The industrial robotics industry is going through a period of rapid upheaval. ABB and Kawasaki have announced plans to work together on the development of “collaborative” robots – effectively systems designed to augment rather than replace human operations. That may reflect the high costs of R&D and arms race (as it were) in technology. At the same time Mitsubishi Electric has announced plans to expand production in China in order to shorten delivery times, Nikkei reports. It remains a growth industry, with industry consultant FMI forecasting a 15% annual growth over the next decade.

The opportunity in China is significant, with Panjiva data showing Chinese imports of industrial robots and parts climbed 51.7% on a year earlier in the third quarter. With a new all-time high set in August, shipments in the past 12 months reached $3.6 billion. However, fragmentation is a challenge. The top 10 consignees only represent 20.3% of imports, partly reflecting a mixture of direct and global sales networks.

Source: Panjiva

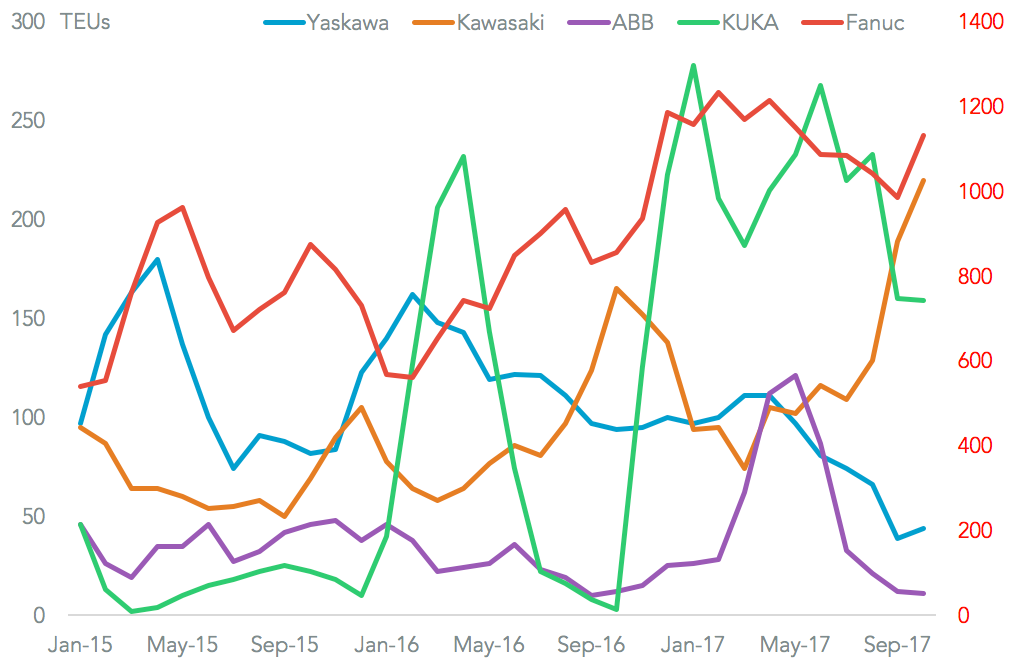

That fragmentation may be another driver for the tie-up between ABB and Kawasaki for new products. U.S. seaborne imports of industrial robotics equipment climbed 13.6% in the three months to October 31, including the highest in over a decade in the month of October. While Kawasaki-related robotics imports climbed 33.3%, those by ABB fell 8.3% – both lost out to market leader Fanuc and a resurgent KUKA.

The manufacturer with the biggest questions to answer however is Yaskawa, whose imports fell 53.2% for the quarter having hit the lowest since April 2014 in September. It is partly addressing that by also expanding its production in China.

Source: Panjiva