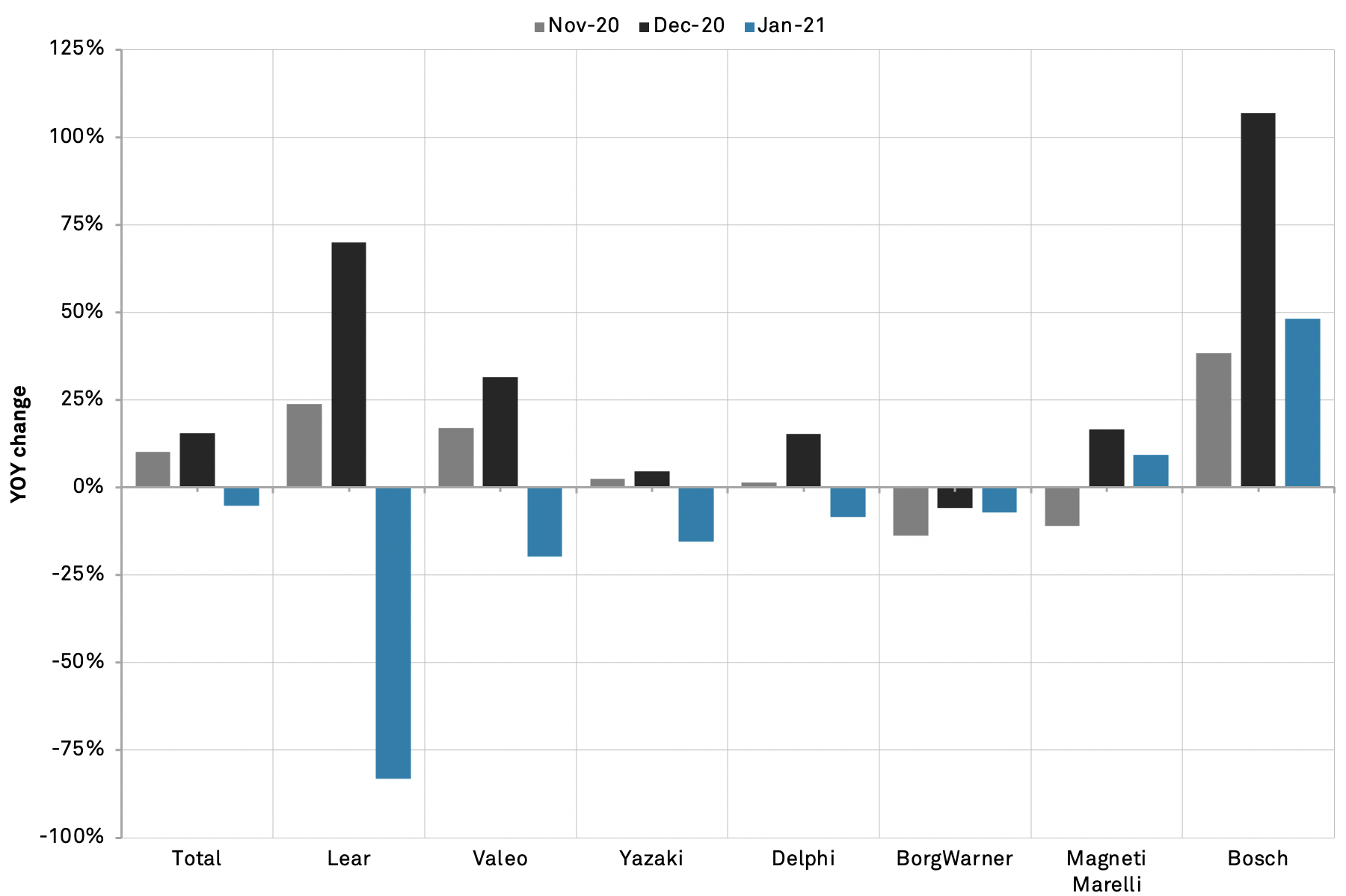

Should other manufacturers follow General Motors’ strategy there’ll likely be a further slowdown in shipments of electrical automotive components. Panjiva’s data shows exports of electrical components from Mexico already dipped by 5.1% year over year in January. The slide was led by a turnaround in exports linked to Lear and Valeo which fell by 83.1% and 19.7% year over year respectively. By contrast imports associated with Magneti Marelli and Bosch improved by 9.3% and 48.1% respectively.

Source: Panjiva