South Korea is “actively considering” a WTO case against China for its trade actions with regards to Lotte, Reuters reports. It alleges these are an economic retaliation against South Korea’s decision to station the THAAD missile system on land formerly owned by the company. There were 43 such interventions against South Korean companies by early February, according to Yonhap News.

While Lotte’s direct imports into China are relatively small, at $32 million according to Panjiva data for 2016, it raises the prospect of a broader trade conflict between the two countries. That likelihood seems relatively small, however. Panjiva’s analysis of China’s top 200 imports from, and exports to South Korea shows such a conflict would be highly disruptive for both countries.

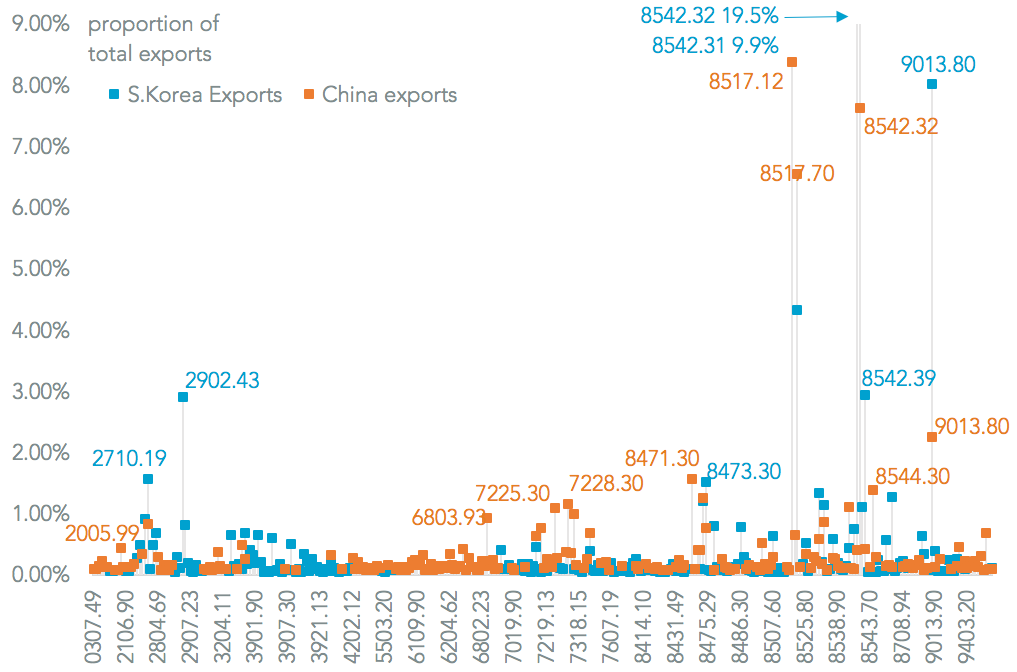

Of the 400 combinations there is only two-way trade in 16.5% of them, though notable examples include display components. South Korea is highly dependent on China as a customer for semiconductors (32.4% of its exports), but these are used in Chinese exports of phones and laptops (16.5% of the total). Furthermore South Korea relies on Chinese steel for its auto manufacturing industry and China is a significant buyer of South Korean energy products.

A lower-level “tit-for-tat” dispute between the two countries could disrupt negotiations to create the RCEP trade deal this year. These are complex enough already, as discussed in Panjiva research of February 26.

Source: Panjiva