Hasbro Inc board member and former CEO Alan Hassenfeld has stated he “doesn’t know what the rules of the game are” for American business, Reuters reports, citing a need for the White House to “improve confidence”. The toy industry generally relies heavily on imports. Toy industry sales reached $20.4 billion in 2016 according to NPD, while imports were $13.91 billion (or 68.3%) Panjiva data shows. Furthermore, China accounted for 86.1% of total imports in the 12 months to March 31.

The “toy trade deficit” (ie exports less imports) reached $12.8 billion in the 12 months to March 31, up from $10.0 billion in 2012. That may bring the industry into the cross-hairs of the omnibus report on the causes of the trade deficit. That was commissioned by the the administration of President Donald Trump and is due to report by June 29, as outlined in Panjiva research of April 26.

The prospect of a border-adjustable tax – which would raises costs for retailers – or increased tariffs on Chinese production could therefore be a heavy burden for the toy retailers. While the first quarter is relatively quiet in terms of toy sales, imports in March increased 20.2% on a year earlier in dollar terms and risen a further 20.0% in April on a shipment basis.

Source: Panjiva

So far it would appear that the toy suppliers are taking different stances. Mattel may be rebuilding its inventories, with imports in the three months to April 30 being 8.2% higher than a year earlier. That’s a marked reversal from the 16.2% drop seen in the fourth quarter. Hasbro meanwhile appears to have remained cautious, with imports down 25.9% after a bumper 2016 that saw total imports rise 6.1%.

Source: Panjiva

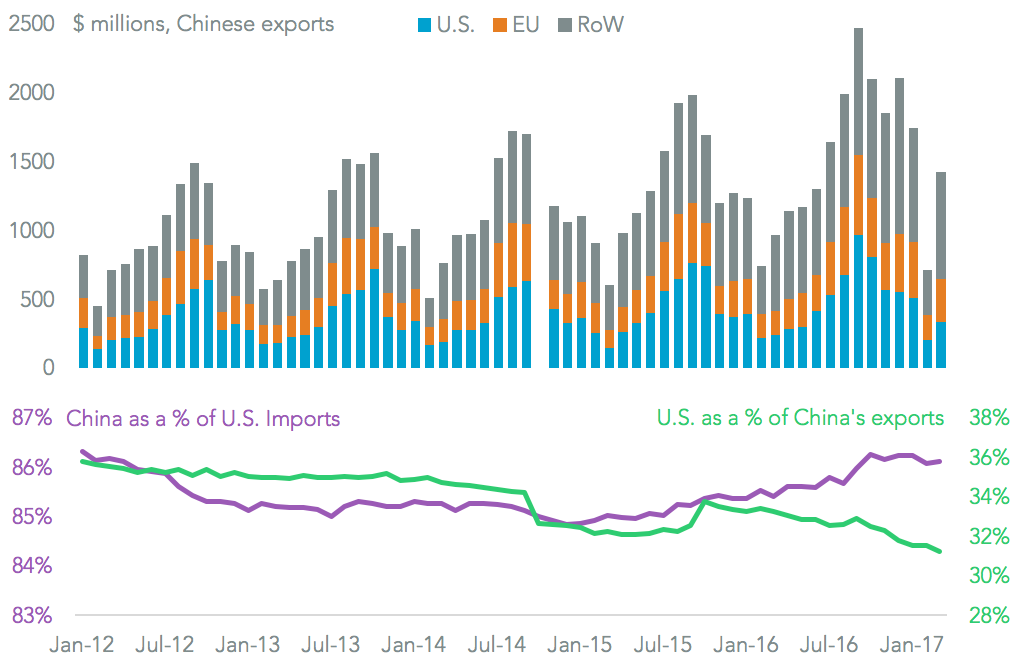

On the other side of the Pacific, Chinese manufacturers have been steadily diversifying their customer base. Exports in the first quarter of the year increased 32.1% on a year earlier. That was actually led by a 50.3% rise in shipments to Europe. As a consequence the U.S. accounted for 31.2% of Chinese exports in the 12 months to March 31, down from 35.8% in 2012.

Source: Panjiva