The personal computer sector has experienced a surge in demand during the pandemic as work practices have had to adapt rapidly to hybrid home-and-work models. Three of the big PC producers have experienced rapid revenue growth in the past quarter.

Dell reported FQ1’22 (to April 30) revenues which climbed 11.8% year over year, including a 58% increase in consumer online business orders. Similarly, HP Inc. reported FQ2’21 (to April 30) revenues which expanded by 27.3% including a 72% rise in consumer net revenue and Lenovo reported FQ4’21 (to March 31) revenue growth of 47.7% including a 369.1% rise in Chromebook shipments.

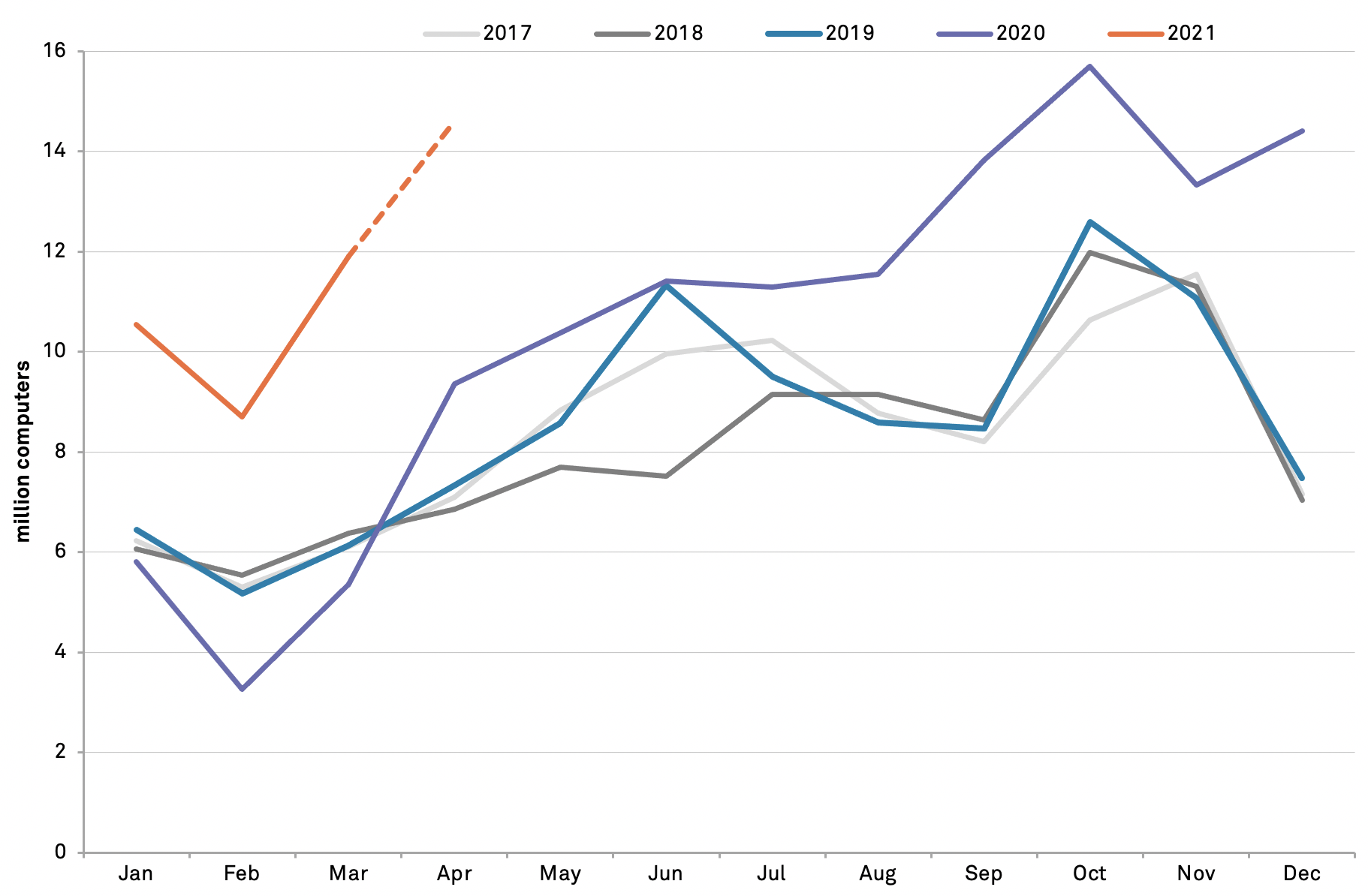

The rapid rise in demand for laptop computers can be seen in U.S. imports which climbed 116.1% year over year in Q1’21, Panjiva’s data shows. Growth has likely continued but at a slower rate with U.S. seaborne imports having increased by 56.1% year over year. As with many other industries the normal off-peak season has been somewhat absent, with shipments in April being similar to those seen during Q4’20.

Source: Panjiva

The outlook may be more challenging. Indeed, Dell has noted that firm faces “ongoing supply constraints particularly impacting CSG (consumer solutions group)”. One particular challenge is “an overall shortage of semiconductors” according to Dell’s COO Jeffrey Clarke. That’s not just an issue for the laptop makers, as discussed in Panjiva’s research of May 21, and does not have a quick fix.

There are also labor issues with HP Inc. CEO Enrique Lores stating that the “resurgence of COVID in Southeast Asia is creating additional pressures on our supply chain“. The shortages combined with elevated demand has meant that “channel inventory has probably never been so low in the history” according to Lenovo’s President and COO, Gianfranco Lanci, with the firm running “two or three weeks of channel inventory” versus six to eight weeks historically.

It appears unlikely that the problem will be cured in the near term. Dell’s CFO, Tom Sweet, has noted that “best point of view is that supply constraint continues on into next year” while HP’s Mr. Lores also stated that the firm “expects supply constraints to continue at least through the end of 2021“.

