The Chinese government has launched the first round of exemptions from tariffs on U.S. imports. The two groups cover similar products though the first will eligible for a rebate from previously paid tariffs but the second will not. The Finance Ministry has also left open the possibility of future rounds of exemptions.

The timing of the announcement, alongside a relaxation of foreign investment rules reported by Xinhua, is not a surprise. As outlined in Panjiva’s research of Sept. 5, talks between the two sides are due to restart in the week starting Sept. 16 and the tariff cuts may be designed to provide some goodwill without significant concessions being granted.

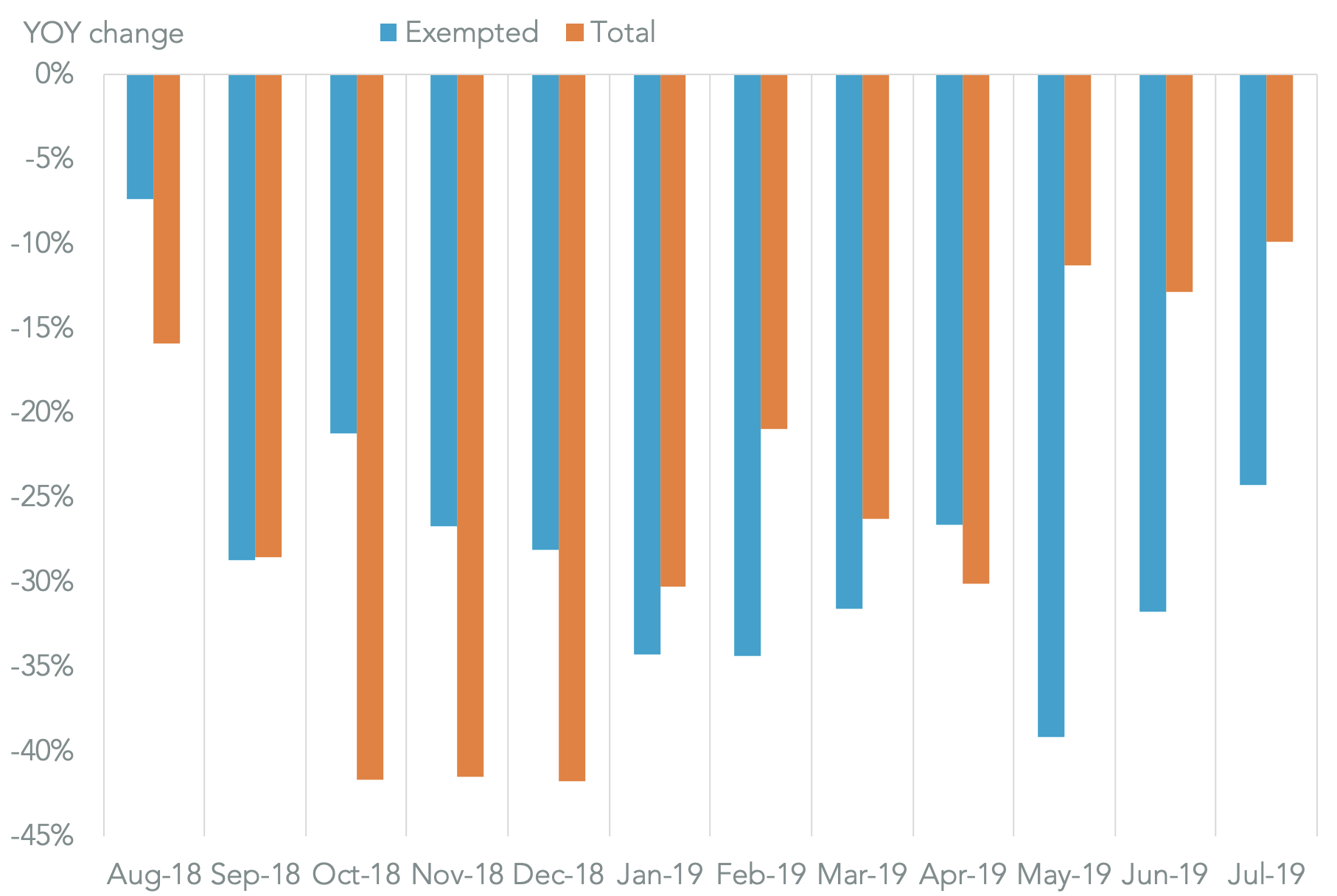

U.S. exports of the products targeted for tariffs were worth around $870 million in the 12 months to Jul. 31 Panjiva analysis shows. In aggregate they fell 27.9% year over year, a similar rate to the 27.0% seen for all U.S. exports that have been targeted for tariffs.

