On Oct. 30, 2019 Panjiva Research held a webinar titled “Light in the Tunnel” which provided a guide to our 4Q 2019 Outlook for trade policy and showed how to use Panjiva’s data and services for Commercial Banking uses cases. This report addresses questions asked during the call as well as two polling questions in the trade war and Brexit that we asked of listeners. A replay of the call is available on-demand, including a link to request more information about Panjiva.

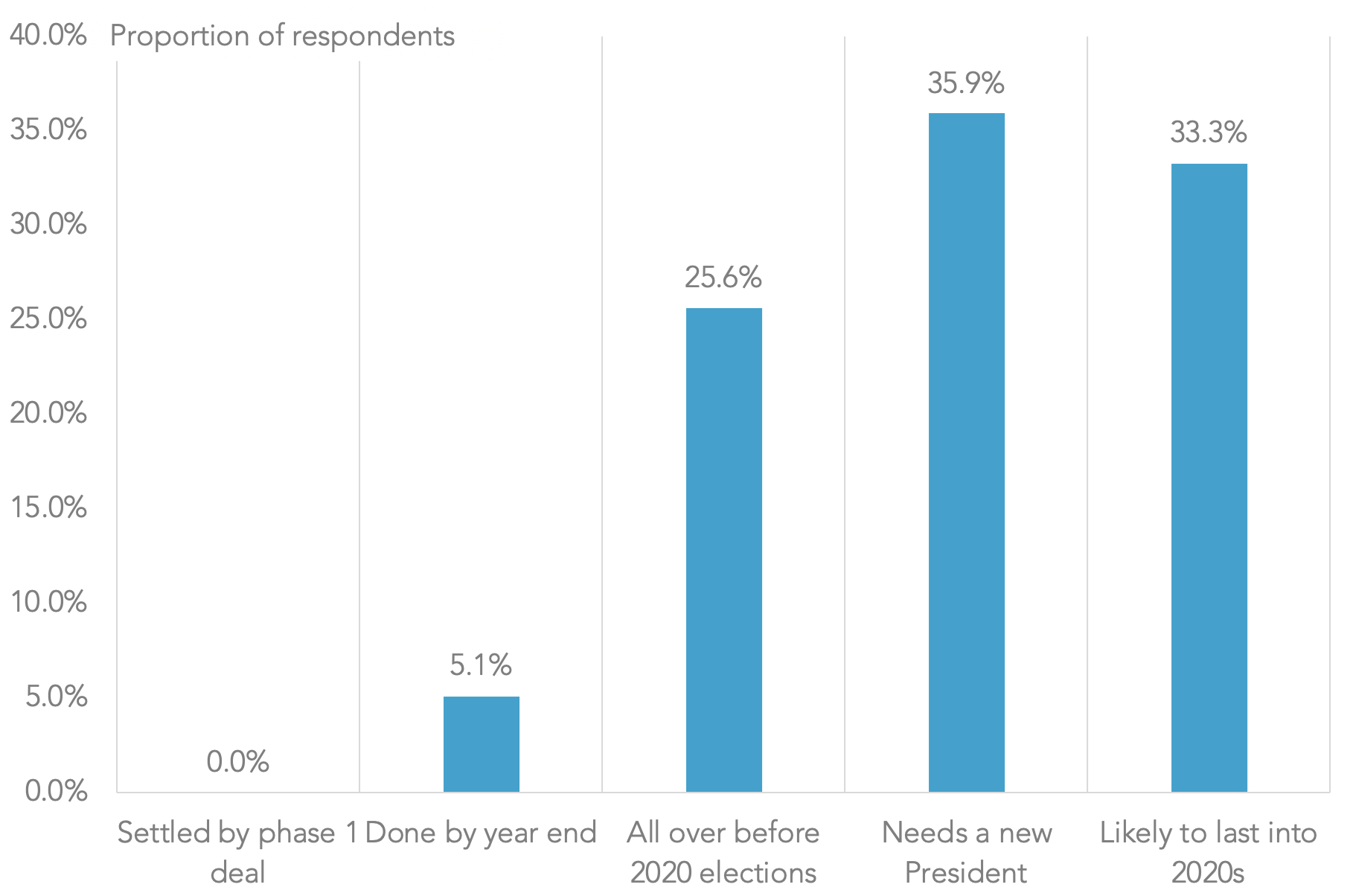

Poll question: When will U.S.-China trade war be over?

