Ventilator maker Drägerwerk has raised concerns about the supplies of ventilators to the U.S. – seaborne imports in the first three weeks of March have collapsed. Ceva’s declaration of force majeure could cast widespread doubts across supply chains.

Also: Konecranes can’t lift spirits as coronavirus delivers demand disruption; Japan may float shipyard mergers in response to global consolidation, COVID-19; Trade talks, data shouts – COVID-19, stories from the data; G20 has best intentions, doesn’t rule out worst actions; “Operation Airbridge” could offset seafreight shortages; discipline stabilizes shipping rates, on some routes; and the trade dispute process is partly unbunged, but WTO reform still far off.

Daily Datum: 20.1%

year over year drop in exports from China’s shipyards in January / February combined

NEED TO KNOW

Drägerwerk’s U.S. ventilator worries already evident in March

Ventilator manufacturer Drägerwerk sees the potential for a significant shortfall in supply versus demand for ventilators globally. Specifically the firm’s CEO, Stefan Dräger, has stated that “the largest part of production capacity for ventilators is in Europe, while the biggest problem appears to be in the U.S.” While the Trump administration has triggered the Defense Procurement Act to ensure supplies, domestic manufacturing by General Motors among others will take time to ramp up.

U.S. seaborne imports linked to Drägerwerk started in Q3 2019 but have focused on components rather than completed machines.

U.S. imports by sea of completed ventilators by all suppliers have slumped by 39.7% in the first three weeks of March compared Q4 2019 on a daily run-rate basis. Shipments from China dropped by 84.7% and were not offset by a 30.4% surge in shipments from Singapore. U.S. imports may fall further if a recent G20 pact fails to prevent the spread of export restrictions globally.

(Panjiva Research – Healthcare)

Source: Panjiva

Ceva’s force majeure bodes ill for supply chain certainty

Freight forwarder Ceva Logistics has declared force majeure and asserts it is “temporarily relieved” of its contractual obligations and may “modify all or part of its services“. If repeated across the industry – as DP-DHL’s forwarding business has done – it decreases the certainty of shipping timings / routings for supply chains.

If the move proves more limited then Ceva may lose market share. Ceva had already experienced a 14.6% year over year drop in U.S.-inbound, seaborne shipments in the first two months of 2020, Panjiva’s data shows, including a 26.3% slide in shipments from China.

