Toy manufacturer Tomy, producer of Transformers and John Deere branded merchandise among others, reported calendar Q2 (fiscal Q1) revenues which fell by 21.0% year over year and missed analysts’ estimates by 13.5% according to S&P Global Market Intelligence data. Tomy also published guidance for the full year to March 31, 2021 for revenues to drop by 12.0% which was also 6.4% points worse than expectations. The firm’s stock price dropped by 5.4% on the day following the results publication.

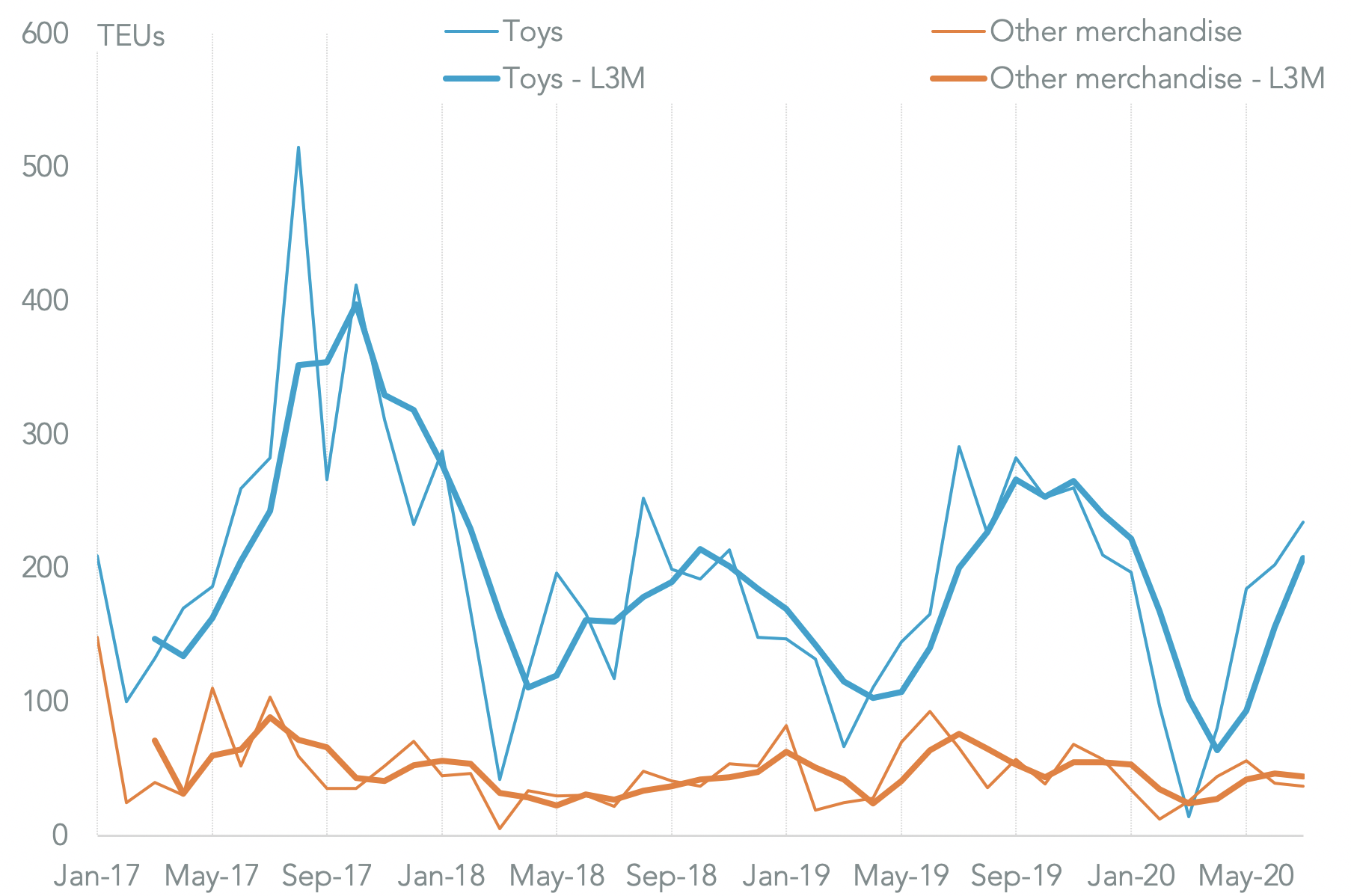

While the majority of Tomy’s sales are in Japan it’s second largest market is North America. Panjiva data shows that U.S. seaborne imports linked to Tomy were unchanged in Q2 compared to a year earlier, including an 11.1% rise in toys and a 27.2% drop in non-toy merchandise.

