The evolution of potassium-ion batteries has increased their potential energy density and lowered their price, presenting a challenge for lithium-ion batteries including the providers of raw lithium according to a recent S&P Global Platts podcast.

Miners in Chile and Argentina also face the prospect of increased U.S. government intervention in the critical minerals market as outlined in Panjiva’s research of Jun. 7.

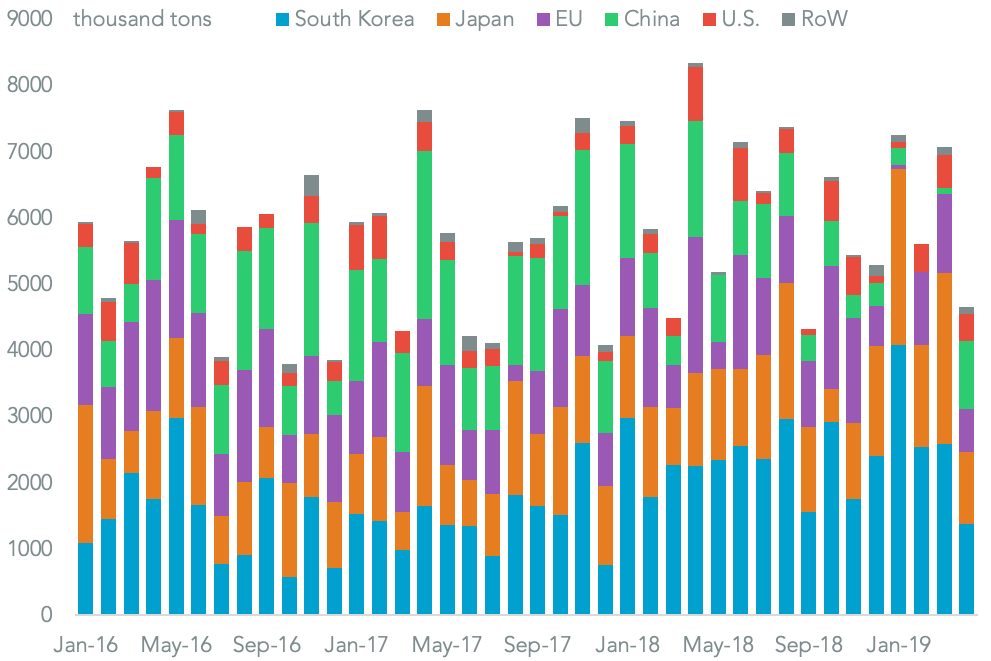

That comes as Chilean exports of lithium dropped 44.3% year over year in April, the fastest decline since Feb. 2012, Panjiva data shows. That may reflect a decision earlier in the year by SQM to restrict output and reverses an 11.8% growth in the first quarter.

Shipments to all major customer regions declined, though buyers in the EU and China have faced falling exports for most of 2019 so far.

Source: Panjiva

The restriction of output wasn’t enough to offset a decline in average achieved prices though – the average value per ton fell 17.7% year over year in April. At $10,593/ton that was the lowest since Nov. 2017 while the rolling quarter average fell to the lowest since Nov. 2018.

That’s left SQM’s export earnings in the three months to Apr. 30 at $125 million, down 15.9% year over year while Rockwood’s fell 22.3% to $67 million.

Source: Panjiva