The spread of COVID-19 coronavirus is primarily a human tragedy, but has also already caused significant disruptions to corporate activity. This report brings together over 20 reports in seven topic areas to provide an overview of Panjiva’s thinking on the topic so far.

We initially identified the electronics and autos sectors as particularly exposed to Hubei province – the epicenter of the outbreak – before going on to find many corporates reactions initially took a wait-and-see approach before focusing on the impact on sales and downstream supply chains.

In electronics, games machines makers Nintendo, Microsoft and Sony are all exposed via a heavy reliance on China, while laptop maker Lenovo has already restructured supply chain away from China and will do more of the same.

In autos Nissan, Toyota, Honda, Hyundai, Fiat-Chrysler JLR and Magna have all already announced disruptions while GM and Nexteer may also face problems.

In capital goods, Illinois Tool Works has included lost production in its earnings guidance, while JCB is slowing production and Deere will utilize expedited shipping to avoid similar challenges.

The logistics sector is heavily exposed with lost volumes for the container lines and higher airfreight costs for freight forwarders while DSV-Panalpina, Maersk and Port of Los Angeles have all raised concerns.

Commodities are both being disrupted by a shortage of shipping capacity – we flag the case of dried distillers grains – while exports of Brazilian soybeans and iron ore are likely to be crimped by reduced demand in China.

Finally, consumer discretionary firms are counting the cost with apparel retailers Under Armour, Adidas, Puma and Uniqlo all flagging sales and supply chain issues, while toymakers Hasbro and Mattel may face more significant issues as peak season approaches.

Please reach out to your usual S&P Global Market Intelligence contact to learn more.

TOP-DOWN ANALYSES

Coronavirus Could Disrupt Supply Chains For Autos, Electronics and Chemicals (Jan. 28)

The spread of novel-variant Coronavirus (nCOV) from Wuhan in the Hubei province of China has caused the Chinese government to extend to the lunar new year break to Feb. 2 from Jan. 30 and led global firms operating in the area to put contingency plans in place. S&P Global Ratings notes the main impact will likely be on consumer spending, though automotive and electronics supply chains also depend on the Hubei region.

Chinese automotive exports already fell by 12.6% year over year in 2019 while seaborne shipments to the U.S. having slumped 40.3% lower in 4Q due to tariffs. Indeed, one risk – albeit relatively unimportant – from nCoV disruptions is that China might not meet its 2020 purchasing commitments resulting from the phase 1 U.S.-China trade deal.

With over 450 U.S. importers exposed to the Hubei region, the breadth of potential supply chain risks is clear. Panjiva’s data shows that Hubei accounted for 27.4% of U.S. seaborne shipments from China associated with Hon Hai and 36.9% of those linked to state-owned China Electronics Corp. Firms whose U.S. imports from China may be even more exposed to the region include consumer goods maker Green Mountain Grills and performance materials producer Avantor.

Source: Panjiva

Corporate Coronavirus Reactions Take Wait-and-See Stance, For Now (Jan. 31)

Regional governments in China have extended factory closures beyond Feb. 2 in order to control the viruses spread via the working population. In terms of demand, the risk to the U.S.-China phase 1 trade deal should be small. It’s based on market terms while U.S. agricultural exports to China, which need to reach $33.4 billion in 2020, peak in the August to October period.

Overseas companies are starting to address the impact on just-in-time supply chains. Few are likely to make strategic supply chain decisions – as U.S. Commerce Secretary Ross has suggested they should – but may face near-term sourcing issues. Around 1-in-8 firms to hold conference calls since Jan. 20 have discussed the impact of 2019-nCoV.

Most, such as electronics maker Celestica and Textron, are taking a watching brief. Panjiva’s data can illustrate geographic exposures. U.S. seaborne imports linked to Celestica are led by China with 48.3% of the total. Those include shipments from Jiangsu and Guangdong provinces which represented 38.1% and 15.5% of the China segment respectively.

