Panjiva Research took part in a webinar with our colleagues from S&P Global Ratings and S&P Global Platts on May 12. The event covered the potential impact of the COVID-19 pandemic on Latin American economies, energy prices, supply chain operations and the financial sector. A recording of the webinar and slides are available here, while this report addresses the supply-chain related questions asked as well as polls of the audience.

The presentation started with an outlook for Latin American economies by S&P Global Ratings’ economics team. In broad brush terms the team expect the downturn in Q2 GDP to be the largest in decades with GDP across the big five economies expected to drop by 5.3% year over year in 2020.

A poll of the audience asked “What country will have the weakest economic recovery from the COVID-19 pandemic“. There was a close run result between Mexico, with 41.2% of respondents from across the finance industry expecting it to have the weakest recovery, followed by Brazil with 39.4%.

Source: Panjiva

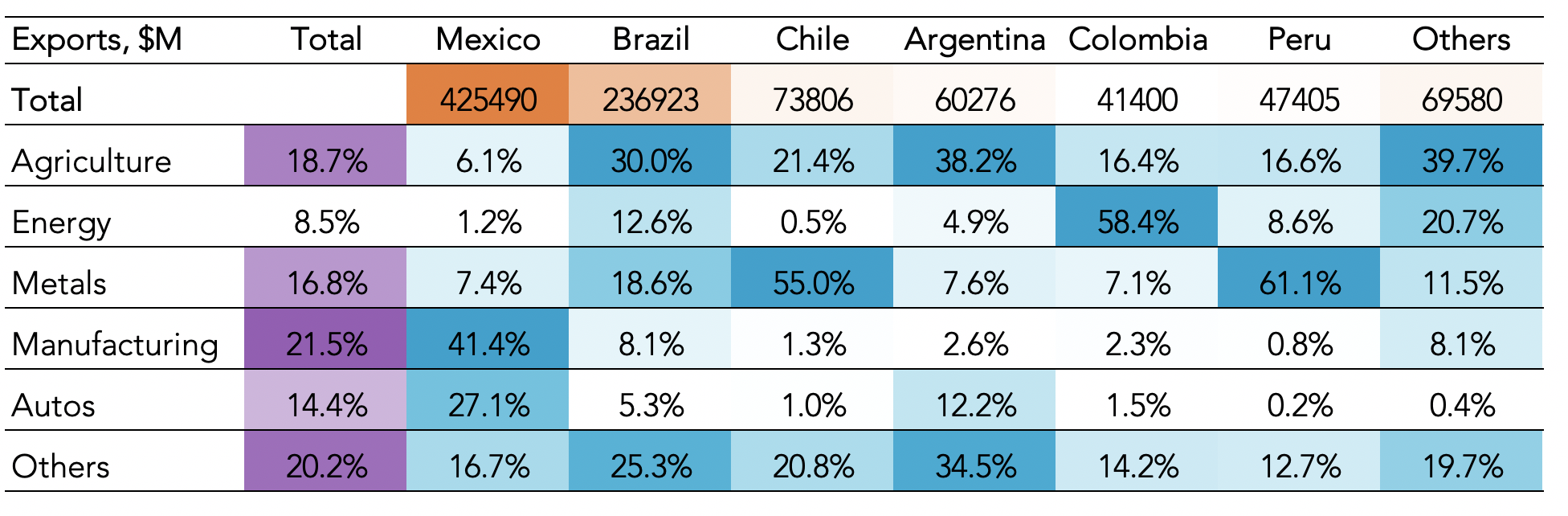

Panjiva’s data shows that most Latin American countries’ exports and supply chains are highly focused on a small range of commodity products. For example 30.0% of Brazil’s exports in 2018 were in agriculture, while 55.0% of Chile’s were in metals and 58.4% of Colombia’s in energy. Mexico is an outlier with 41.4% of exports in industrials ex autos and a further 27.1% in autos. It is, however, highly exposed to the wider North American market and specifically the U.S.

