The U.S. government has issued 103 exemptions from section 301 duties on list 4A products, where tariffs were applied at a 15% rate in Sept. 2019 and cut to 7.5% in mid February. Those represent the first of the list 4A appeals to be approved and cover 10 products imported by 27 companies. There are a further 8,768 applications still awaiting approval, Panjiva’s analysis of official filings shows.

Source: Panjiva

Perhaps unsurprisingly all the products approved are in the medical supply industry including surgical gowns, masks, gloves and hand sanitizer. That comes as several countries have started to restrict their exports – China not yet being one – in response to the COVID-19 coronavirus outbreak as discussed in Panjiva’s research of Mar. 5.

Panjiva’s data shows that total U.S. imports of the products exempted – note only a handful of companies importing the products have been formally absolved – were worth $3.68 billion in 2019. That represented 51.7% of total U.S. imports of the products concerned.

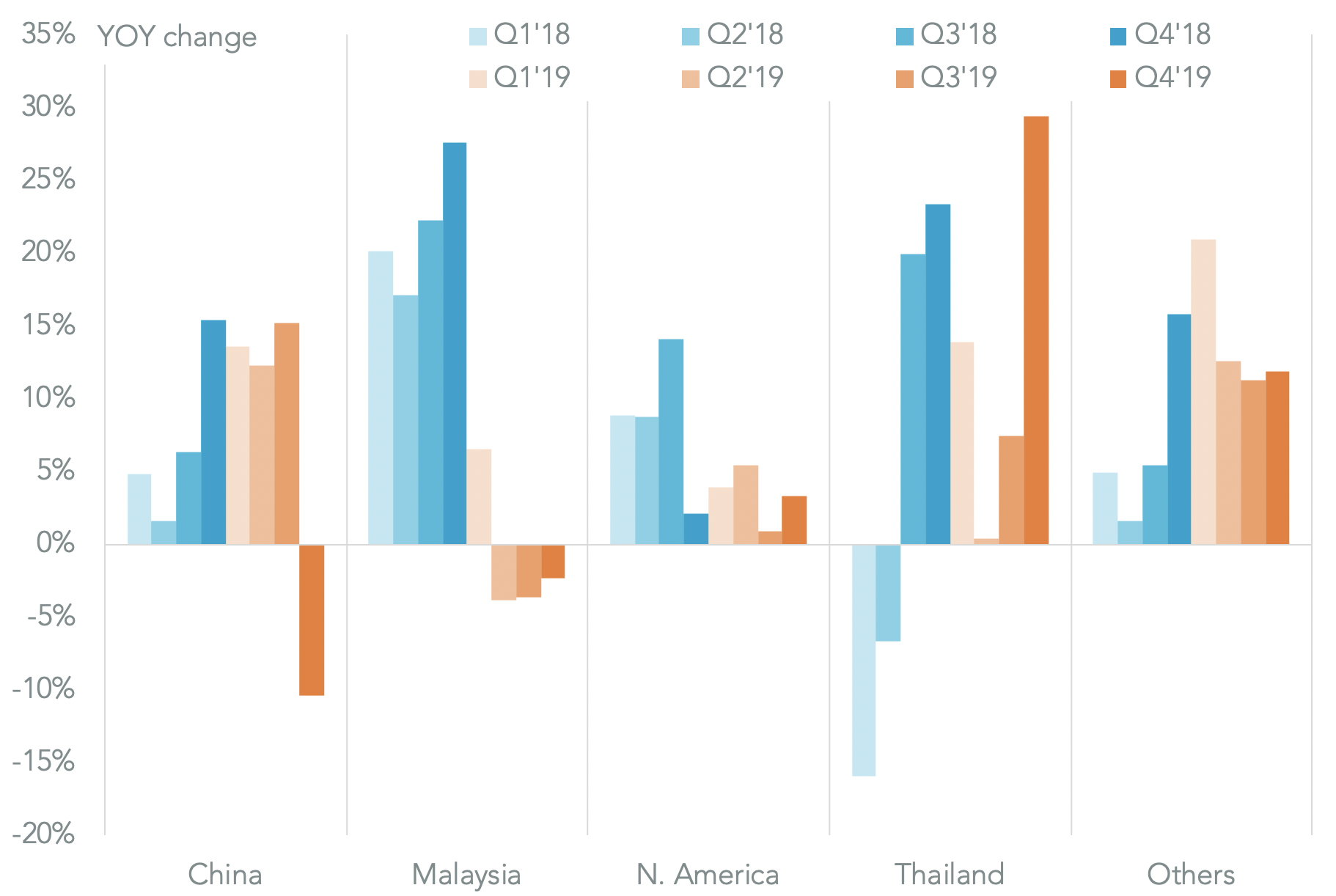

The tariff saving for U.S. healthcare providers across all imports could be equivalent to $275 million annually. Imports from China dropped 10.4% year over year in Q419 while imports from Thailand and Mexico / Canada climbed by 29.4% and 3.3% respectively to compensate.

Source: Panjiva

Among the winners of exemptions were Cardinal Health and Brady Corp. with six and four products approved respectively each. Those included gowns and gloves for Cardinal and plastic ID bands for Brady. Panjiva’s seaborne data shows that 52.1% of U.S. import shipments linked to Cardinal Health came from China in 2019 while for Brady the ratio was 31.6%.

Both firms have cut back their imports from China in response to the tariffs, with shipments linked to Cardinal from China having fallen by 11.8% in Q4 and in Brady’s case a drop of 15.4%. The start of 2020 did not bring much change with Cardinal’s imports unchanged in January and February while Brady’s fell a further 8.3%.

Source: Panjiva