Panjiva’s 4Q Outlook for U.S. trade policy identified the potential for a “phase one” trade deal between the U.S. and China in mid-November. We cautioned that it looks like the fifth version of previous agreements – which failed – covering agricultural purchases and minor policy adjustments.

We then asked participants to the call when they thought the trade war between the U.S.-China trade war would be over. Just under 31% of respondents – principally from the banking and investment industries – expected a deal before the elections.

That’s similar to the 36.2% observed in our previous webinar as shown in Panjiva’s research Aug. 7. Notably nearly 36% expect to see a solution need a change in President with most of the remainder expecting the trade war to extend well into the 2020s.

Source: Panjiva

Q: What will the Federal Reserve do next?

Panjiva research doesn’t take a view on macro-economics – our colleagues at S&P Global Ratings will publish on the topic. It is nonetheless notable that Fed Chairman Jerome Powell has stated – after the webinar finished – with regards to the U.S.-China trade war that there would be need to be a significant worsening of relations from here for the Fed to make a “material reassessment” of its position. See the chart above for what our respondents think.

Q: What strategies are companies following to deal with tariffs resulting from the U.S.-China trade war?

Panjiva’s “ Tariff Quote Watch” series has identified at least seven corporate reactions. These include: requesting tariff exemptions; increasing prices for customers; demanding reduced prices from suppliers; stockpiling; re-engineering supply chains on both temporary and permanent bases; utilizing de-minimis shipping strategies; and of course doing nothing.

The ongoing 3Q results season is showing that some companies have been successful in the execution of their strategies – for example Husqvarna – while others such as iRobot have had to think again.