Aside from presenting challenges in meeting customer demand there are also risks for corporate profitability. The computer manufacturers face a similar mix of inflationary issues as other industries. Dell’s Mr. Sweet has stated “we expect component cost to be inflationary in Q2” and that there are “increased logistics costs just given the availability of containers“. HP Inc’s CFO, Marie Myers, also expects “increased costs in commodities and logistics as compared to (fiscal) Q2 levels“.

There are a variety of strategies for dealing with the shortages and margin compression. One is to pass through costs to consumers. Dell’s Mr. Sweet noted “we will price the input cost increases as appropriate, keeping a thoughtful eye on the market and keeping — making sure we’re in a competitive position“. Similarly, Lenovo’s Mr. Lanci has flagged that “pricing is slowly going up” with more to come “for the next 3 or 4 quarters“.

Another is to guard against future shortages by taking more control over the supply chain by alternating inventory practices. HP Inc’s Ms. Myers has stated that “to approve assurance of supply, we are carrying higher levels of owned inventory“, though that comes with cash flow costs.

An extension to that is to physically control more of the supply chain. In the case of Lenovo the firm’s CEO, Yuanqing Yang, stated that the firm’s hybrid in-house / outsourcing model “gives us advantage to approach upstream vendors” and that they can “leverage this relationship to get better supply situation“.

While constraints abound some of the laptop shippers have done well, others less so. U.S. seaborne shipments linked to Dell climbed 232.2% year over year in Q1’21 before continuing at an 89.4% rate in April. Similarly, Lenovo also expanded but at a slower rate of 18.8% in Q1’21 before accelerating to 113.3% in April. Both were also well above 2019 levels.

Not all firms are doing well, however, with Acer’s shipments dropping by 16.1% in April after surging 151.8% in Q1’21. Some care with monthly figures is needed, however, with the total build up in imports running into the initial peak in the U.S. for the back-to-school season being more imports.

Source: Panjiva