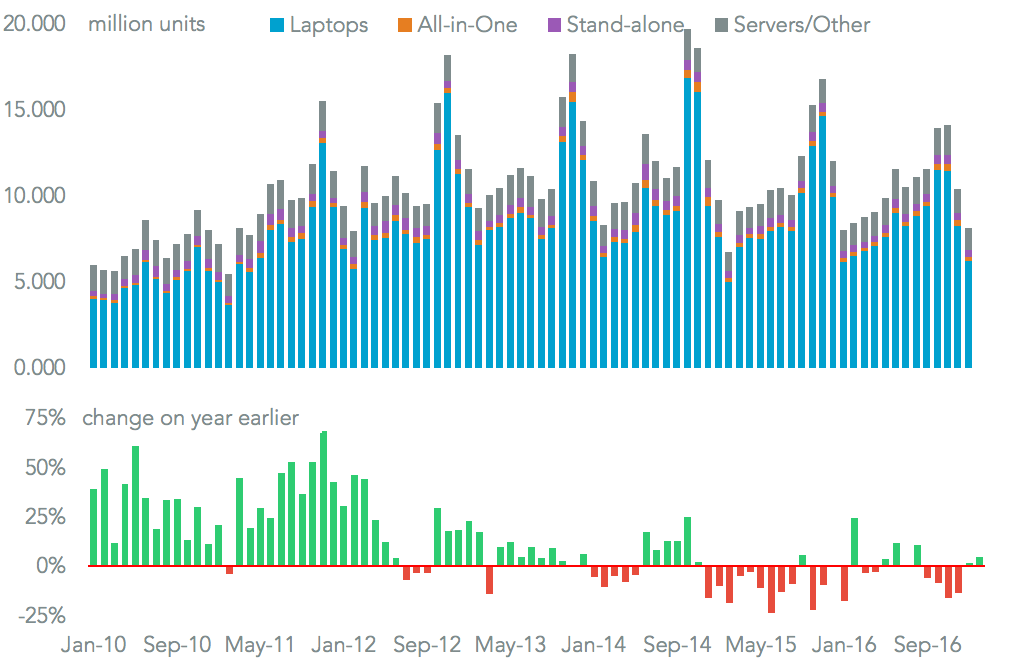

The U.S. personal and business computing market may be staging a recovery in the first quarter. That follows a “slight decline” in sales in the fourth quarter, according to IDC. Total imports across laptops, desktops, all-in-ones and servers increased 1.4% on a year earlier in January to reach 16.26 million units, Panjiva data shows.

That was the first growth after four straight months of declines going into the holiday sales season. All four groups increased, though laptops only increased 0.8%. Seaborne shipment data for February shows a 4.4% increase across the four classes.

Source: Panjiva

Shipments by the Chinese manufacturers including Compal and Wistron increased in both January and February, bringing three month growth for the former to 31.1% and the latter 87.1%. As discussed in Panjiva research of March 16 this followed an 8.8% expansion in global exports from China. Shipments to the U.S. potentially increasing to pre-empt new tariffs or taxes, though so far no concrete moves have been made by the Trump administration.

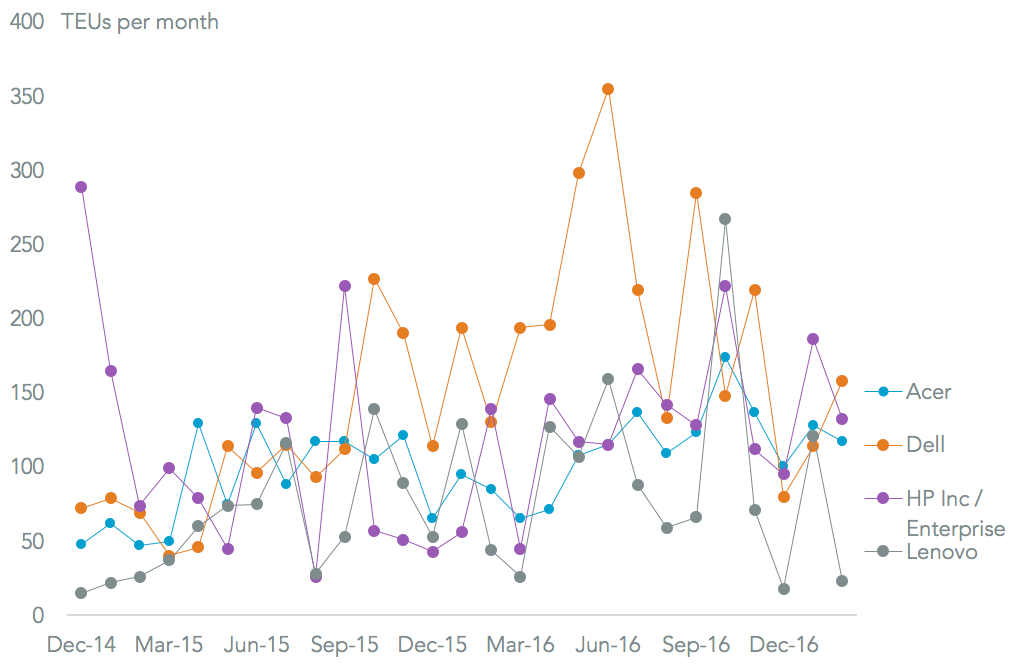

Among the name-brand suppliers Acer saw the fastest growth during the month of February, with a 37.6% growth in imports to the U.S. bringing the three month total to 40.8%. HP Inc. imports are 73.5% higher for the past three months, but actually contracted by 5.0% in February. Dell by contrast improved during the month, with shipments rising 21.5% to overtake HP, though its quarterly run-rate is still down 19.6%.

Source: Panjiva