Tea and coffee brewer JDE Peet’s reported H1’21 revenues that increased by 0.5% year over year on a reported basis. In-home sales improved in the six-month period but restaurant sales remained unchanged as pandemic-related lockdowns came and went in different countries at different rates.

One universal trend though has been price inflation in coffee. JDE Peet’s CEO, Fabien Simon, has noted “many raw and packaging materials but also distribution costs started to see substantial price increases,” which he said will reach the firm’s “P&L in the second part of this year“.

The company does not appear to be overly concerned though given “consumer price increases or decreases tend to follow with a lag of about 2 to 3 quarters of the commodity price inflation” and given “consumption of coffee in retail was not lower than in previous years despite almost 14% to 15% consumer price inflation“.

Food price inflation, as discussed in Panjiva’s July 12 research, has been a common trend across food and beverage supplies in 2021 and is largely a result of unusual weather conditions.

Extreme drought conditions in Brazil had already been affecting coffee supplies, including cutting JDE Peets exports of coffee in May. That may become worse with unseasonal frosts in Brazil according to Reuters which could jeopardize next year’s crop.

Panjiva’s analysis of ICO data shows that global exports of coffee actually improved 3.7% year over year in June. That may reflect a comparison to the period when many cafes and restaurants were closed as well as a pickup in supplies from outside Brazil. Shipments from Brazil only fell by 1.3% while those from Mexico surged 41.1% higher to the largest since at least 2015.

Source: Panjiva

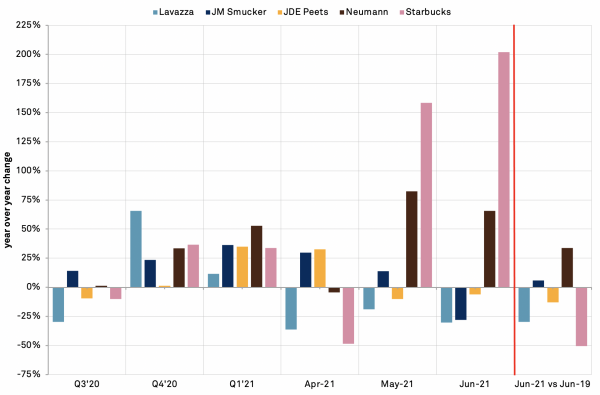

The dip in shipments from Brazil masks a widely different performance from the major coffee buyers. That likely reflects the different firms’ positioning in foodservice versus home consumption products.

Panjiva’s data shows that Brazilian exports linked to JDE Peet’s fell by 6.1% year over year in June which extended a downturn in May and left shipments 13.0% below June 2019 levels. Shipments associated with JM Smucker fell by a more rapid 27.9% year over year in June, reversing an earlier increase but were nonetheless 5.9% better than exports in June 2019. Starbucks likely experienced the fastest expansion in June on a year-over-year basis with a 201.9% rise, though that likely reflects the recovery of foodservice demand and exports were still just half of what they were in June 2019.

Source: Panjiva