Sri Trang is planning an initial public offering of its rubber glove subsidiary, Sri Trang Gloves Thailand, shares following a COVID-19 linked surge in demand for its products, Nikkei reports. The firm plans to spend the funds raised on adding 18.5% to its annual production capacity. That will increase competitive pressure on Malaysia’s Top Glove which, as outlined in Panjiva’s research of March 20, is in the midst of adding 11.2% to its capacity.

Panjiva data shows that U.S. seaborne imports linked to Sri Trang Gloves got underway in April 2017 and increased by 21.1% year over year in Q1. There may have been a reversal, however, with data for the first 15 days of April showing a 32.0% drop compared to a year earlier. Leading importers in the past 12 months include Fresenius and Genuine Parts as well as the firm’s own shipments for onward sale.

Source: Panjiva

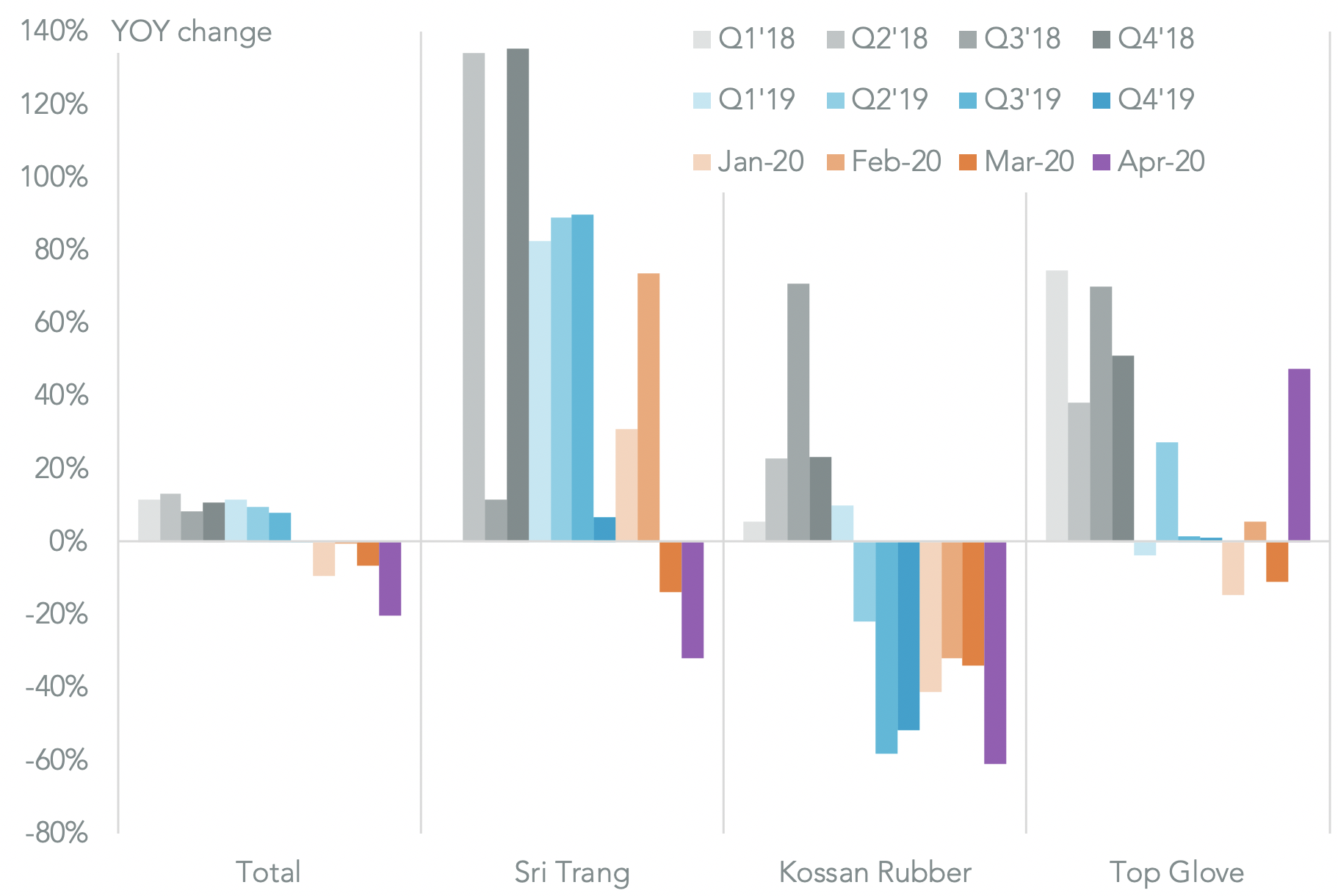

Total U.S. seaborne imports of rubber gloves meanwhile fell by 6.6% year over year in March and by 20.1% in the first half of April. Aside from the slide in shipments linked to Sri Trang there was a 61.1% slide in shipments linked to Kossan Rubber. The latter continued a longer-term downtrend and so may not be just COVID-19 linked.

Other shippers have been able to increase deliveries though with imports linked to Top Glove having risen by 47.4% in the first half of April while Owens & Minor’s surged 147.2% higher. It’s worth noting that total U.S. imports will also have been helped by the roll out of “Project Airbridge” deliveries too.

Source: Panjiva