Source: Panjiva

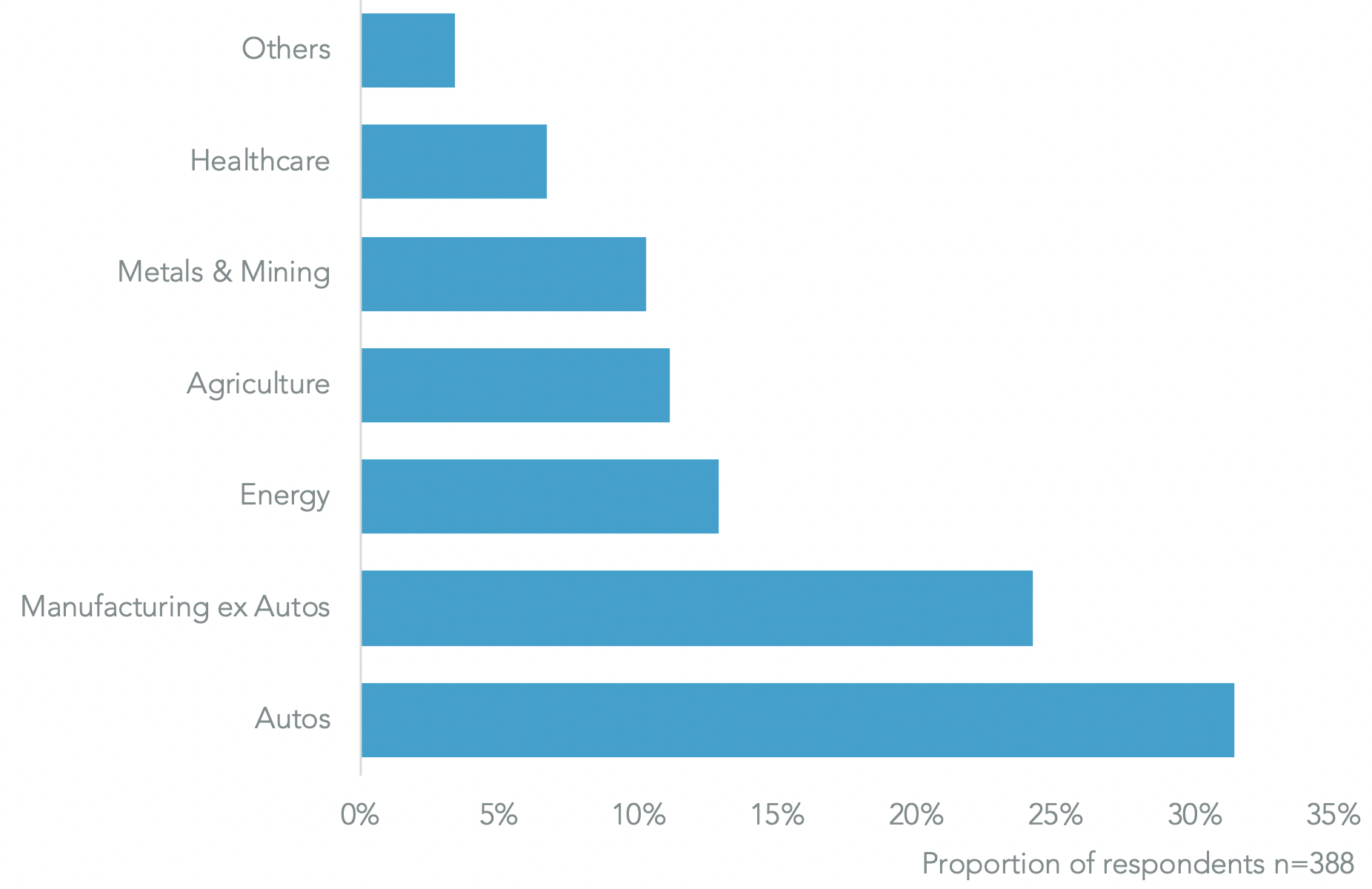

We asked the attendees “Which LatAm supply chains face the greatest disruption from COVID-19“. Industrial activities were rated the highest with 31.4% of respondents expecting autos to be the most disrupted followed by manufacturing ex autos at 24.2%. Most commodity businesses were much lower down the list with energy and agriculture at 12.9% and 11.1%. Just 10.3% of replies cited metals while healthcare was lowest at 6.7%.

Source: Panjiva

Q: Post-COVID-19, do you anticipate an increase in protectionist policies in different countries and what is the expected impact on supply chains and economies? Can we expect increased protectionism that will favor growing local production vs imported goods?

Broadly speaking there’s been an increase in trade liberalization across the region over the past couple of years. That included trade deals between both Mexico and Mercosur (Argentina, Brazil, Paraguay and Uruguay) with the European Union. Those may stumble at the ratification stage, as outlined in Panjiva’s research of Jan. 27, with the economic downturn caused by COVID-19 being a potential trigger.

There’s also concerns regarding relations between Argentina and Brazil with respect to the continuation of the Mercosur region. Broadly speaking, however, the focused goods outflow nature of trade in Latin America described above means that countries have little room to sensibly restrict trade.

Q: Are you worried about countries continuing to limit their exports of medical supplies?

Absolutely yes. The World Bank has identified 156 export measures across 75 countries limiting the export of medical supplies in response to the COVID-19 pandemic. While some of these are being relaxed, such as those applied early by Turkey and India, they will continue to be a challenge. There’s also the potential for future arrangements within trade blocs, for example the ASEAN+3, to put in place standing regulations to assure medical supplies in the event of another public health emergency.

