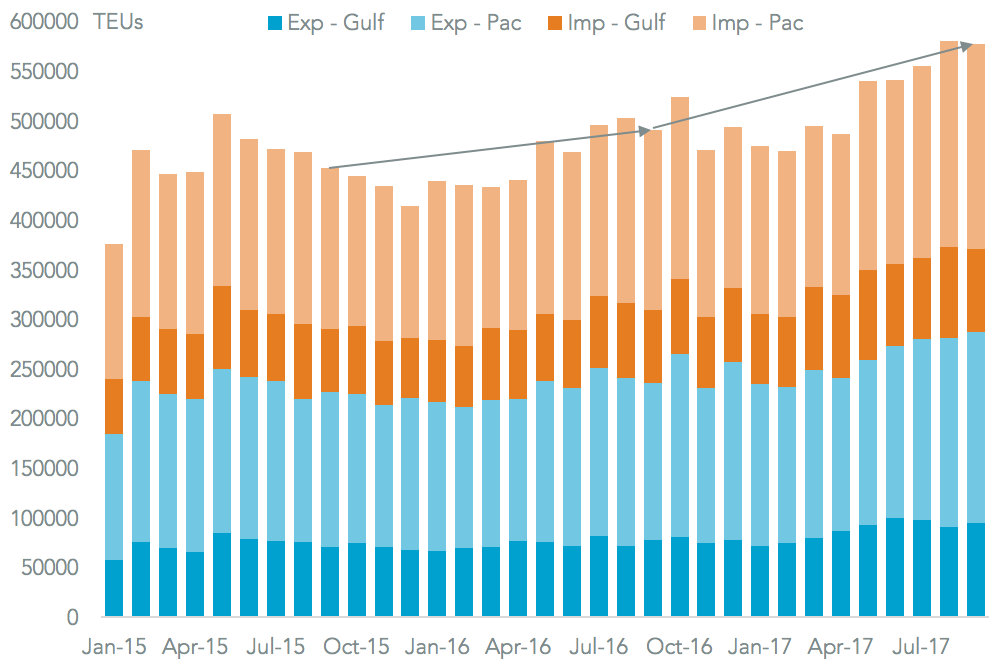

Container handling through Mexico’s ports jumped by 17.8% on a year earlier in September, official data shows. That was the fastest rate of growth since December, and makes the 15th straight month of expansion. While led by a 30.8% increase in empty container handling, full container shipments also continued their double digit growth at 13.2%. The gulf coast ports, which grew by 18.9%, modestly outpaced the Pacific ports. That’s remarkable given the natural disaster impacts earlier in the month, as outlined in Panjiva research of October 3.

Source: Panjiva

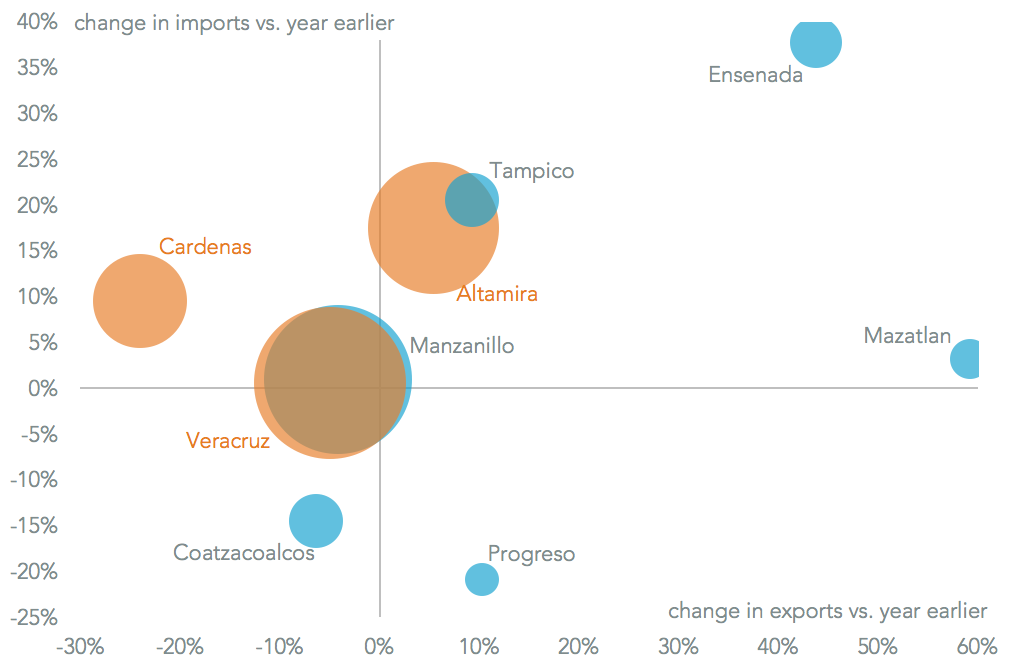

Among the major ports Altamira’s import growth of 17.5% was notable, Panjiva data shows, as a result of rapid growth in the steel industry. Neighboring Tampico saw a similar trend, with imports growing by 20.5%. By contrast the worst performer was Lazaro Cardenas, which experienced a 24.1% drop in exports due to lower steel shipments.

Source: Panjiva