However, the rate of decline in exports of the products covered by the new exemptions accelerated to 32.4% year over year in the three months to Jul. 31 compared to 11.4% for all exports. That would suggest the tariffs’ negative impact on Chinese companies has become more pressing.

Source: Panjiva

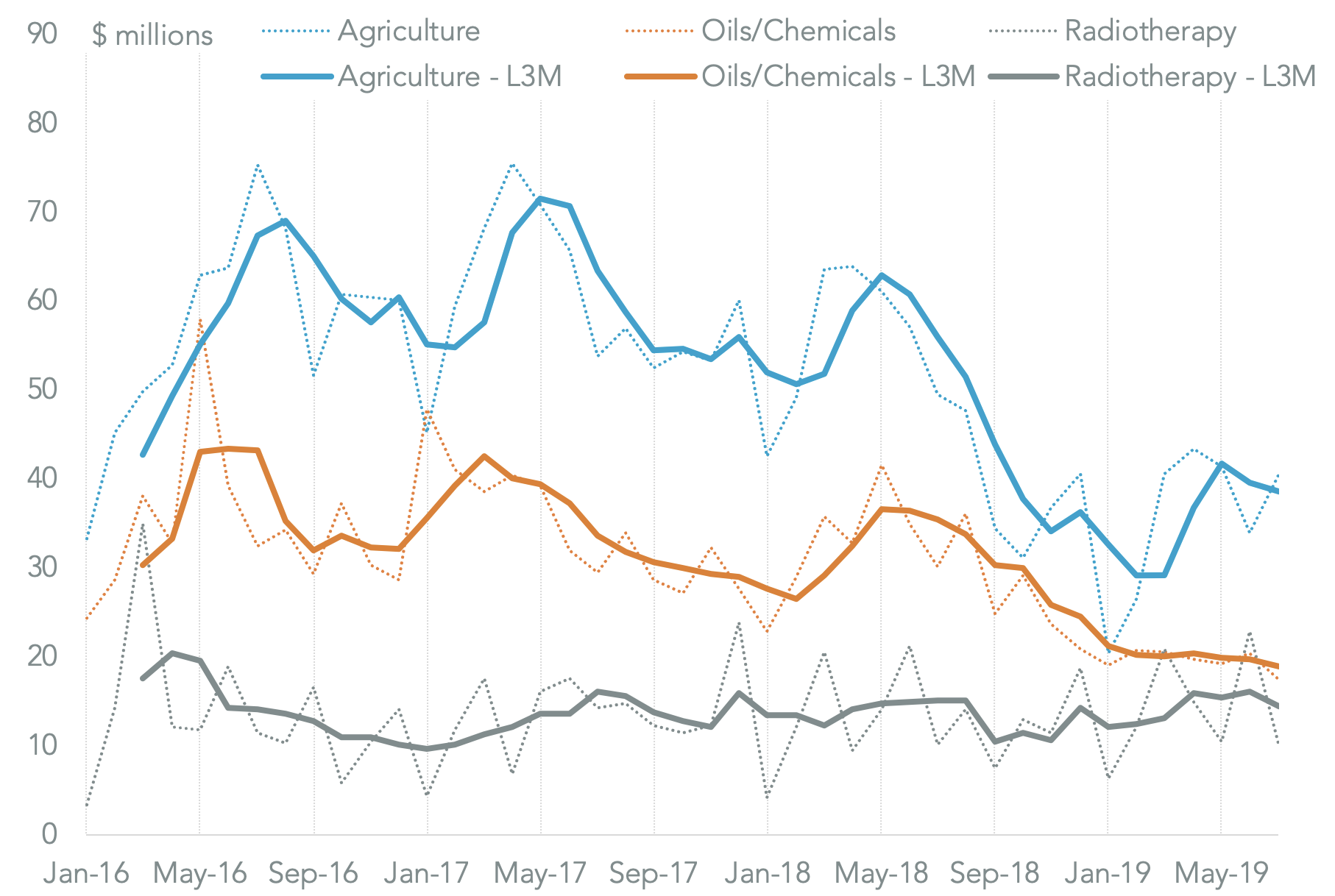

The exemption group is led by agricultural products worth $437 million in the 12 months to Jul. 31 after a 34.2% year over year decline in the 12 months to Jul. 31. That was led by a 44.6% slide in shipments of whey powder and a 29.0% slump in animal feeds including hay.

Exports of oil and chemicals, which may have included ExxonMobil and Valvoline, Panjiva data shows, fell by 46.6% to $271 million.

The only major manufactured products that have received an exemption are linear accelerators, used for radiotherapy. Imports were worth $162 million after a decline of just 4.2%, but the tariffs may have led to an unacceptable increase in healthcare investment costs. The exemption may help exports of Varian’s Vitalbeam and Trilogy models.

Source: Panjiva