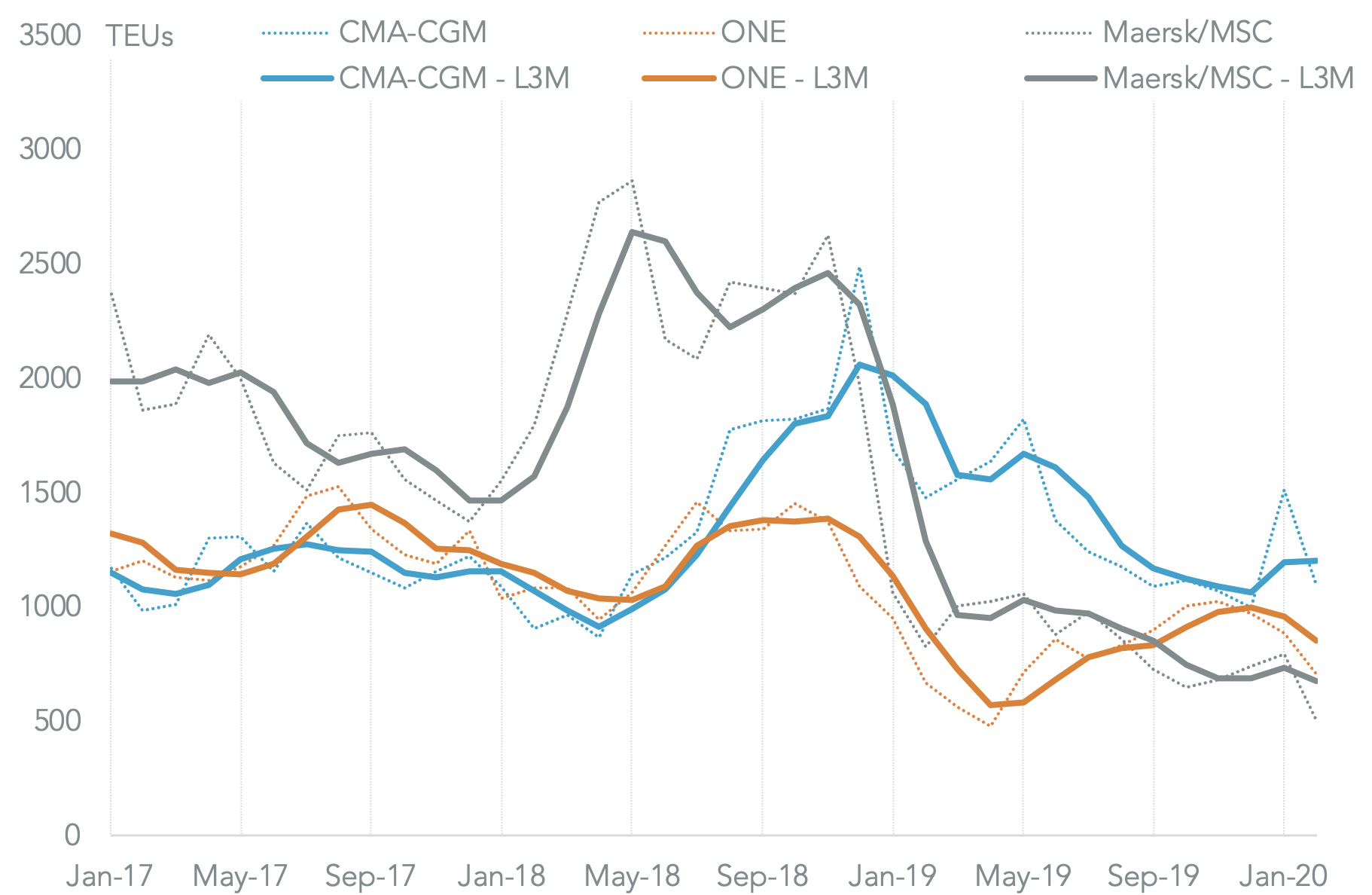

There may be a knock-on effect for container-lines that Ceva works with if it uses the force majeure declaration. Ceva’s owner CMA-CGM accounted for 20.9% of U.S. inbound shipments linked to Ceva in 2019 and saw a 17.5% drop in volumes directed to it from Ceva in January and February combined compared to a year earlier.

(Panjiva Research – Logistics)

Source: Panjiva

Konecranes can’t lift spirits as coronavirus delivers demand disruption

Industrial crane maker Konecranes has withdrawn its earnings guidance and cut its demand outlook in connection to the coronavirus outbreak. The firm has stated that demand “across our customer segments and regions is deteriorating“. That shouldn’t be a surprise given the warnings regarding the outlook for volumes from across the logistics industry – Konecranes supplies ports.

It also comes against the backdrop of an 11.3% year over year slide in imports of all types of cranes in the U.S. in the three months to Jan. 31.

Seaborne imports linked to Konecranes meanwhile fell by 15.2% year over year in the first two months of 2020. A 77.4% slump in imports from China reflects the impact of tariffs while a 17.6% slip in shipments from Europe may illustrate the wider weakening of demand.

(Panjiva Research – Capital Goods)

Source: Panjiva

GLOBAL SUPPLY CHAIN WRAP

Japan may float shipyard mergers in response to global consolidation, COVID-19

The Japanese government may be considering a wide-ranging merger of shipbuilders, following an alliance involving Imabari Shipbuilding and JFE Holdings. In the short-term that may improve the financial viability of the sector in the aftermath of the coronavirus outbreak.

