The U.S. stock market, as measured by the S&P 500 index, has fallen by 6% since last Friday according to Bloomberg figures. That’s been driven by a mixture of fundamentals (concerns about monetary policy tightening after recent strong labor figures) and technical issues (trend following passive funds as well as derivatives), according to Reuters.

That decline, if sustained, raises the prospect that President Donald Trump may enact restrictive trade policies, Axios reports. The theory assumes (a) he has not acted broadly so far in order to avoid damaging the market recovery which has been a measure of his success in office and (b) that a prolonged downturn would require an offsetting “policy momentum” ahead of the midterm elections. The latter could also be set in an employment perspective as the administration sees a correlation between actions to close the trade deficit via restricting imports and the level of U.S. employment.

As outlined in Panjiva research of January 22 the President has six areas where action can be almost immediate including: the section 232 reviews of steel and aluminum; action on the section 301 review of Chinese IP; complete the KORUS trade deal renegotiation; secure further import concessions from Japan; implement the defense procurement review; and start more “self initiated” trade cases.

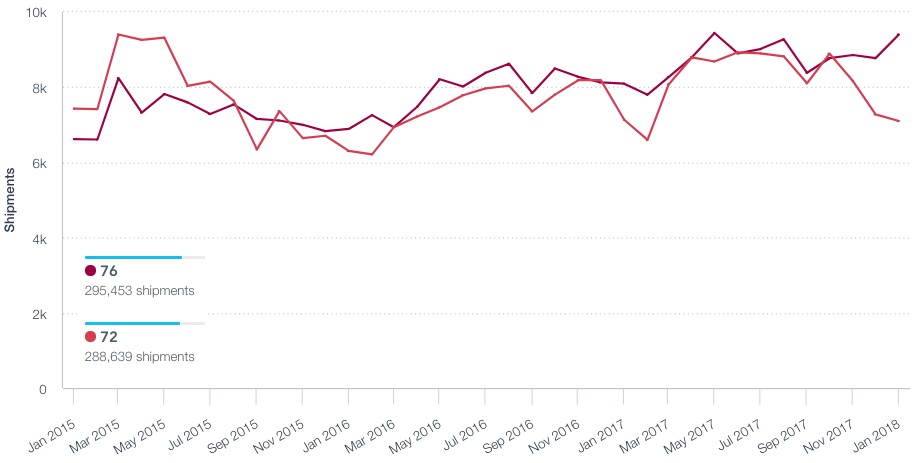

The most “shovel ready”of these would be to enact the – as yet unknown – results of the section 232 reviews of the steel and aluminum industries. Aluminum buyers may be more concerned about the outcomes than steel buyers. Panjiva data shows seaborne imports of aluminum products from outside Canada and Mexico climbed 16.1% higher in January on a preliminary basis vs. a year earlier and were 6.8% higher than the prior three months, perhaps indicating a build-out of inventories. Imports of steel meanwhile were unchanged on a year earlier, and 12.4% down vs. the fourth quarter.

Source: Panjiva

There will be a knock-on effect to businesses downstream of the aluminum users. An association of aluminum users including beverage makers such as Coca Cola and Molson Coors have indicated that tariffs on aluminum can sheet, primary aluminum or scrap would increase their costs vs. their overseas competitors. Imports of can sheet, cans and scrap from outside NAFTA rose 33.7% in three months to January 31 on a year earlier and by 7.6% sequentially.

Source: Panjiva