The U.S. has withdrawn from OECD-level talks to formulate a global approach to levying taxes on digital services, the Financial Times reports. That could provide the seeds for a new trade war, particularly between the U.S. and EU. As outlined in Panjiva’s research of June 4 the U.S. has held back tariffs on French luxury goods in reprisal for France’s DST on the condition of OECD-level talks being completed. Those could be very rapidly put into place.

More importantly the U.S. has also launched a section 301 review of European DST plans more broadly. A trade spat between the EU and U.S. over DST would add to existing disagreements over aerospace subsidies as well as the EU’s new environmental policies.

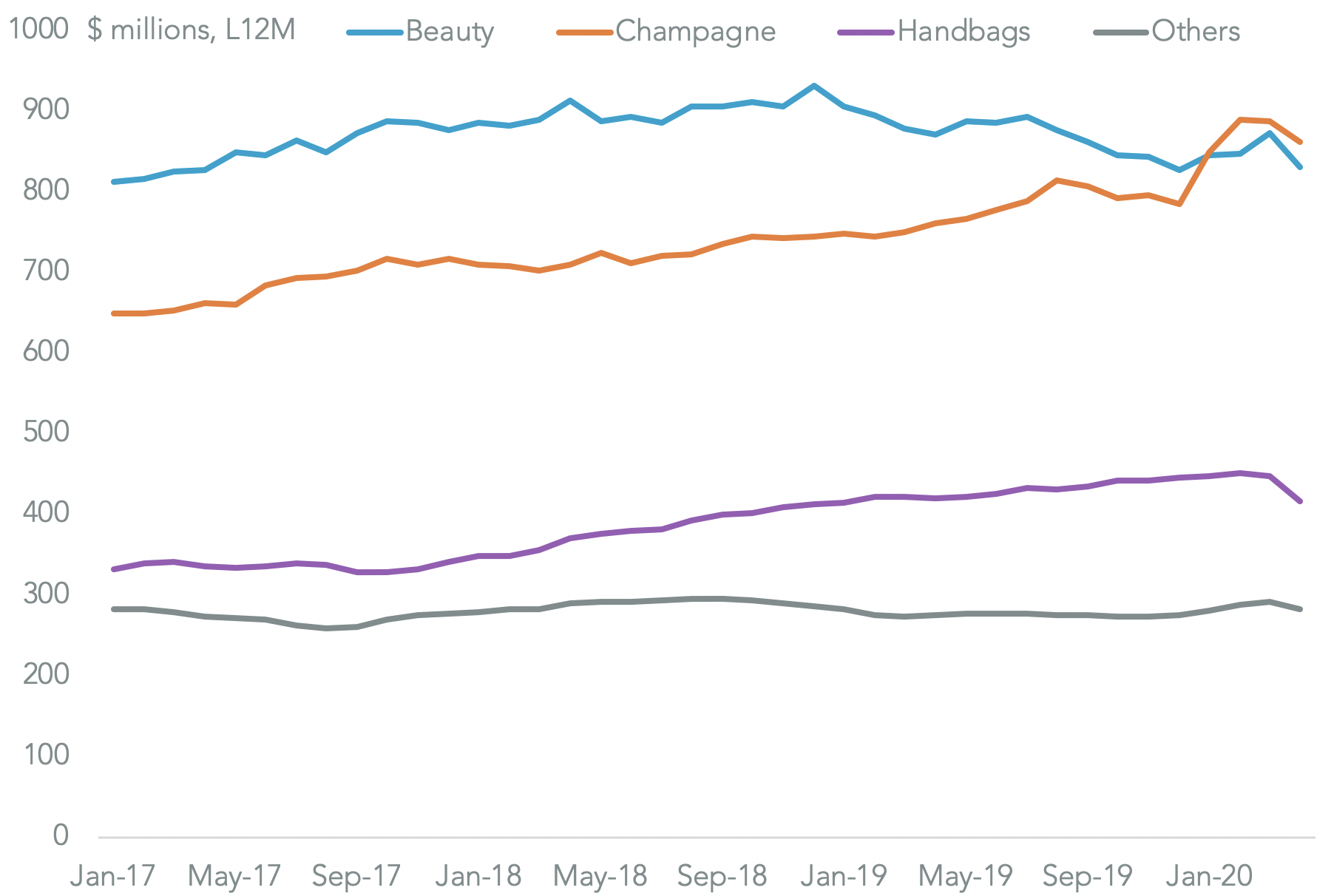

Panjiva’s analysis shows the product groups specifically targeted for retaliation against the French DST are focused on those that are less likely to have an impact on most Americans as well as hitting iconic French companies. The largest product group targeted was champagne worth $862 million in the 12 months to April 30, Panjiva’s data shows, followed by beauty products worth $831 million and handbags worth $416 million.

