NAFTA negotiations that restart January 23 look increasingly likely to fail. It has emerged that the Canadian government filed a complaint with the World Trade Organization on December 20 regarding U.S. antidumping / subsidy case methodologies. The complaint covers seven aspects of U.S. trade policy and cites over 100 cases going back to 1996. Those cases only include two products for Canada – softwood lumber and supercalendered paper – with the vast majority relating to other countries. That is likely designed to broaden the base of complainants joining the case, increasing pressure on the U.S.

The move by Canada is clearly aimed at the forthcoming NAFTA negotiations, and follows a pattern of more hawkish rhetoric from the Canadian government as outlined in Panjiva research of December 29. It is also adds to an increasingly rancorous environment that has seen Canada raise concerns that President Trump may issue a termination notice and comments from Mexico that they would withdraw from talks if he did so, Reuters reports.

Unsurprisingly the U.S. Trade Representative has condemned the Canadian move, noting that a reversal of the cases highlighted could hurt Canadian exports of metals and forestry products to the U.S. as other countries could increase their shipments once more. That’s a valid point given only two Canadian cases are covered, and in the case of softwood lumber it already launched a WTO complaint in December.

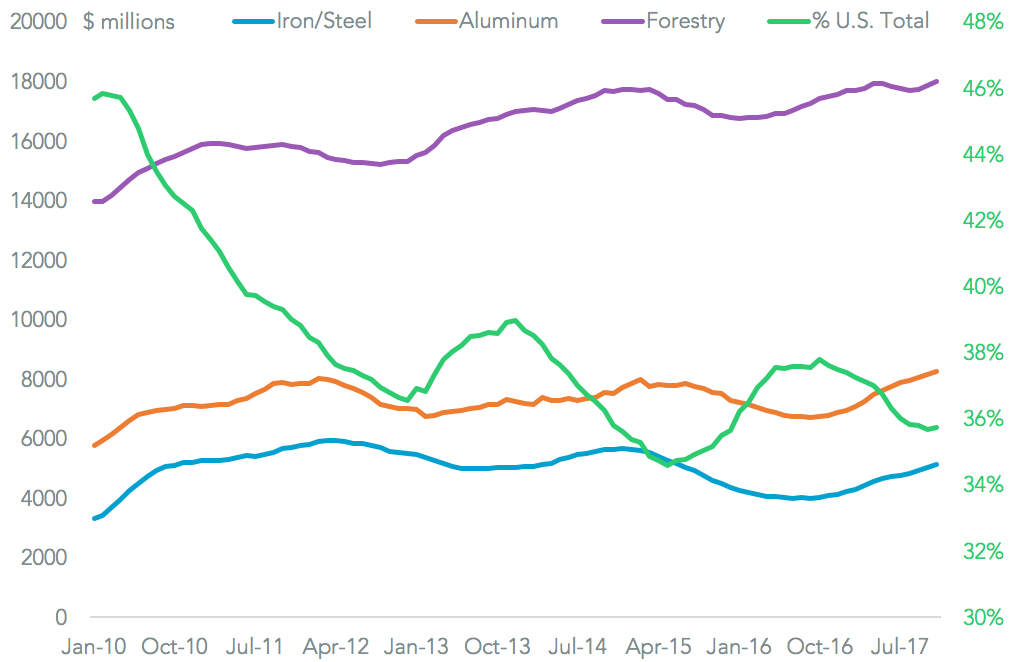

Putting aside the future of NAFTA negotiations, the WTO case has plenty at stake for Canada. Panjiva data for U.S. imports of iron/steel, aluminum and forestry products shows exports in the 12 months to November 30 totalled $31.4 billion. They have increased 4.1% annually for the past seven years vs. 7.1% for U.S. imports overall. When compared to 2010 Canada’s share of U.S. imports in the three products fell 35.7% from 45.7% Should the WTO case be successful, and / or NAFTA talks end Canada could end up losing further.

Source: Panjiva