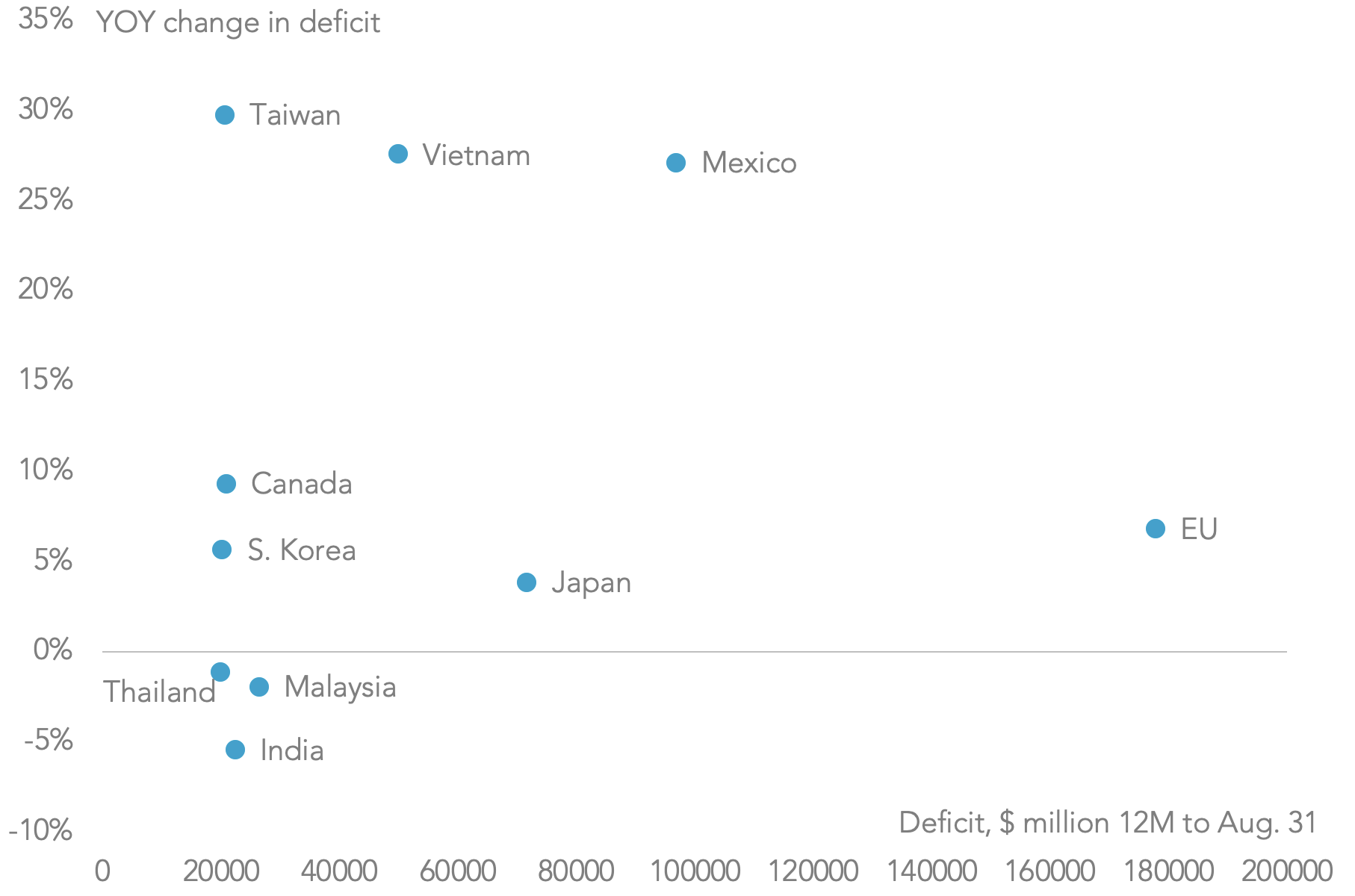

Q: How quickly can the US take action against other countries like Vietnam or Malaysia?

The governments of Vietnam and Malaysia have already raised concerns that their surging exports to the U.S. could trigger tariff action by the Trump administration.

Vietnam is arguably the most exposed to the risk of action. Panjiva’s data shows that Vietnam had the fifth largest trade surplus with the U.S. in the 12 months to Aug. 31 at $49.8 billion. That was equal to India and South Korea combined. Vietnam’s deficit has also expanded by 27.6% year over year in the 12 month period, lagging only Taiwan’s 29.8% surge.

The main tariff mechanism used by the U.S. against China was the section 301 review of business practices. In the China case the review was launched in August 2017, an initial report announced in March 2018 and first tariffs applied from July 2017.

That may not be fast enough for the U.S. government, which may opt for quicker action by leveraging countries’ Generalized System of Preferences status. Of course, the carrot of trade deals could be used instead – likely using the “mini-deal” format that has become a favorite for the Trump administration.

Source: Panjiva

Q: What are mini deals and why are they different from other deals?

The U.S. has recently decided to eschew all-or-nothing complete trade deals including services and regulations as well as goods to instead focus on smaller, transactional deals. These may be set in the context of wider deals – for example as is the case with Japan, and in theory will be the case with China. They typically involve commitments on market access, commodity purchases and a limited range of tariff reduction or policy exemptions.

They won’t be without challenges. Deals that are too narrow may fall foul of World Trade Organization rules – that may not be a problem given the imminent shut-down of the WTO’s dispute mechanism. Deals that are too wide may exceed Presidential authority and require Congressional approval – something that may be lacking in 2020’s election year.