Within Latin America, Argentina and Brazil both limit the exports of medical supplies while Chile and Mexico among others do not. The Brazilian government has previously also cut import tariffs to try and improve the flow of medical supplies.

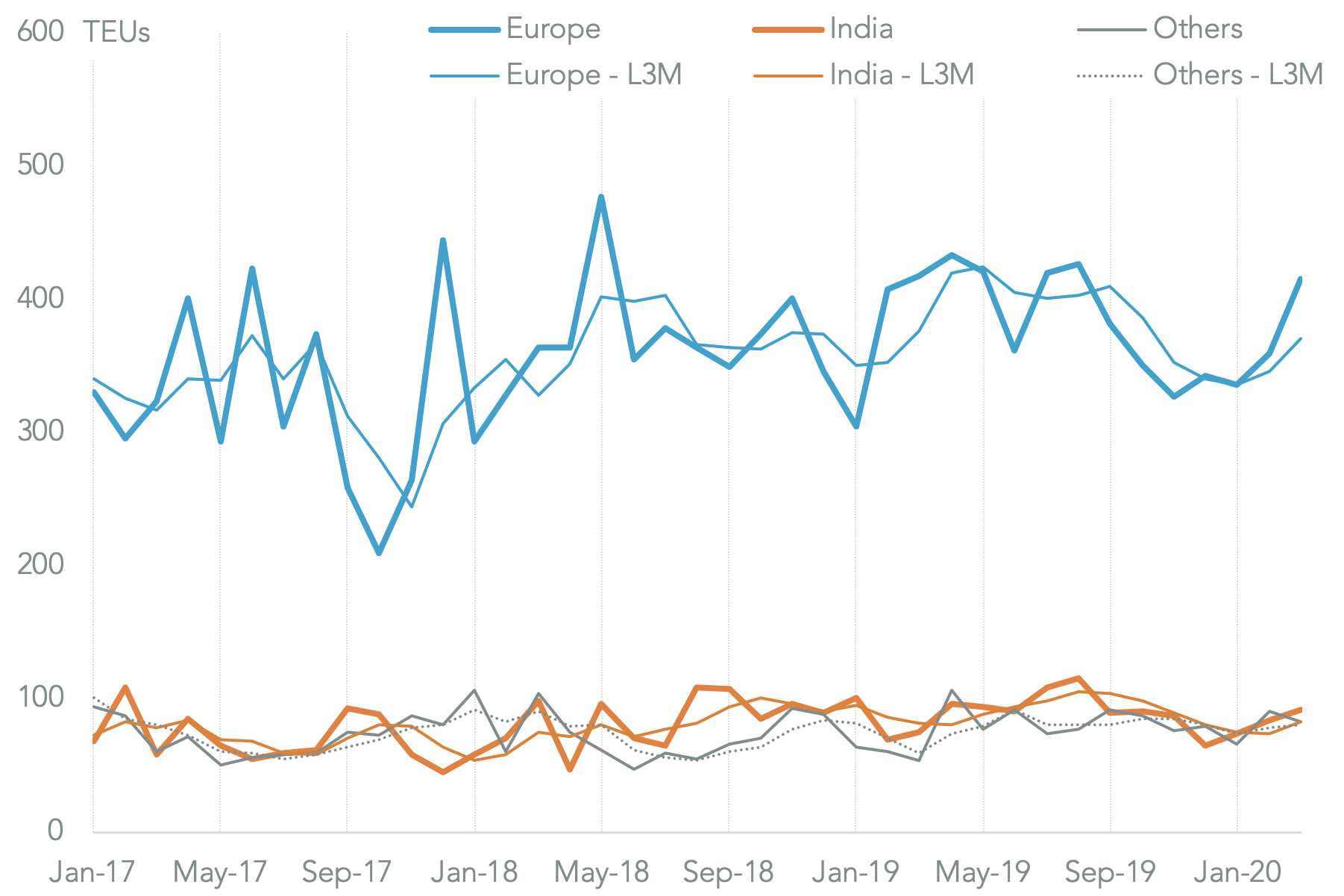

That policy may have helped. Panjiva’s data shows that Brazilian imports of pharmaceuticals increased by 7.9% year over year in March and by 18.2% versus the prior three months, The latter was widespread but included a 19.9% rise in imports from Europe and a 23.8% surge in shipments from India.

Source: Panjiva

Q: Are you expecting some Latin American businesses to return to the U.S. or go to Asia because of the economic crisis in Latin America?

Much of the focus of the Trump administration’s trade policies have been on repatriating manufacturing from China rather than from the rest of the world more broadly. Many industries supplying the U.S. will, however, have to address the structure of their supply chains in light of the U.S.-Mexico-Canada Agreement (USMCA, or NAFTA 2.0) which has updated rules on sourcing and comes into force from July 1.

