The U.S Trade Representative has released a 17 page document covering the key negotiating objectives of administration of President Donald Trump. Primary among these is a desire to “address persistent trade imbalances”, specifically in terms of the balance goods. While not calling for a removal of the trade deficit in goods in total, there may be some controversy over levels of adjustment to make.

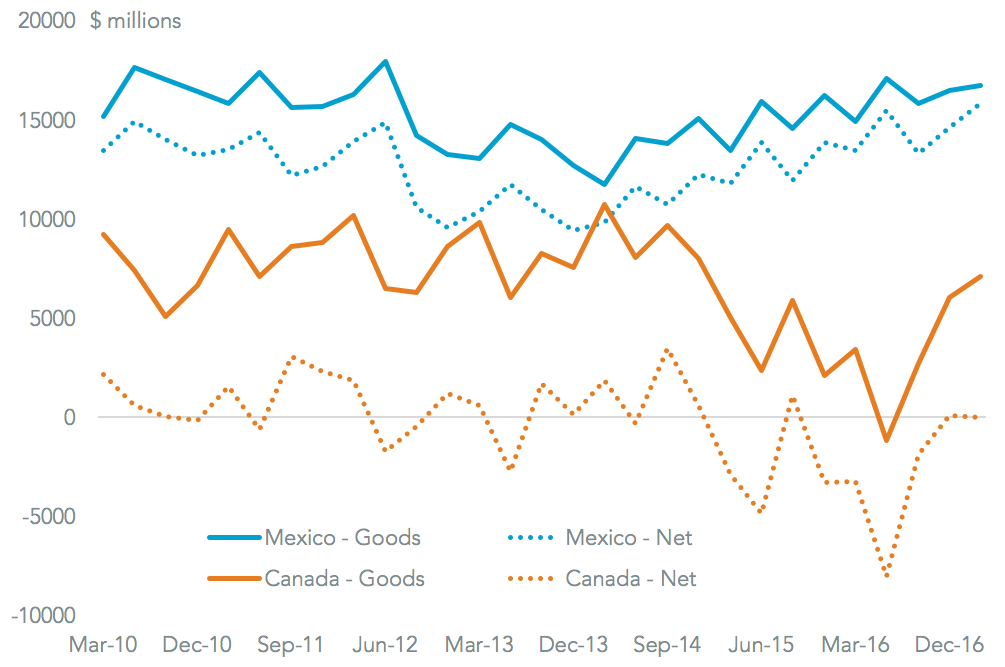

While the U.S. ran a $80.8 billion deficit in goods in the 12 months to March 31, it also had a $31.4 billion surplus in services, Panjiva analysis of U.S. goods imports and exports and official current account data shows. Trade with Canada was actually in surplus by $9.8 billion in the past year, while the total trade deficit with Mexico was $59.2 billion. While the Mexican and Canadian government may be persuaded to reduce the former, moving the latter to zero would probably not be an acceptable objective.

Source: Panjiva

In goods there is a stated desire to “break down barriers to American exports”. That would suggest an export-boosting, rather than import-limiting approach. Assuming the target is the goods deficit, that is equivalent to 17.1% of U.S. exports – ie a 17.1% increase in exports would offset the goods deficit per the stated objective. Taking off the services surplus would cut this to 11.0%.