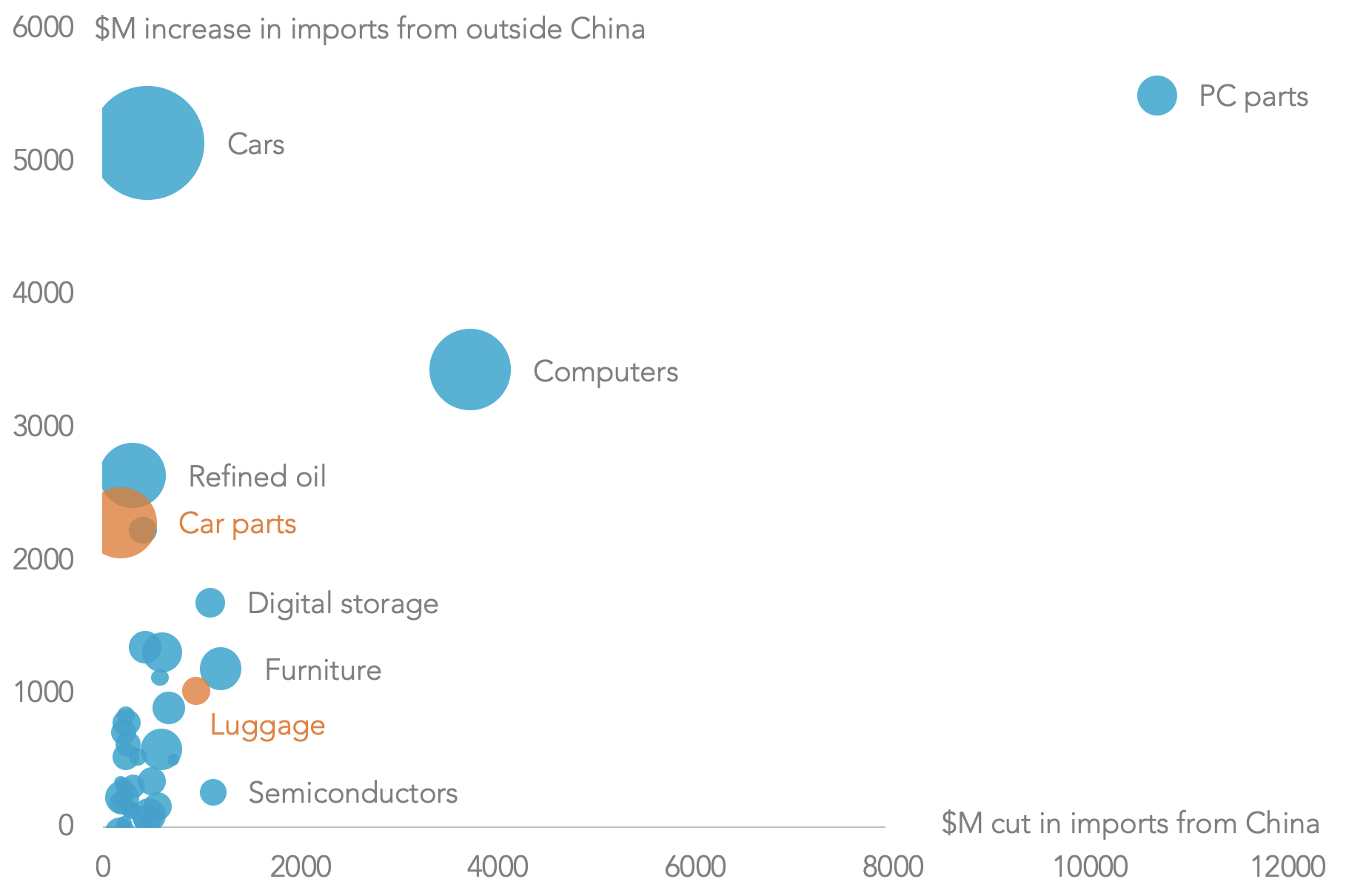

Q: Is it possible to segment which industries have seen the biggest changes due to the trade war?

Panjiva’s analysis shows that the electronics industry has seen the biggest upheaval in dollar terms, expressed as a drop in U.S. imports from China offset by a rise in imports from elsewhere in the world.

U.S. imports of computer components from China slumped 57.8% year over year in the 12 months to Aug. 31, while imports from the rest of the world surged 65.7% higher. Similarly, there’s been a 7.2% drop in imports of computers from China and 8.8% rise in imports from elsewhere despite most products not yet being subject to tariffs.

Outside electronics the furniture industry saw a 9.9% drop in imports from China and 9.5% rise from elsewhere. The luggage sector saw a 15.2% slide in supplies from China in favour of a 20.8% increase from elsewhere. The analysis can be deepened systematically to the corporate level using Panjiva over Xpressfeed.