The increase in toy shipments may have led to a surge in inventories – indeed at the group level the firm’s inventory days increased to 87.3 in the latest quarter compared to 68.6 a year earlier. Inventory management can be a key differentiator of success for toy manufacturers, as flagged in Panjiva’s research of July 27.

Source: Panjiva

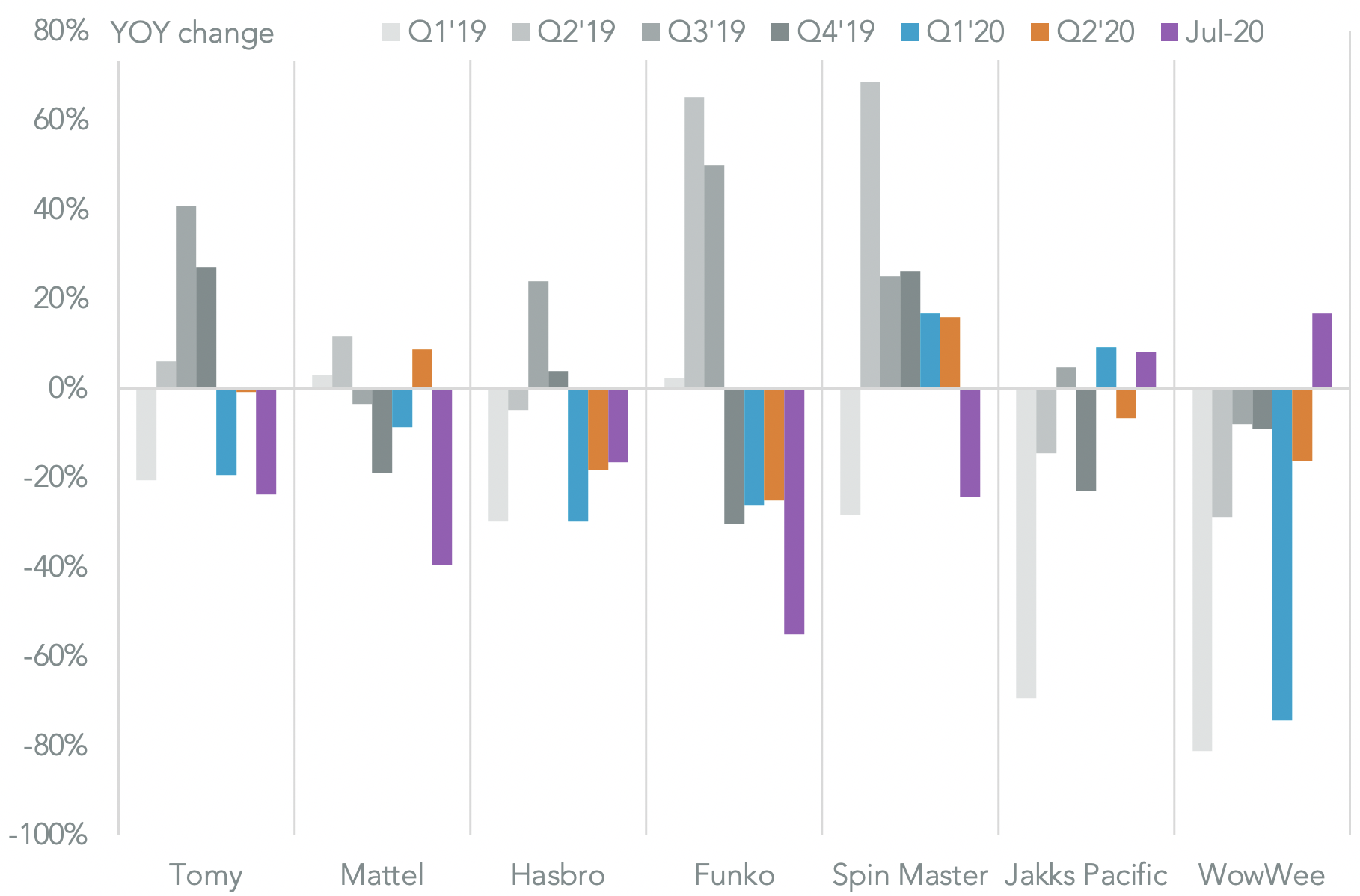

There are signs that Tomy is cutting shipments to manage inventory at the start of Q3, with total imports down by 23.7% including a 19.3% decline in shipments of toys. Indeed, many other larger toymakers are following suit with shipments linked to Mattel and Hasbro having fallen by 39.4% and 16.5% year over year respectively in July.

Among the smaller, more brand-focused suppliers there was a 55.0% cut in imports linked to Funko and a 24.2% drop in shipments linked to Spin Master, ending the latter’s extended growth.

The outliers have been WowWee and Jakks Pacific with growth of 16.8% and 8.2% respectively, though both had cut shipments in Q2 and so may have had more manageable inventory positions to start with.

Source: Panjiva