Trade activity in the U.S. oil sector shows the country took a marked step towards energy independence in the past three months. That came as the OPEC oil cartel decided to continue its current cutbacks through the end of 2018, opening the opportunity for increased U.S. oil exports to come – though the window may be limited if crude inventories drop, Bloomberg reports. There may also be temporary opportunities, for example resulting from the outage of the critical Forties pipeline in the U.K. by Ineos.

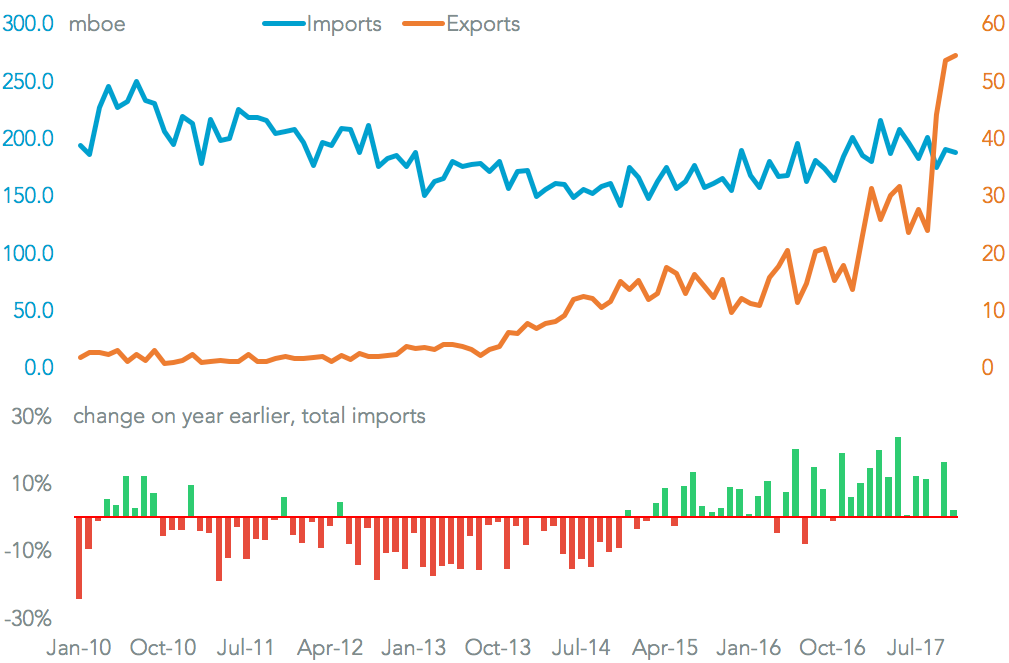

Panjiva data shows U.S. imports of crude oil climbed 16.4% on a year earlier in October, before slowing to a 2.0% rise based on preliminary EIA data. The October growth was driven by a 28.0% surge in shipments from Mexico, which regained their pre-hurricane season levels. Exports meanwhile jumped to a level 3.5x a year earlier in October and 3.0x in November. The latter brought exports to 28.9% of imports, the highest ratio on record.

Source: Panjiva

Among the refiners Valero remained the number one importer of oil by sea to the U.S., with 37% of its shipments coming from Venezuela, 27.3% from Mexico and 17.9% from Kuwait, Panjiva data shows. It was followed by ExxonMobil which relied more on Iraqi supplies and Chevron which used mostly Mexican oil.

Source: Panjiva

November represented a rare month of improvement for the seaborne tanker operators, with a 7.7% rise in volumes compared to a year earlier. The major carriers grabbed most of that extra market, with the leading carrier of international volumes into the U.S. (i.e. excluding intra-U.S. shipments by Jones Act carriers) being MISC’s American Eagle (AET) with a 13.2% market share. It’s shipments increased by 46.0% vs. a year earlier.

It was closely followed by Teekay’s 11.4% share, with volumes that rose 38.5%. It’s too early to say though that we are seeing a resurgence in fortunes for the tanker operators. As a group the management teams are bearish about the outlook for rates in 2018 as outlined in Panjiva research of November 22.

Source: Panjiva

U.S. oil exports are likely to expand further, with President Trump scheduled to release a new offshore oil production plan to cover 2019 to 2024, Bloomberg reports. China has been a leading market for supplies so far, accounting for $630 million of shipments in the third quarter, though that is still only 1.7% of supplies.

India meanwhile is also expanding its oil imports, with a 13.1% increase in October. The U.S. became the eighth largest exporter to India in October having displaced Algeria and Brunei. It does have a cost disadvantage vs. the larger suppliers including Saudi Arabia and Iraq purely from a transportation perspective.

Source: Panjiva