U.S. supplies of personal protective equipment needed to tackle the COVID-19 pandemic are suffering from issues of price as well as availability, CBS reports, with a shift in emphasis towards gloves away from masks. The U.S. Government Accountability Office reported that the U.S. nation stockpile of gloves fell to 2 million units in October from 16.9 million in December 2019.

Panjiva’s analysis shows that the value of U.S. imports of PPE including gloves, masks and gowns dropped by 30.0% sequentially in October versus September and by 49.6% from their peak in June. That was supported by imports of gloves which climbed 18.8% higher sequentially in October while masks have actually been in decline with a 52.8% drop.

Source: Panjiva

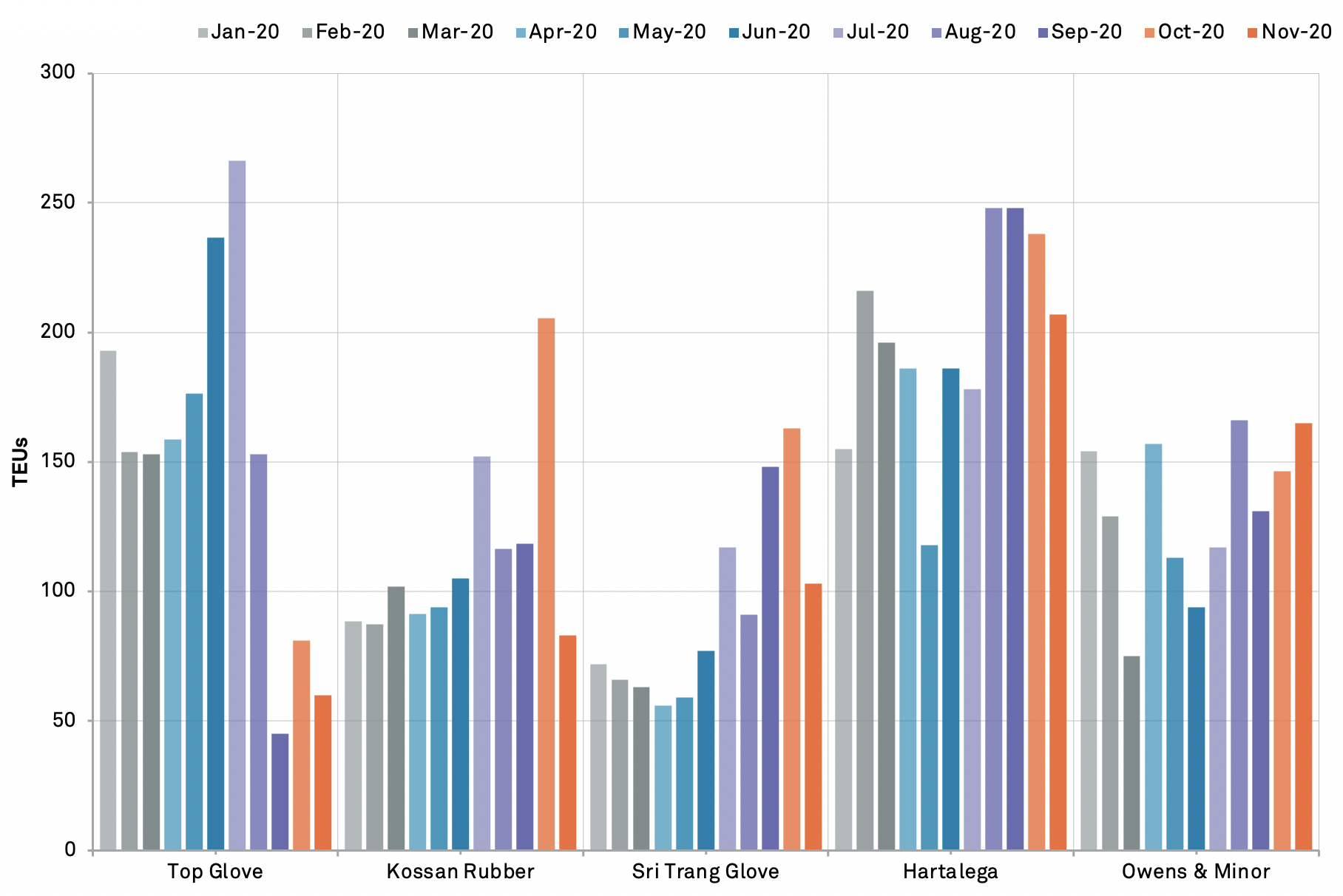

While the value of imports of gloves has gone up, the number of units may have fallen. Panjiva’s U.S. seaborne import data shows imports of gloves may have fallen by 6.4% sequentially in November. That’s partly due to reduced imports linked to Top Glove, with shipments that declined by 25.9% and were around one third the levels seen in the summer as a result of an earlier restriction due to labor practice allegations as discussed in Panjiva’s research of Nov. 18.

There’s also been a marked downturn in imports by other major suppliers including a 59.6% drop in shipments linked to Kossan Rubber and a 36.8% slide in imports linked to Sri Trang. Both had expanded significantly in earlier months, perhaps indicating a shift in sales to other markets. Imports handled by Owens & Minor by contrast have continued to improve, rising by 12.7% in November.

Source: Panjiva