Textron is more diversified with China accounting for 27.3% of the total led by shipments with Guangdong representing 23.0% of China-U.S. shipments and Jiangsu 22.1%

Source: Panjiva

ELECTRONICS INDUSTRIES

Nintendo counts coronavirus cost as factories await reopening (Feb. 7)

Chinese factories that have been closed to slow the spread of 2019-nCoV coronavirus are due to reopen on Feb. 9. That may allow companies to start to count the cost of the outbreak to their supply chains. Nintendo has stated “production and shipment delays will be inevitable” for its Switch platform peripherals. The impact on full year sales may be mitigated as deliveries for the holiday shopping season typically only peak in September and October.

The industry overall has a significant exposure to China, with 87.9% of total U.S. imports of videogames coming from China. Yet, that has fallen from 97.6% in 2018. Microsoft’s Xbox may be most exposed to China with 95.1% of U.S. seaborne imports linked to the brand coming from mainland China in 2019, led by shipments from Jiangsu province.

Mainland China represented 90.1% and 68.2% of shipments linked to Nintendo and Sony’s PlayStation respectively. All three have seen a decline in shipments in 2019 and into January 2020 with no major new platforms scheduled to be released until later this year.

Source: Panjiva

Lenovo refactors its laptop supply chain in response to COVID-19

Computer maker Lenovo will ramp up production at its factories in Mexico, India and elsewhere to offset lost output from its Chinese operations. Lenovo’s factory in Hubei – the province that has been the worst affected by COVID-19 coronavirus – reportedly remains closed.

Lenovo has already started to diversify away from China for its U.S. supplies. China represented 65.4% of the shipments to the U.S. linked to the firm in 2019, while Mexico represented 28.9% and Taiwan the remainder. In 2016 China had provided 80.1% of the total.

Lenovo won’t be the only firm needing to adapt its supply chain for laptop computers. China represented 92.1% of U.S. laptop computer imports in 2019. Other major importers include HP Inc and Dell with predominantly all the U.S. seaborne imports associated with the two companies’ laptops coming from China – though not Hubei province.

Source: Panjiva

AUTOMOTIVE INDUSTRY

Coronavirus could stall Fiat-Chrysler, General Motors auto production (Feb. 10)

Automakers and their suppliers are starting to feel the cost to their supply chains from the coronavirus-linked loss of parts supplies from China. Fiat-Chrysler, Toyota and Honda have all announced disruptions. Panjiva’s data shows China accounts for a small but increasing share of Mexico’s parts imports – central to North American supply chains for the big auto assemblers – with 5.7% of parts sourced from China in 2019.

