The Brazilian government is considering ending the “reintegra” export tax credit next year, Bloomberg (paywall) reports. The rate, applied on value added, was set to rise from 2% to 3% for 2018 and cost the government 10 billion reais ($3.2 billion). The steel industry is reported to be the biggest user of the tax break.

Panjiva data shows Brazil’s exports of steel products have already been in decline, with a 5.3% drop in volumes shipped in the second quarter on a year earlier. That would suggest a decline in demand in key markets including the U.S. and Europe. They also potentially face threats from the U.S. section 232 review of the steel industry, as outlined in Panjiva research of July 24. Further up the value chain shipments of iron ore have increased, with a 2.7% increase in the quarter.

Source: Panjiva

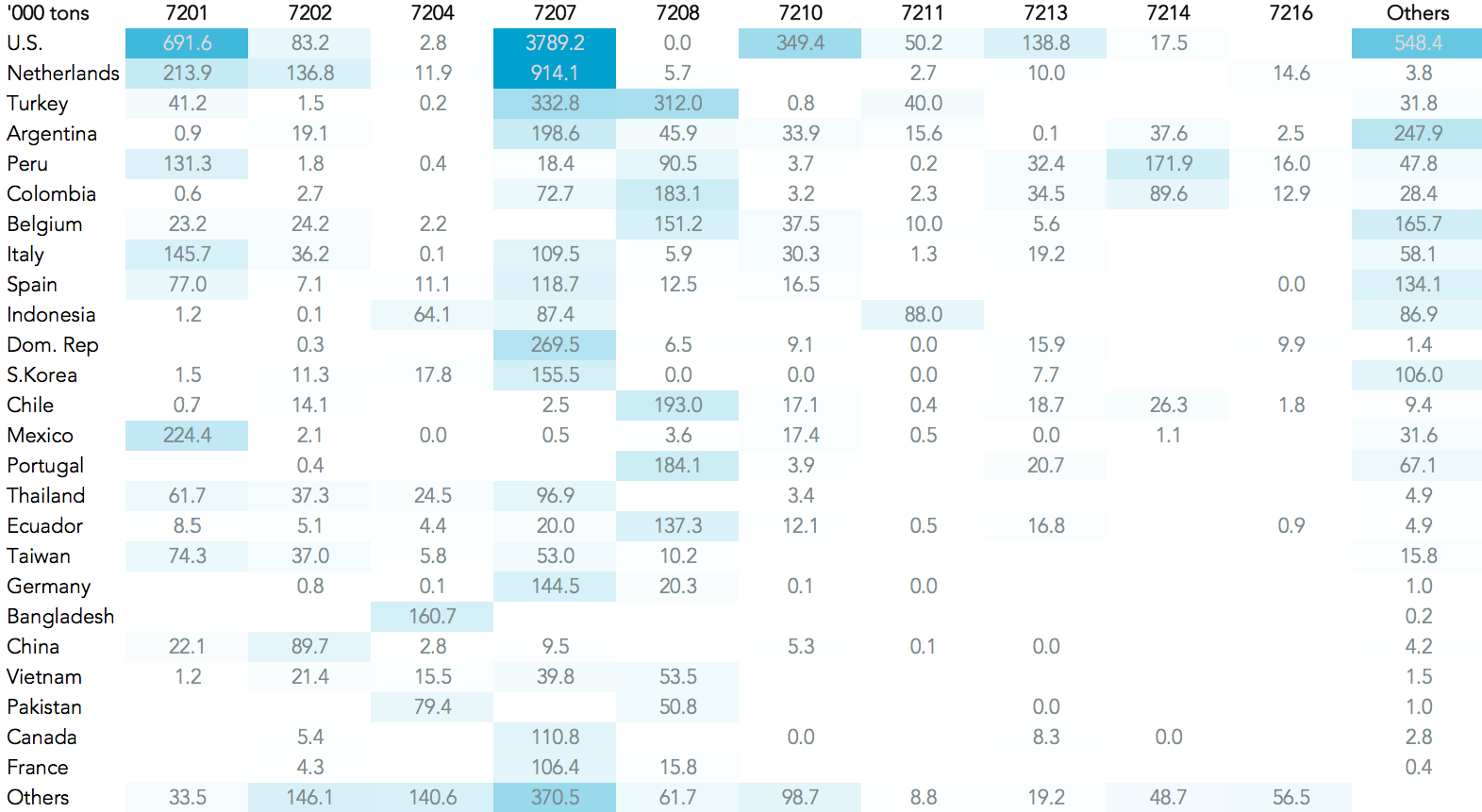

Panjiva analysis of 570 country-product pairs shows the Brazilian steel industry’s biggest exposure, by weight, is to exports of semi-finished steel plate to the U.S. (25.1%) and the Netherlands (6.1%) as well as higher-value added products to the U.S. including flat-rolled, coated steels (2.3%) and hot-rolled bars (0.9%).

Source: Panjiva