It’s also a longer term response to consolidation in the sector that has seen the merger of DSME and Hyundai Heavy in South Korea and a wide ranging restructuring in China. Conditions in Japan, expressed as shipyards’ exports, have improved recently with an 8.9% year over year rise in exports in the first two months of the year.

Exports from China by contrast fell by 20.1% as the first effects of coronavirus-linked disruptions were felt. The outlook for shipyards depends on the willingness of shipping firms to invest in the face of considerable uncertainty.

New shipping orders for Chinese shipyards climbed 41.4% year over year in the first two months of the year, though includes an unusually low comparator while the remaining orderbook of business is only equivalent to 17 months of production at recent rates.

(Panjiva Research – Logistics)

Panjiva Insights: Trade talks, data shouts – COVID-19, stories from the data

Panjiva Research took part in the Trade Talks podcast, hosted by Soumaya Keynes of The Economist and Chad Bown of the Peterson Institute for International Economics on March 26. A link to the podcast is included in this report, which also summarizes the key points covered. Broadly the podcast looked at lessons from Panjiva’s data emerging from the COVID-19 outbreak.

Topics covered included: the impact of China’s lockdown, including seasonality and what happened immediately after; how the logistics and manufacturing industries dealt with China’s closure; comparisons between dealing with the U.S.-China trade war and dealing with COVID-19; initial data for other countries that have gone into lockdown; the impact on ventilator supply chains; trade policy responses from around the world; the outlook for global trade; and whether there’ll be a lasting impact on global supply chains.

(Panjiva Research – Insights)

G20 has best intentions, doesn’t rule out worst actions

Coming back to medical supplies, a meeting of G20 trade ministers may have reduced the probability of a further extension of further trade restrictions being applied. A WTO study shows that nine countries and the EU have introduced export barriers, though on the other side of the equation major importers – including the U.S. as discussed in Panjiva’s research of March 17 – have cut tariffs or regulatory restrictions.

The G20 agreement states the aspiration to ensure equal access to medical supplies, but doesn’t rule out interventions by countries or regions. It allows for measures as long as they are “targeted, proportionate, transparent, and temporary” and inline with WTO rules. Should the latter prove controversial it’s unlikely that WTO rulings blocking the move could be implemented in the near-term.

(G20, World Trade Organization)

“Operation Airbridge” could offset seafreight shortages

The U.S. government has started airlift shipments of medical supplies from China as part of “Operation Airbridge”. The shipments are set to continue over the next four weeks as the Trump administration seeks to address the emerging shortfall in supplies. As outlined in Panjiva’s March 23 reportthere’s been a slump in shipments of basic personal protective equipment by sea at the start of March as China and others have prioritized domestic buyers.

(Reuters)

Discipline stabilizes shipping rates, on some routes

The container shipping industry continues to face weakening demand due to the spread of coronavirus. That’s led many shipping companies to blank sailings, most recently with MSC / Maersk blanking two Asia-Europe routes for the whole of Q2.

The capacity discipline shown earlier in China-outbound routes, discussed in Panjiva’s March 9 report, has been reflected in a modest uptick in rates of 0.4% last week according to SSE data. Yet, the wider downturn in demand has dragged on global rates which fell 5.8% according to S&P Global Platts.

The latter also reflects a continued slump in fuel prices which dropped 10.3% last week to their lowest since May 2016. That’s been the result of the ongoing crude oil price war between Russia and Saudi Arabia.

(Maersk, Shanghai Shipping Exchange, S&P Global Platts)

Trade dispute process unbunged, but WTO reform still far off

Returning to WTO disputes, 15 countries plus the EU have reached agreement on a parallel trade dispute settlement process that bypasses the WTO. The latter has not been able to rule on disputes this year due to the inquoracy of the appellate function of the dispute settlement process.

As shown in Panjiva’s 2020 Outlook a reformation of the WTO’s processes is unlikely without significant concessions from the U.S. Notably the new group includes Mexico and Canada, raising questions about how disputes between the two would interface with their USMCA commitments.

(European Commission)