NAFTA is about more than just U.S.-Mexico tariff politics. Foreign Minister Chrystia Freeland of Canada and Economy Minister Ildefonso Guajardo will meet at a AS/COA conference this week and may discuss their negotiating stances. Both governments have committed to renegotiating NAFTA, and have been awaiting the start of the U.S. consultation process, as outlined in Panjiva research of May 18.

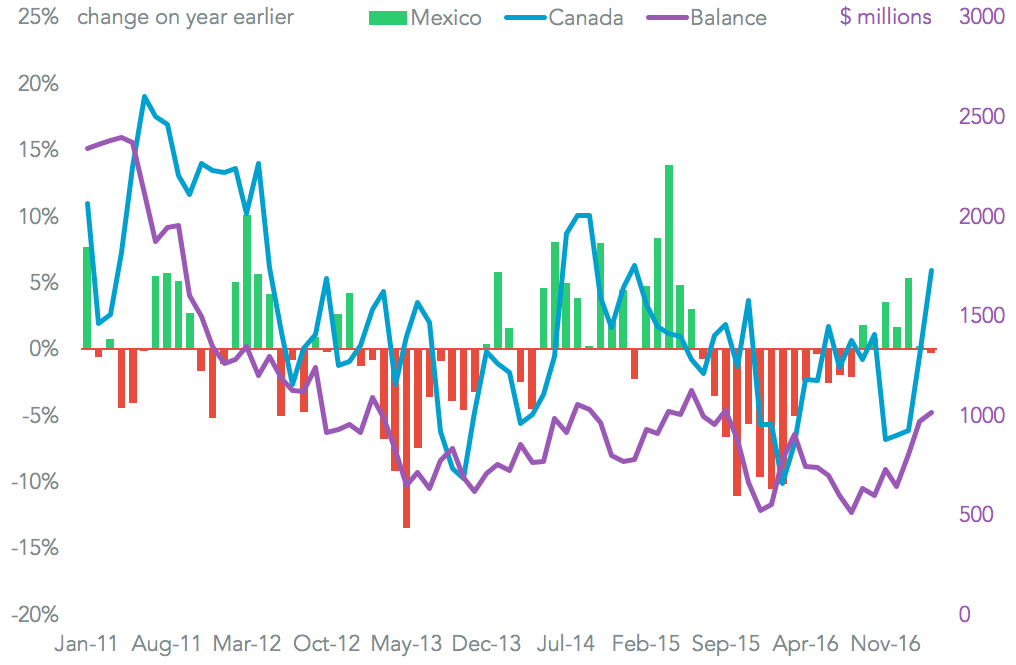

Mexico’s exports to Canada have undergone a slowdown, falling 0.3% on a year earlier in the first quarter, Panjiva data shows, while Canada’s exports have accelerated. The most recent increase of 5.9% for the first quarter partly reflects energy exports, however. Nonetheless Mexico’s trade surplus vs. Canada on a trailing 12 month basis increased above $1 billion for the first time since September 2015 in March.

Source: Panjiva

While there is an element of indirect flows from Canada to Mexico via the U.S., for example in energy, there are still significant areas of trade sensitivities between the two countries. Panjiva analysis of the top 500 export lines in each direction shows the export of manufactured products from Mexico in the autos and electronics industries are the main contributors. Canada’s shipments meanwhile are more oriented towards components, especially in metals and plastics.

The relative unimportance of agriculture to both sides removes one potential area of friction that the two countries will separately have with the U.S., simplifying the negotiating process somewhat. Importantly the analysis also shows that Mexico is more dependent on fewer products. The top 10 exports from Mexico account for 20.9% of the total, vs. 9.5% for Canada. That may impact negotiating tactics – Mexico will care more about specific products, Canada about general rules.

Source: Panjiva