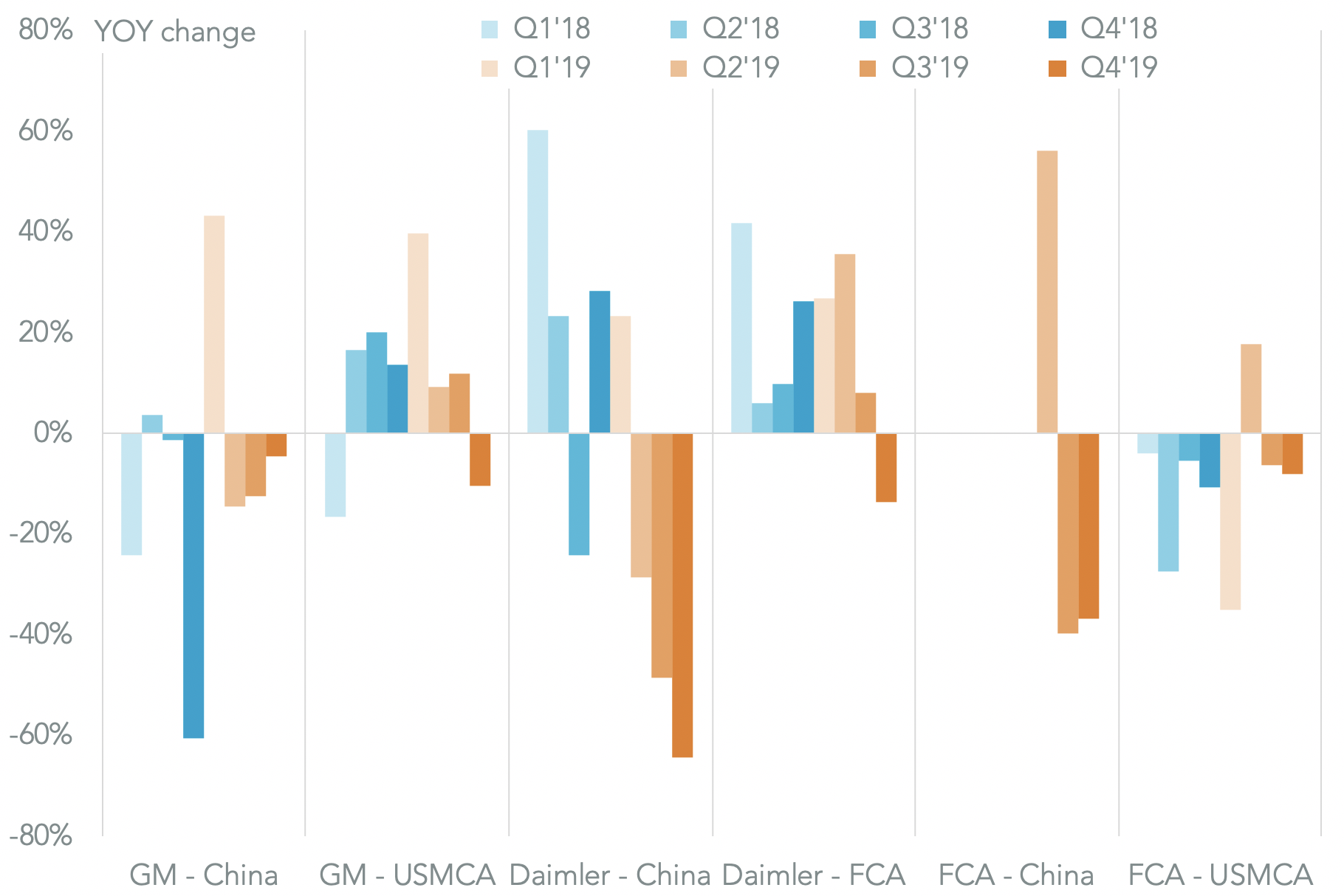

While small at first glance, even a few missing components can stall just-in-time supply chains. Shipments from China increased by 4.6% year over year in Q4 while those from Canada and the U.S. dropped by 7.3%. Fiat Chrysler and Daimler have been reducing their use of parts from China after a 37.0% and 64.4% year over year drop in their imports from China in Q4. General Motors meanwhile has seen its reliance rise after imports from China slipped 4.5% while those from Canada and the U.S. slumped 10.5% lower.

Source: Panjiva

Steering industry has to navigate coronavirus as Huida declares force majeure (Feb. 11)

The return to business in China after the extended lunar new year holiday is proving far from simple or certain. The automotive sector has been particularly affected as a result of its just-in-time supply chains. It’s emerged that the Chinese government has provided a force majeure certificate to Huida Manufacturing for supplies to Peugeot.

Panjiva’s data indicates that the steering components manufacturer has also supplied Nexteer in the U.S. since Aug. 2019. More broadly China represented 7.9% of U.S. steering component imports in 2019 after a 19.0% year over year slump due to U.S. tariffs on imports from China.

Source: Panjiva

Nissan, Tata join the list of automakers facing COVID-19 disruptions

The spread of COVID-19 coronavirus has continued in the past week. While more 99.1% of cases have arisen in China, disruptions to manufacturing have spread across global automotive supply chains. The autos industry had already been struggling. There was a 7.6% drop in total Japanese auto exports in December and a 5.8% slide in U.S. imports of vehicles from all countries in the same month because of falling sales.

Nissan has had to cut production of the Rogue SUV in its Kyushu factory in Japan that’s normally sold into the U.S. Nissan’s total exports from Japan already fell by 10.8% year over year in December while U.S. seaborne imports linked to the firm dropped 9.2% in January compared to a year earlier.

It’s not just Japanese auto firms that have been impacted. Tata’s Jaguar Land Rover factory in China has closed because of the outbreak, which may eventually choke off the surge in shipments to the U.S. by the firm which had reached 24.3% year over year in January.

Source: Panjiva

Magna dealing with COVID-19 and tariffs, to a certain extent

Auto parts maker Magna International has suffered production interruptions in China resulting from the COVID-19 coronavirus. The firm’s CEO, Donald Walker, has stated that the firm’s factories are “up and running, at least to a certain extent” while the firm’s customers “can airfreight things if they have to” to meet just-in-time supply chain requirements.

