President-elect Biden has held a speech outlining his administration’s economic priorities. Perhaps unsurprisingly the focus was on restarting the economy and tackling the COVID-19 pandemic. The President-elect reiterated themes from the campaign, stating that “from autos to our stockpiles, we’re going to buy American. No government contract will be given to companies that don’t make their products here in America.” Details for how manufacturers will otherwise be incentivized to onshore manufacturing have yet to emerge, though the initial outlines have been provided for the healthcare industry, as outlined in Panjiva’s Nov. 10 research.

On trade deals, Biden noted that in talks with heads of state in the CPTPP and RCEP groups that the U.S. priorities will be: “invest in American workers and make them more competitive“; “make sure that labor is at the table and environmentalist are at the table“; that the U.S. is “not looking for punitive trade” with friendly states; and that he wants the U.S. to “set the rules of the road, instead of having China and others dictate outcomes“.

While that would suggest a return to multilateral deals with Asian trade partners is possible, the details are unlikely to be forthcoming in the near term. The President-elect did state that “I have a pretty thorough plan, and I hope to be prepared to announce that to you on January 21“. That may resolve whether an attempt will be made to rejoin CPTPP, the shortest route to taking on China’s position within RCEP in the Asian trade order. The recent signing, but not yet ratification, of RCEP creates more of a sense of urgency here.

Broadly speaking, the U.S. is more “relevant” to the CPTPP group – excluding Canada and Mexico which are already part of USMCA – than RCEP. Bilateral merchandise trade with the U.S. represented, on average, 7.1% of GDP for CPTPP members excluding Canada and Mexico and experienced growth of 18.7% in 2019 compared to 2016, Panjiva’s data for U.S. imports and exports shows.

For the RCEP group meanwhile trade with the U.S. represented just 4.8% of GDP with growth of 7.8%. The latter has been skewed somewhat by the U.S.-China trade war, with bilateral trade in 2019 excluding China up by 18.9%.

Should the U.S. rejoin CPTPP it may make the group more attractive to other countries that are not already a part but may look to do so. South Korea has had discussions to that effect in the past, though the ongoing poor relations with Japan may have held that up.

Indonesia is another country which may benefit from “crossing over” to join CPTPP as well as RCEP. Indeed, Indonesia’s deputy foreign minister, Mahendra Siregar, has noted “the ambition of the government is to double trade in the next five years to $60 billion“, Reuters reports. There’s plenty to play for given the bilateral trade in 2019 of $27.9 billion was just 2.5% of Indonesian trade – the third lowest except Laos and Myanmar whose existing bilateral trade together was just 5% that of Indonesia.

Source: Panjiva

Indonesia already has a degree of preferential access to the U.S. via the Generalized System of Preferences. Access to the GSP was recently renewed by the Trump administration, avoiding the challenges faced by Thailand whose access was partly withdrawn.

