Following the death of Fidel Castro the future of Cuba’s position in world trade is likely to come into focus again. The U.S. position may, if anything, harden following comments from President-elect Trump that he would terminate the current deal if it isn’t made “better”. China’s position will likely not change given its previously stated support for the current regime. Yet, China is trying to extend its trade influence in the region, as discussed in Panjiva research of November 23.

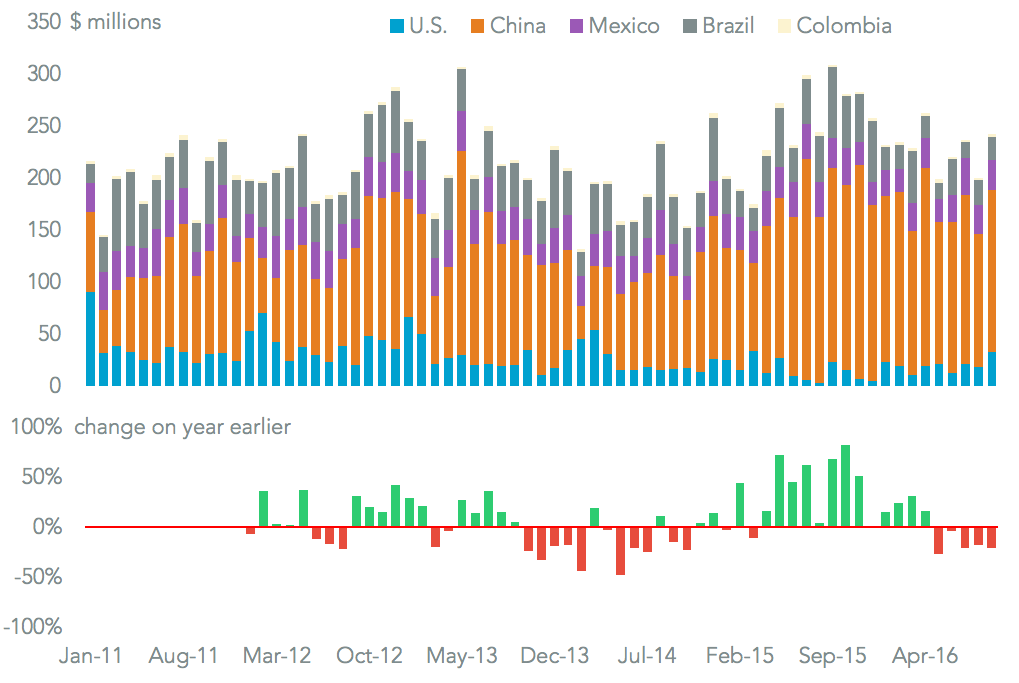

The country does not publish regular trade statistics. However, Panjiva data for five trade partners (the U.S., China, Mexico, Colombia and government data for Brazil) shows imports fell for five straight months to September 30. In September alone it fell 21.5%.

This was led by a drop in imports from China, which accounts for 67.3% of the total across a broad range of industrial and consumer goods and fell 16.6% in September. Imports from Brazil, dominated by food and forestry products, slumped 67.6%. The latter may have been displaced by a 43.5% jump in imports from the U.S., of which 47.8% were meat products over the past year.

Source: Panjiva

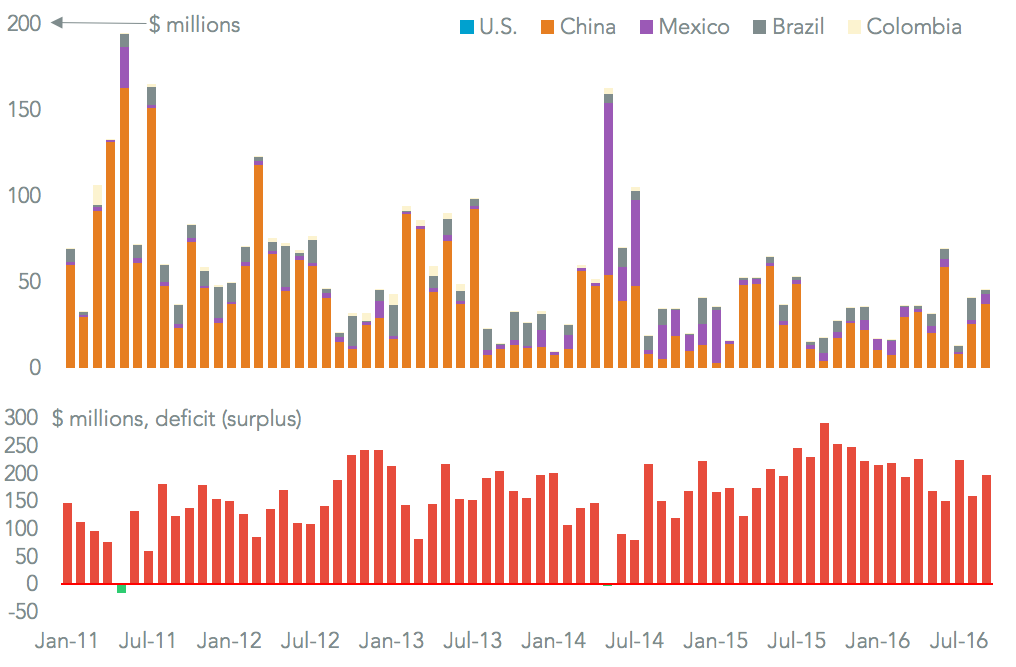

The challenge for Cuba going forward lies in managing its trade deficit. It ran a monthly goods deficit of $205 million over the past 12 months when allowing for exports to the U.S., China, Mexico, Colombia and Brazil.

A 24.4% drop in the deficit in the third quarter vs. a year earlier likely reflects a later-than-normal sugar harvest as well as the aforementioned drop in imports. Cuba’s export base depends on shipments to China. These have averaged $24.6 million a month in the past year and have been dominated by sugar (69.7% year-to-date) and nickel oxides (23.1%). The remainder of the deficit is likely financed by services (particularly healthcare) and direct investment.

Source: Panjiva