Magna’s reliance on Chinese parts in its U.S. supply chain has been declining. Panjiva’s data shows shipments from China to the U.S. linked to the firm fell by 35.8% year over year in 2019, accelerating to a 47.0% slump in Q4 as a result of widespread U.S. tariffs which remain in place. Magna has instead been scaling up supplies from Mexico which may have increased by 9.0% in 2019, accelerating to 23.6% in Q4.

Source: Panjiva

CAPITAL GOODS SECTOR

Illinois Tool Works trims guidance In response to coronavirus (Feb. 3)

The spread of 2019-nCoV coronavirus has led Chinese provinces including Zhejiang and Guangdong to extend the lunar new year holiday to Feb. 9. That’s led Illinois Tool Works (ITW) CFO Michael Larsen to state that “we’ve baked into our guidance a lost week of production, assuming that we all return to work in China on February 10”.

U.S. seaborne imports linked to ITW fell by 72.0% year over year in Q4 2019, partly reflecting stockpiling ahead of earlier tariff increases. China represented 46.6% of those shipments in 2019, down from 58.2% in 2017, indicating the degree of supply chain restructuring already caused by tariffs. Within shipments associated with ITW’s Chinese supplies, Zhejiang and Guangdong provinces represented 60.0% of the total in 2019.

Source: Panjiva

COVID-19 set to leave hole in JCB’s U.K., U.S. supply chains (Feb. 18)

Construction equipment maker JCB is cutting production in the U.K. because over a quarter of its Chinese suppliers remain closed due to COVID-19 related restrictions. COO Mark Turner has indicated operations “will be disrupted in the coming weeks”.

While China only represented 3.8% of total British imports of intermediate industrial components, at £2.72 billion ($3.54 billion) there will still be a significant number of firms facing similar challenges to JCB. There may also be a knock-on to JCB’s sales in the U.S. Seaborne imports linked to the firm rose by just 2.0% year over year in the three months to Jan. 31.

Of those 59.4% were linked to completed machines imported from the U.K. That leaves the firm exposed to developing U.S.-U.K. trade relations. A further 6.6% were source from China, potentially including spare parts that could be interrupted by the COVID-19 issues.

Source: Panjiva

Deere’s shipping could get dearer due to COVID-19 disruptions

Tractor-maker Deere & Co. has flagged “improved sentiment” among its U.S. farming customers resulting from China’s purchasing commitments related to the phase 1 trade deal. Yet, Deere has cautioned that farm exports won’t actually increase until harvest season where exports typically peak in October.

In the past two years Deere’s U.S. sales growth has run ahead of agricultural exports. In fiscal 2019 Deere’s sales rose by 9.8% whereas U.S. farm exports fell by 5.7%. The firm also faces supply chain disruptions from COVID-19 in its Chinese equipment supplies.

The company has therefore factored in $40 million of costs for “expedited freight to make sure that we’re able to have that availability to get parts into the operations” according to CFO Ryan Campbell. Deere’s supply chain is well diversified. Just 8.5% of U.S. seaborne imports linked to the firm came from China in 2019. There was a 24.5% year over year drop in shipments from China which was only partly offset by increased shipments from Japan.

Source: Panjiva

LOGISTICS SECTOR

Coronavirus delivers a blow to the logistics sector (Feb. 5)

The spread of 2019-nCoV coronavirus has now reached nearly 25,000 cases. While 99.0% of cases are still in mainland China, the global logistics industry is already having to adapt. Container-lines Maersk, CMA-CGM and ONE have all discussed cutting shipping capacity from Asia to Europe.

Freight forwarders Flexport and DP-DHL have warned of increased rate volatility for airfreight due to reduced “belly cargo” capacity on passenger jets, on top of marine shipping capacity cuts.

Flexport is more exposed to China than DP-DHL, with China representing 52.2% of Flexport’s U.S. seaborne inbound handling in 2019 compared to 31.4% for DP-DHL.

Car carriers will also be affected after Hyundai suspended car production in South Korea due to a shortage of Chinese parts. Leading carriers of vehicles on South Korea to U.S. lanes in 2019 were Hyundai Glovis with a 49.4% share of volumes and Eukor (controlled by Wallenius Wilhelmsen and Hyundai) with a 32.2% share.