Source: Panjiva

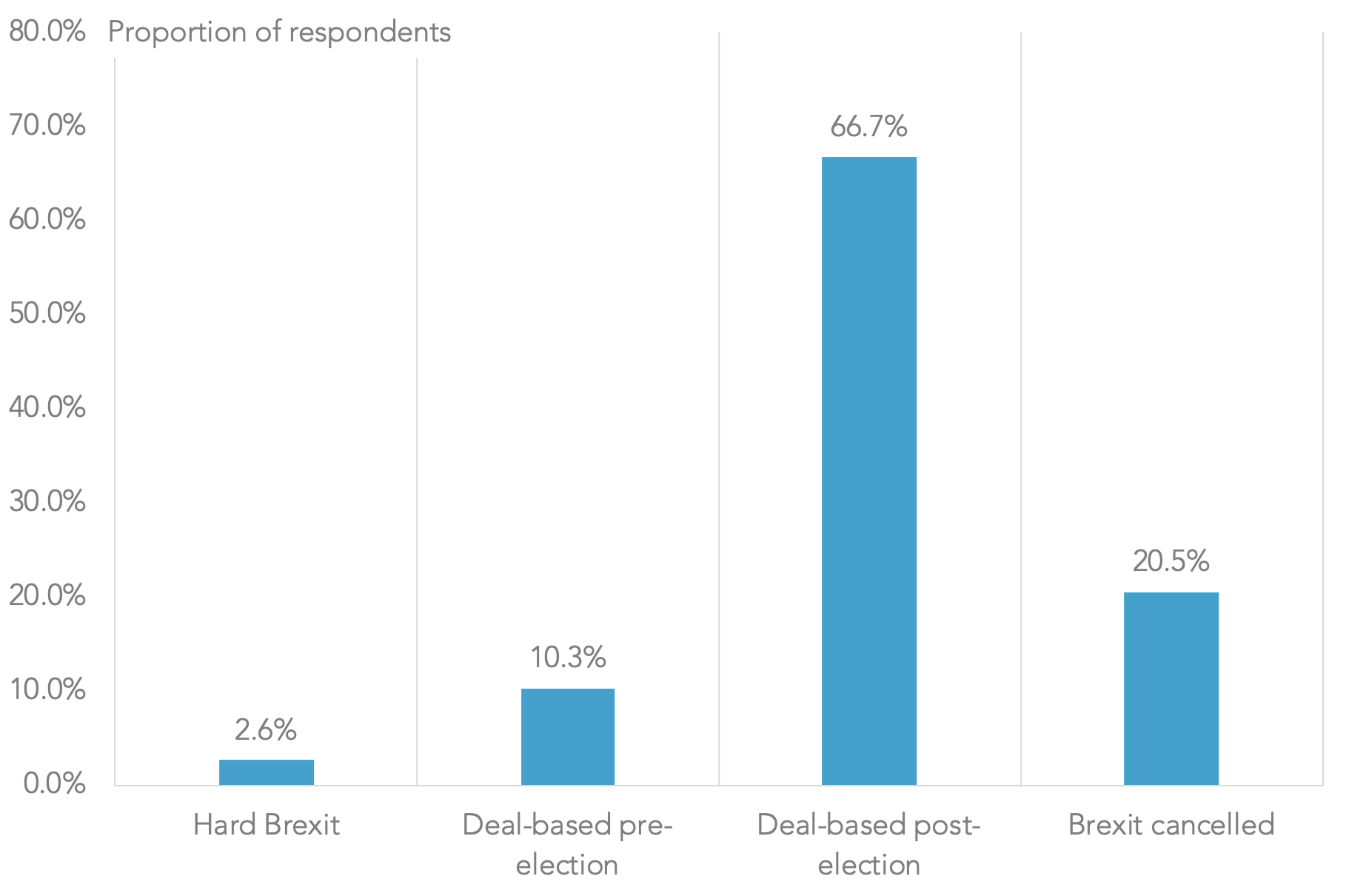

Poll Question: What will a deal-based Brexit mean for logistics in agriculture?

Developments have been rapid in the past few days, with the British government now set to hold elections in mid-December. Presumably the existing Withdrawal Agreement Bill will be passed thereafter, or a review of Brexit altogether called depending on the complexion of the new government.

Our poll of attendees on the call indicated two-thirds of respondents expect a post-election deal to be signed, though as many as one-fifth see the potential for Brexit to be cancelled altogether.

A deal-based Brexit should markedly reduce risks for the agricultural sector. The logistics industry has already been scaling up its use of refrigerated container shipping globally – mostly so far in response to increased demand for produce exports from South America. However, should extended customs delays become the norm such equipment could be redeployed to Europe to extend the acceptable timeframes for shipping to- and from the U.K.

Source: Panjiva