Source: Panjiva

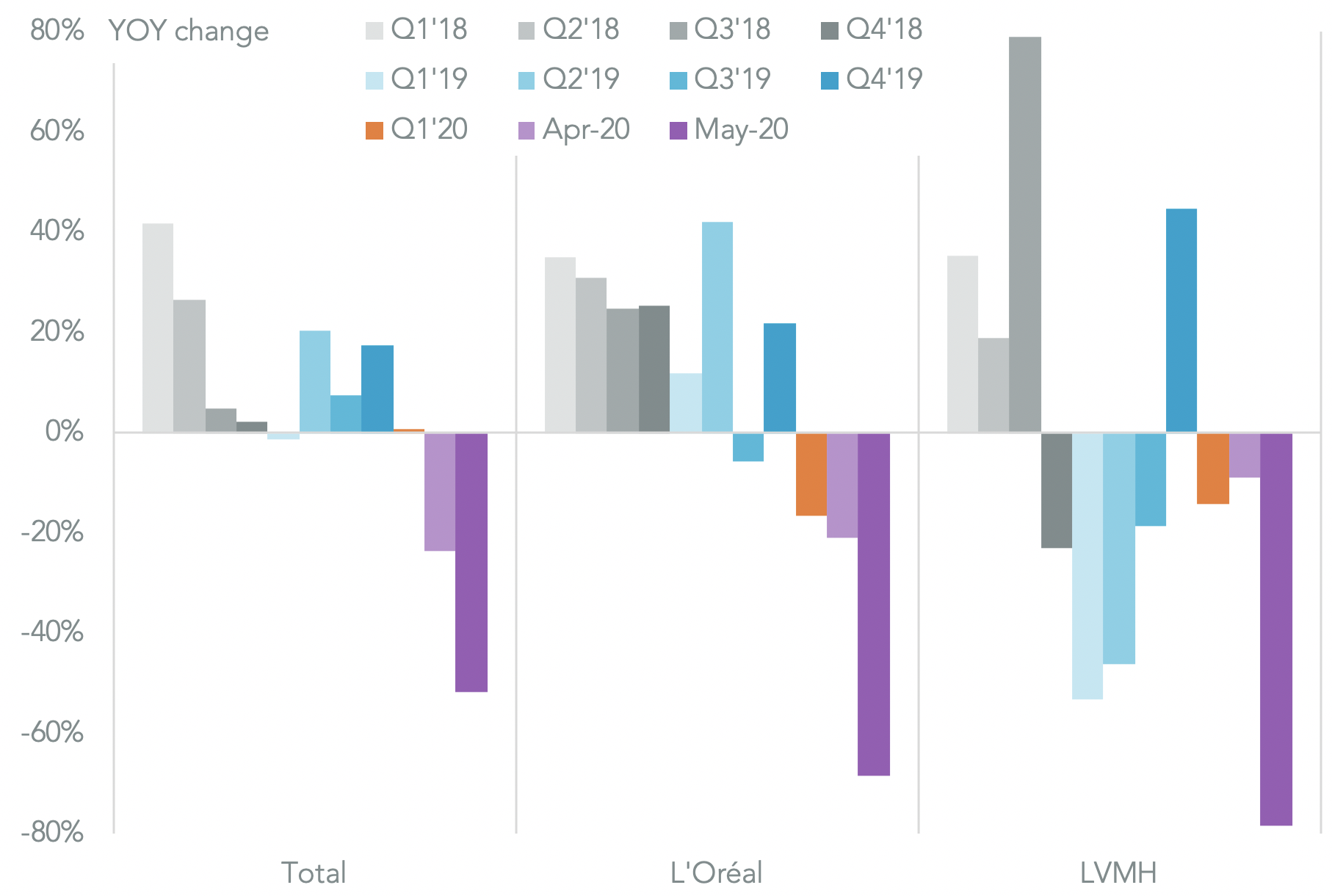

Panjiva’s U.S. seaborne import data shows that the primary targets for tariffs on beauty products would be L’Oreal and LVMH. Both have already seen a slump in their shipments of luxury goods as a result of COVID-19 and a weakening U.S. economy.

Imports of beauty products targeted for tariffs and associated with L’Oreal dropped by 68.5% year over year in May after a 20.8% slip in April and a 16.7% decline in Q1. LVMH, which includes champagne and handbags as well as beauty products, has seen a similar decline with shipments that fell by 78.0% in May after an 8.8% dip in April and a 14.3% slide in Q1.

Source: Panjiva