President Vladimir Putin and President Donald Trump may hold their first face-to-face meeting on the sidelines of the G20 Summit, Reuters reports. No timetable has been formally set, with the summit set to run on July 7 and 8. While the meeting may focus predominantly on geopolitical issues (including accusations of electoral intervention) and national security (including Syria and the fight against IS) trade may feature on the agenda.

Russia ran a $10.0 billion trade surplus with the U.S. in the 12 months to April 30, Panjiva data for U.S. imports and exports shows. That’s 22.5% higher than a year earlier, but largely reflects growth in energy exports from Russia to the U.S. Excluding energy the surplus falls to $2.0 billion, 47.7% higher than a year earlier.

Source: Panjiva

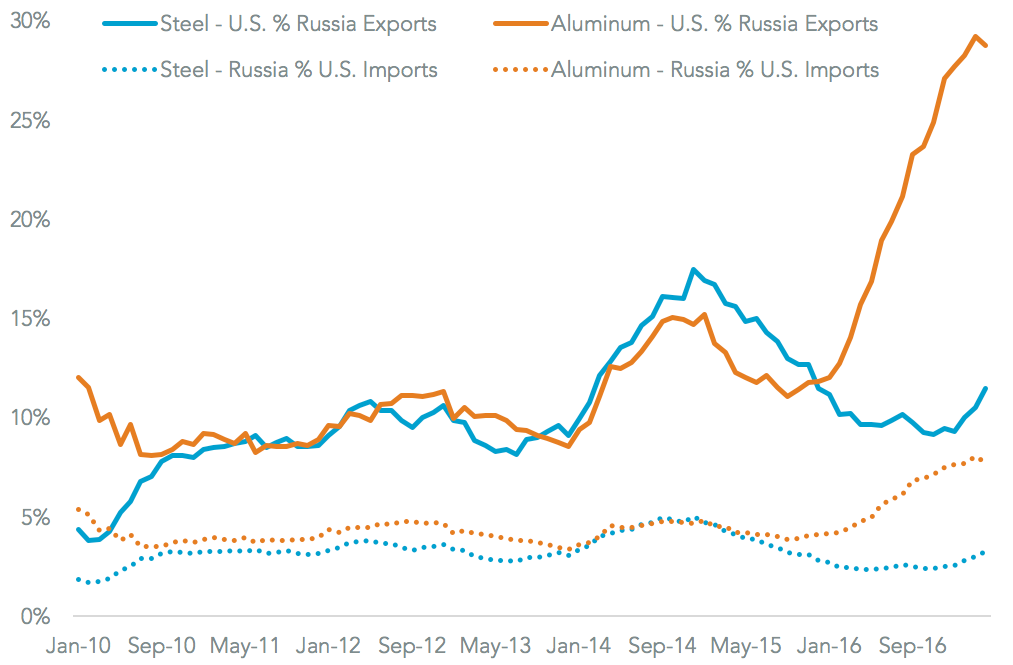

The main driver of that rising surplus has been the steel industry, which the U.S. is already reviewing via its section 232 review of the national security implications of steel imports. Russia’s exports of steel to the U.S. climbed 207% on a year earlier in the three months to April 30, compared to total U.S. imports that climbed 23.6%.

More importantly Russian exports of aluminum reached 7.7% of the U.S. total in the past 12 months, up from 4.1% in 2015. At the same time the U.S. accounted for 28.8% of Russian aluminum exports from 12.0% in 2015, Panjiva analysis of Russian customs data shows. That would suggest a more aggressive approach to marketing in the U.S. from Russian manufacturers.

Source: Panjiva

President Trump may therefore look to address the, as yet unpublished, conclusions of the U.S. steel and aluminum reviews and policy actions with President Putin. The importance of the U.S. to Russian steel and aluminum producers may provide President Trump with some leverage, though this shouldn’t be overstated.

Russia is already getting closer to China from a trade perspective. The most recent move is the creation of a $10 billion investment fund as part of China’s belt-and-road strategy and Russia’s Eurasian Economic Union project, the Financial Times reports. Furthermore U.S. exports to Russia are dominated by aerospace products. These accounted for 21.3% of total U.S. exports to Russia in the 12 months to March 31, are already at threat from new Russian jet construction.

Source: Panjiva