Source: Panjiva

DSV Panalpina confirms soft outlook for 2020, coronavirus uncertainty (Feb. 10)

Freight forwarder DSV Panalpina reported an organic revenue decline of 1.1% year over year in Q4. A 3.0% drop in air freight handling was to blame, which isn’t a surprise given global air freight fell by 2.5% year over year on average in Q4 according to IATA data.

The outlook from DSV Panalpina is muted with an expectation of less than 3% growth in revenues for the legacy DSV business and a 5% slide for Panalpina. There are also risks as “currently the coronavirus situation is impacting global supply chains and creating uncertainty” according to CEO Jens Bjørn Andersen.

DSV Panalpina has a lower-than-average exposure to China on its U.S.-inbound shipping business with 32.1% of volumes coming from Chinese ports in 2019. There’s been a 31.8% year over year slump in January, based on preliminary Panjiva data, while its shipments from the rest of the world have also declined with a 4.2% slide in shipments from Asia ex-China and a 0.6% slip in shipments from Europe.

Source: Panjiva

Maersk’s COVID-19 rebound in Q2 may be foiled by weaker European shipping (Feb. 21)

Container-line Maersk reported a 5.5% year over year drop in revenues in Q4, citing “front-loading to the U.S. in Q4 2018 ahead of anticipated tariffs”. The firm has taken a downbeat outlook to 2020 with a decline in profits expected due to COVID-19 coronavirus which has “significantly lowered visibility” for the first half of the year.

CEO Soren Skou has stated that Chinese factories are now running at 50-60% capacity, ramping up to 90% in the first week of March which “hopefully (means) a strong rebound into April, May, June”. China represented 26.2% of U.S.-inbound shipping handled by Maersk in 2019 and had already fallen by 22.9% year over year in January.

The first half of February brought a decline of just 11.3%, though that likely reflects the last of pre-lunar new year shipping in mid January from China. China’s not the only challenge facing Maersk. Shipments from Europe to the U.S. have fallen by 12.6% in January leading total volumes to drop by 8.8%.

Source: Panjiva

Port of Los Angeles raises COVID-19 worries, Savannah’s shipping slides

Container handling through U.S. ports fell by 2.7% year over year in January, with the worst performers being Seattle-Tacoma with a 12.5% drop and Savannah with a decline of 8.2%. The rate of decline at Los Angeles and Long Beach slowed to just 3.9% and 0.2% respectively despite their higher-than-average exposure to China. The ports’ volumes will likely be crimped in February and March by disruptions caused by COVID-19 coronavirus.

According to Port of LA director Gene Serotka there could be a 15% year over year slide in Q1 volumes handled through the port as a result. The third most exposed top 10 port to shipments from China after LA and Long Beach in 2019 was Savannah with 40.8% of volumes exposed. Savannah’s slide in January was largely down to a 36.2% slump in traffic handled by Maersk which wasn’t offset by a 18.8% rise in shipping by CMA-CGM. The latter may reverse given China represented 45.8% of CMA-CGM’s shipping into Savannah in 2019.

Source: Panjiva

COMMODITY PRODUCTS

Delong, Gavilon face export squeeze as COVID-19 cuts container availability (Feb. 18)

Restrictions to international shipping activity linked to COVID-19 is leading to a shortage of containers for commodities exports in the U.S., including those of dried distillers grains (DDGS) according to S&P Global Platts. U.S. exports of DDGS have already been in decline with a 16.5% year over year drop in Q4, led by a slide in shipments to Asia ex-China.

Exports linked to Delong and Gavilon may have dropped more quickly – shipments linked to the firms fell by 45.9% and 41.4% respectively. Total U.S. shipments to China improved by 14.3% though still only represent 2.6% of the total versus 50.6% at their peak in 2015. The latter may be attained as part of the phase 1 trade deal between the two countries.

Source: Panjiva

Bunge, Vale face sliding Brazilian commodity exports to China due to COVID-19 (Feb. 21)

Brazilian commodity exports are set to slide as a result of reduced Chinese demand due to COVID-19 coronavirus related disruptions. The loss of sales comes at a bad time for the Brazilian economy with total exports having fallen by 20.2% year over year in January.