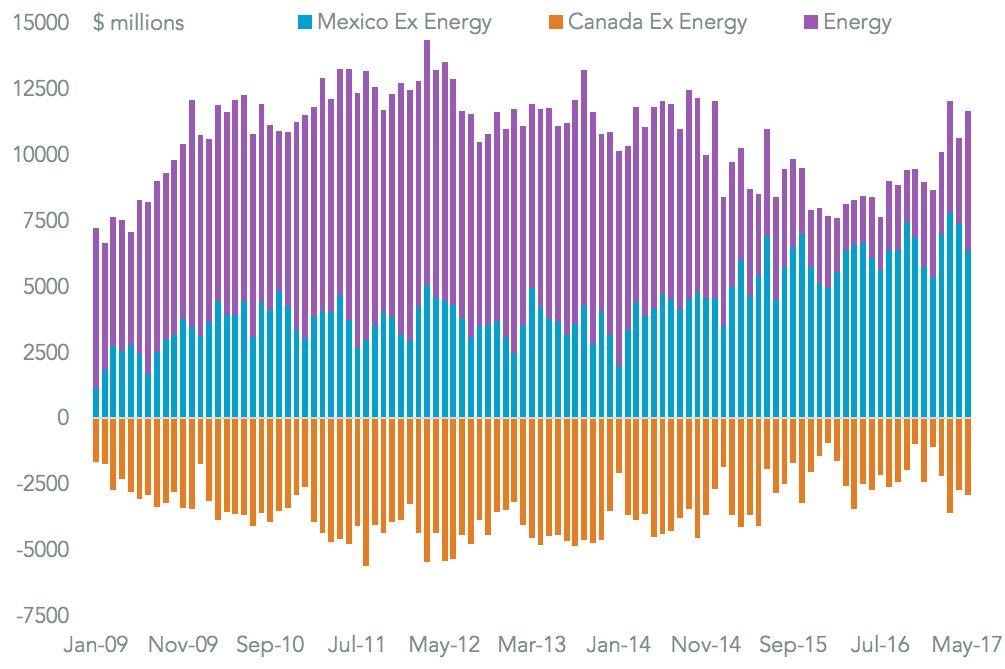

One complication is the energy industry. There are unlikely to be changes here resulting purely from NAFTA objectives – although the Trump administration does have a separate aim to reduce its energy deficit. The U.S. imported $75.0 billion of energy products from NAFTA and exported $38.6 billion for a deficit of $36.5 billion in the past 12 months. Factoring this in then exports (adjusted for energy) would need to rise 11.7% to offset the goods deficit, and 4.4% to offset to overall trade deficit at current energy prices.

Source: Panjiva

The objectives also include with terms on digital trade, competition policy, labor and environmental standards as well as activities state-owned enterprises. That makes for a broad, more complicated deal. While the U.S. has its own internal processes, so do the other countries. Indeed, the Canadian government has indicated it has not yet completed its own consultations.

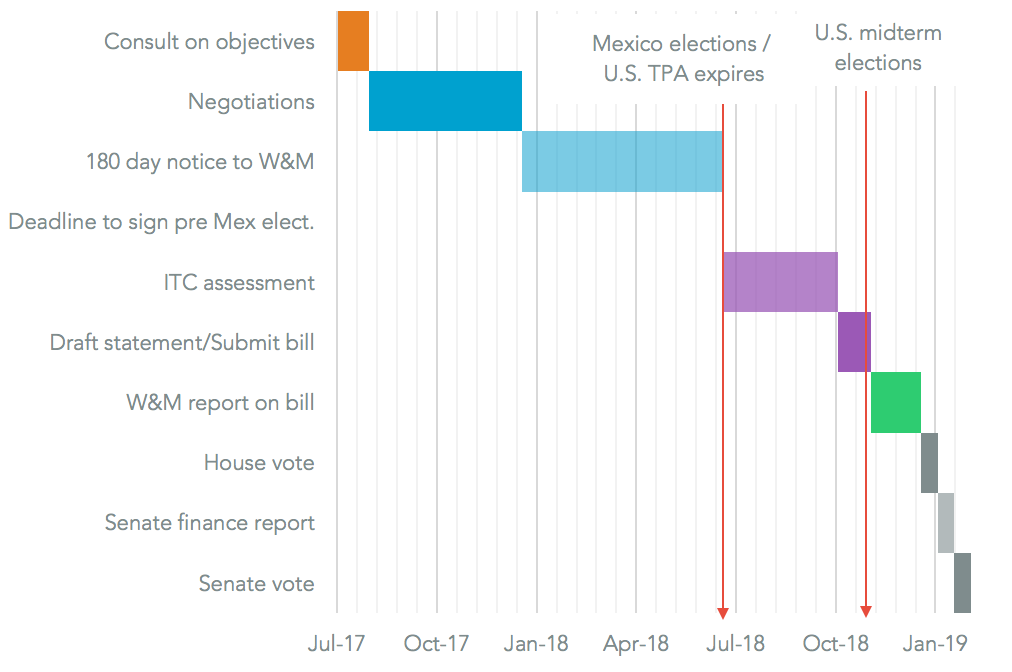

While the first stage of technical talks will start today, according to Reuters, formal negotiations cannot start for another 30 days under TPA rules. The U.S. sees no “ artificial deadlines”, though it is worth noting (a) TPA expires in July (b) Mexican elections are due in July and (c) a 180 day notice of legal changes must be made to the U.S. House Ways & Means committee before a deal can be signed. It is difficult to see, therefore, anything other than set a year-end limit on negotiations.

Source: Panjiva