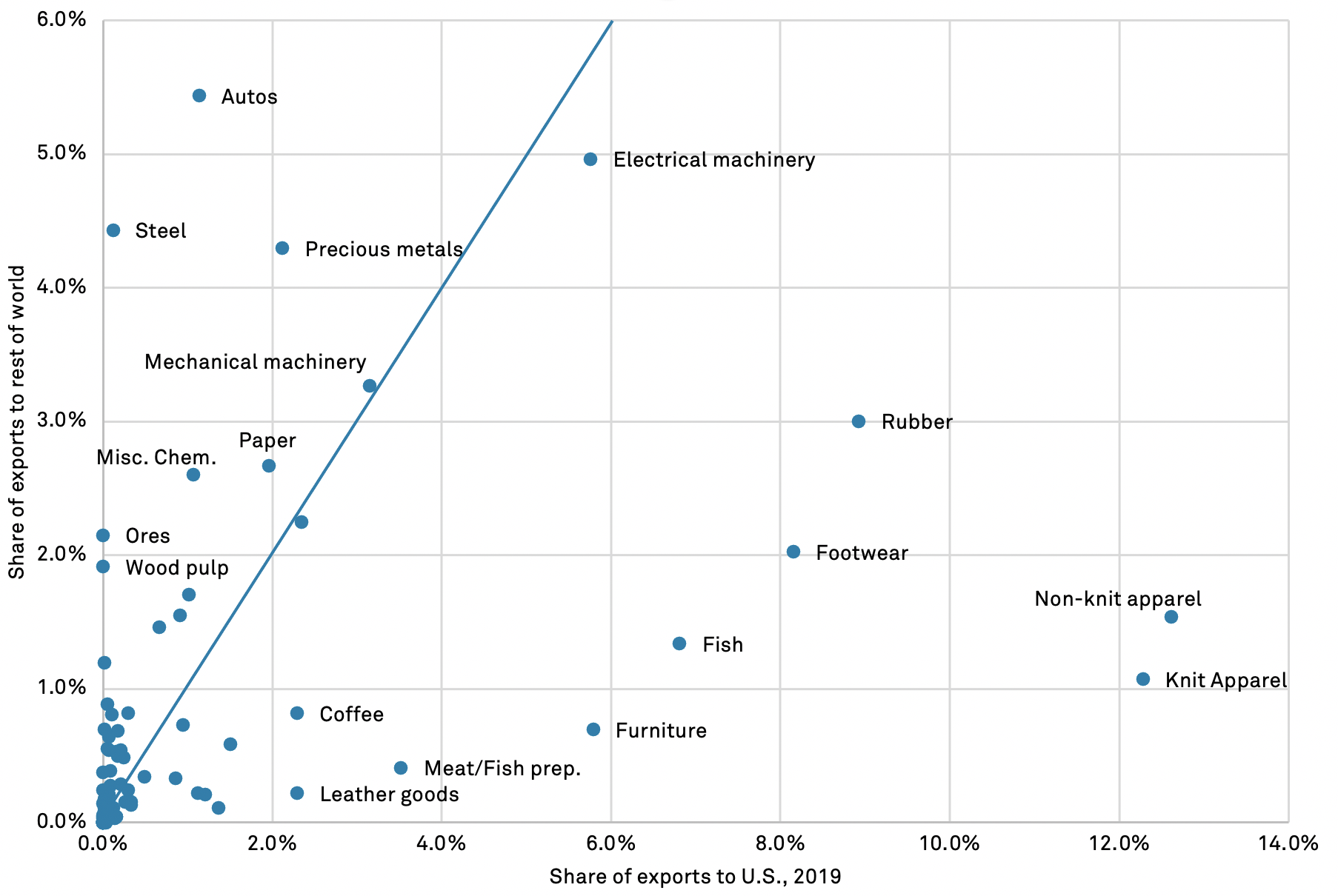

Panjiva’s data shows that Indonesia’s exports to the U.S. are unevenly distributed among products compared to its exports to the rest of the world. The largest examples are in energy products and palm oil. Energy represented 22.8% of Indonesia’s exports to the world ex-U.S. but only 0.4% of shipments to the U.S. That’s hardly surprising given both are significant hydrocarbon producers with minimal competitive advantage.

In the case of palm and other vegetable oils the products accounted for 11.5% of world ex-U.S. exports and 4.5% of U.S.-bound shipments. Again though commodity markets may leave little room for gains given U.S. import duties are already at- or near-zero for those products.

In terms of manufactured goods the most valuable gaps (share of exports ex-U.S. versus U.S. times total U.S. exports in dollars) are in steel and autos which only represented 0.1% and 1.1% respectively of Indonesia’s exports to the U.S.

Products that are over-represented include apparel and footwear which represented 33.0% of exports to the U.S. versus 4.6% of rest-of-world shipments. The Indonesian government will be keen to protect those industries.

Source: Panjiva

Indonesian steel- and automakers that may benefit from increased sales from a trade deal who are not already exporters to the U.S. are led by the local operations of multinationals.

In the autos sector the largest exporter to countries outside the U.S. in the 12 months to July 31 was Toyota with $2.48 billion of shipments led by vehicles produced by the Toyota Astra joint venture. That was followed by exports by Yamaha and Honda exports of motorcycles and parts worth $766 million and $658 million respectively. All three have experienced a downturn in exports during the pandemic.

Among steel exports the largest exporter in the 12 months to July 31 was the local subsidiary of Tsingshan Steel with $1.36 billion of exports. That’s included 18.2% growth in the three months to July 31 compared to a year earlier as the result of the Indonesian government’s prioritization of stainless steel exports over nickel ore shipments. Second was South Korea’s Posco with exports worth $594 million in the past 12 months following growth of 9.6% in the past three months.

Source: Panjiva