Brazilian soybean exports to China, including those by Bunge and Louis Dreyfus, already fell by 24.9% year over year in Q4 as a result of increased purchasing by China from the U.S. ahead of the phase 1 trade deal.

There’s also been a 52.7% slide in Brazilian iron ore exports to all destinations as a result of Vale’s mining disaster in April 2019. The latter has not been offset by higher exports by Anglo American. China represented 62.3% of Brazil’s total iron ore exports and 62.9% of Vale’s with industrial demand likely to have collapsed.

Source: Panjiva

CONSUMER DISCRETIONARY SECTOR

Under Armour’s COVID-19 costs could spread (Feb. 12)

Apparel maker Under Armour reported Q4 revenue growth that was two percentage points lower than analysts’ expectations. Panjiva’s data shows that U.S. seaborne imports linked to the firm climbed 12.3% higher in Q4. A 5.7% rise in shipments in January compared to company revenue guidance of a “low single digit percentage” decline globally. The latter is down to a five percentage point drag due to lower Chinese consumer spending resulting from the spread of COVID-19 coronavirus.

The firm’s CFO, David Bergman, has also indicated that “we are currently exploring and further impacts of the coronavirus”. That may include an interruption to sourcing from China for its U.S. operations.

China represented 18.0% of U.S. seaborne imports linked to the firm in 2019. There was already a 23.8% year over year slide in shipments to the U.S. from China, while the firm has restructured its supply chain away from China and Vietnam toward Taiwan and Honduras.

Source: Panjiva

Adidas, Puma look to hurdle COVID-19 challenges (Feb. 19)

The toll to the apparel sector from COVID-19 has been spreading with Adidas and Puma warning about the impact on sales in China. All three also have to contend with downstream supply chain threats to their U.S. operations.

Panjiva’s data shows that 9.6% of U.S. seaborne imports linked to Adidas in 2019 came from China while for Puma the figure was 9.0% and Under Armour 14.6%. A bigger issue for all three would be an interruption to shipments from Vietnam, which so far isn’t on the cards but could be the result of U.S. tariffs rather than coronavirus.

The challenges come as U.S. imports of apparel and footwear fell by 13.8% year over year in January after an 11.3% drop in Q4. Adidas has performed close to average with a 13.3% slide in January while Puma and Under Armour shipments have increased by 11.5% and 5.7% respectively.

Source: Panjiva

Uniqlo’s fast-evolving supply chain can’t avoid COVID-19 disruptions (Feb. 21)

Fast Retailing’s Uniqlo is facing shipping delays of products from Vietnam of around two weeks due to upstream material supply shortages from China resulting from the spread of COVID-19 coronavirus. Vietnam accounted for 16.1% of U.S. imports of apparel by value in 2019, with a 10.3% rise offsetting a tariff-linked 8.3% slide in shipments from China.

Uniqlo has aggressively moved its sourcing towards Vietnam recently. Vietnam represented 20.2% of U.S. seaborne imports linked to the firm in 2019 compared to 11.5% in 2016. That process has continued recently with a 365% surge in shipments in January compared to a 25.2% drop in imports from China.

Source: Panjiva

Hasbro, Mattel supply chains face coronavirus, Hong Kong protest disruptions (Feb. 24)

The toy industry has faced significant disruptions to production due to the spread of COVID-19 coronavirus. China represented 84.0% of U.S. toy imports in 2019, similar to the 86.2% level seen in 2016. Timing-wise the impact of factory closures may be mitigated by the peak export season not getting going until June. Mattel’s CEO, Ynon Kreiz, has stated the firm’s factories in China reopened on Feb. 17, though not all employees have returned to work. Similarly for Hasbro, CFO Deborah Thomas has stated that the firm is “working to mitigate the impact”.

Strategically, Hasbro COO John Frascotti has noted the firm “in the next couple of years will be about 50% out of China”. U.S. seaborne imports from mainland China represented 64.5% of the total linked to Hasbro in 2019. That was up from 56.0% in 2018, though that in part reflects a scaling back in shipments from Hong Kong which may have related to protests there. A similar pattern, though more tilted to Hong Kong, can be seen at Mattel.

Source: Panjiva