An association of four U.S. hospital groups are combining to produce their own generic pharmaceuticals – likely via contracting with other manufacturers the Wall Street Journal reports. The aim is to cut costs for higher priced generic drugs where there are few suppliers. The group will require FDA permissions for its production plans, limiting their impact in the near term.

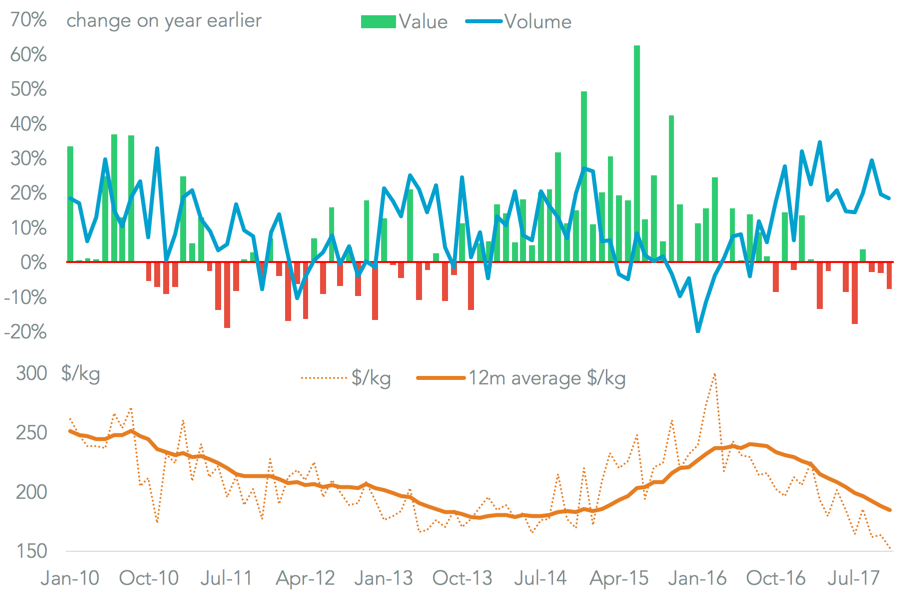

On a broad-basis U.S. pharmaceutical imports have increased rapidly in the past year as prices have fallen. The quantity of imports climbed 20.5% in the 12 months to November 30, including a new record for the month of November alone, Panjiva data shows. Yet, average import values – a proxy for costs – fell by 20.1% to reach the lowest on an annual average basis since January 2015.

Source: Panjiva

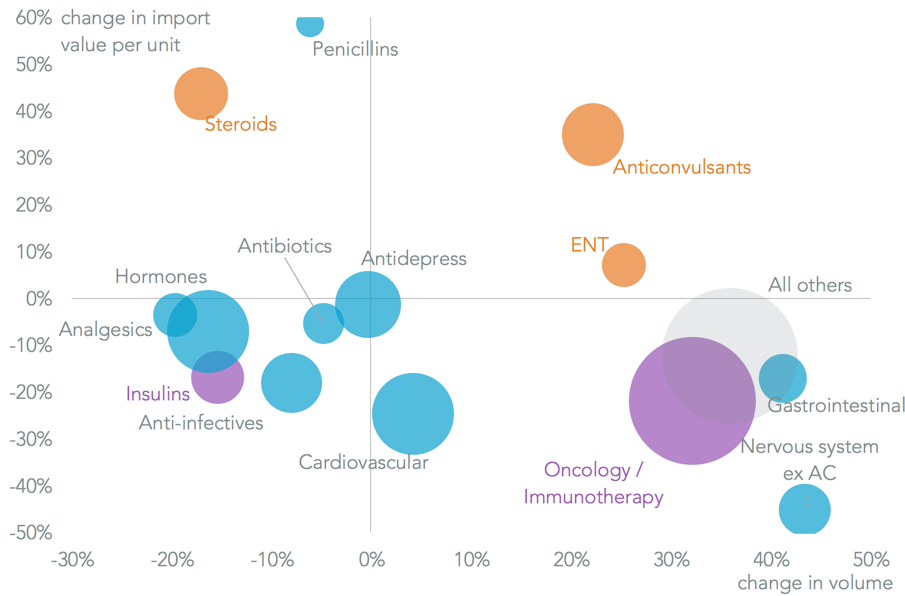

Major drug classes where there have been significant increases in average import costs per unit have been anticonvulsants (35.0% in the three months to November 30 on a year earlier), steroids (43.8%) and ear/nose/throat treatments (7.2%). Pricing in the most costly import line, oncology, has fallen 21.9% over the same period and totalled $14.0 billion of imports in the past 12 months vs. $7.45 billion for the prior three drug classes combined.

Source: Panjiva

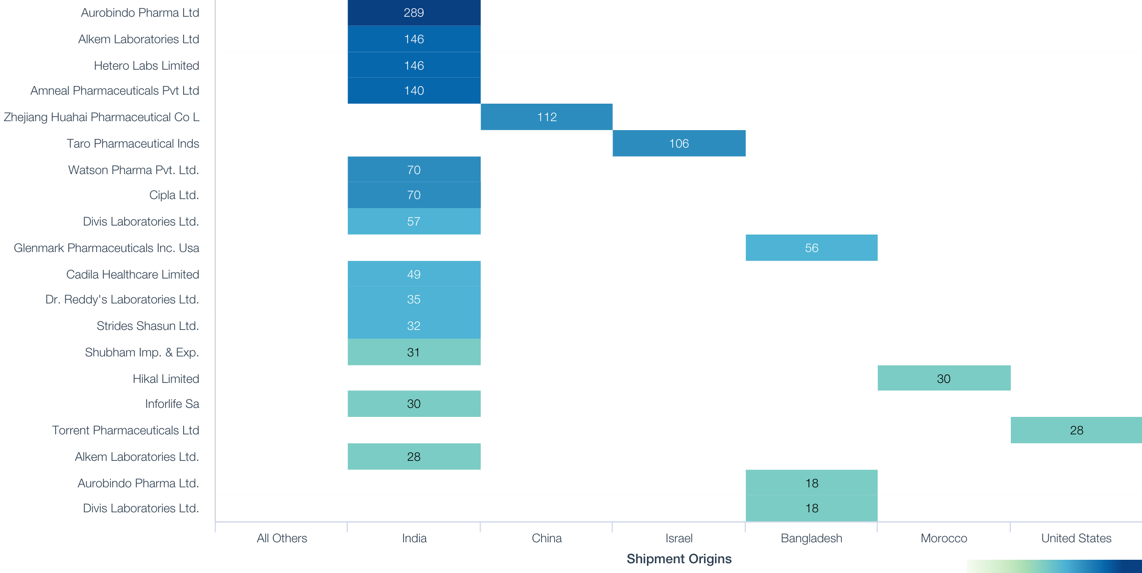

The joint venture has yet to detail which drugs and which suppliers it is targeting. Yet, the largest overseas supplier of anticonvulsant drugs in 2017 was Aurobindo with production in both India and Bangladesh accounting for 33.4% of seaborne imports. That was followed by Alkem, also from both countries at 17.9%). The largest non-Indian suppliers were Zhejiang Huahai (7.5% sourced from China) and Taro Pharma (7.1% from Israel).

Source: Panjiva