If anything, an economic crisis in Latin America twinned with depreciating currencies and reduced relative labor costs may lead manufacturers to expand in Latin America rather than head to Asia.

Q: What will be the impact in the automotive industry for Latin America?

The automotive industry has felt the dual impacts of supply chain reductions and a slump in demand resulting from the COVID-19 pandemic. While many automakers are now returning to full operations it’s not clear whether demand will return sufficiently. There’s also challenges in terms of managing social distancing within production lines.

Structurally it’s likely that companies will want to diversify their supply chains rather than focus them as a response to the regionally granular nature of industrial lockdowns and reopenings. USMCA is a force multiplier here, particularly for automotive component manufacturers in Mexico.

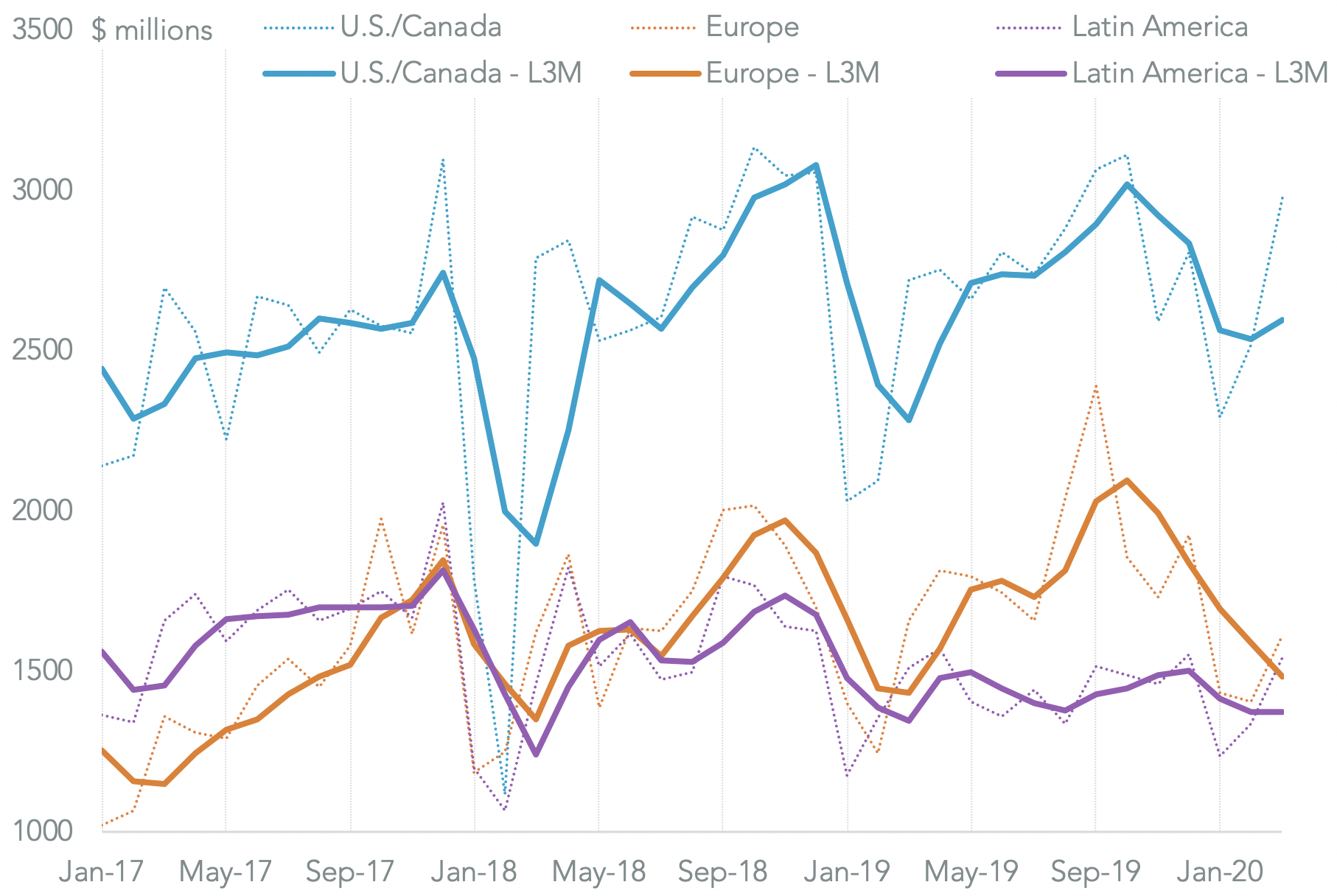

There’s already been a differential in performance. Panjiva’s data shows that Mexican imports of automotive components from the U.S. and Canada climbed 13.7% higher compared to a year earlier in Q1 2020, while shipments from Europe and Latin America fell by 3.4% and 1.9% respectively.

Source: Panjiva