Mobile World Congress, the annual smartphone conference held in Spain from February 27, will likely bring new product launches and updates on companies’ expectations. In the U.S., at least, smartphone shipments appear to be struggling.

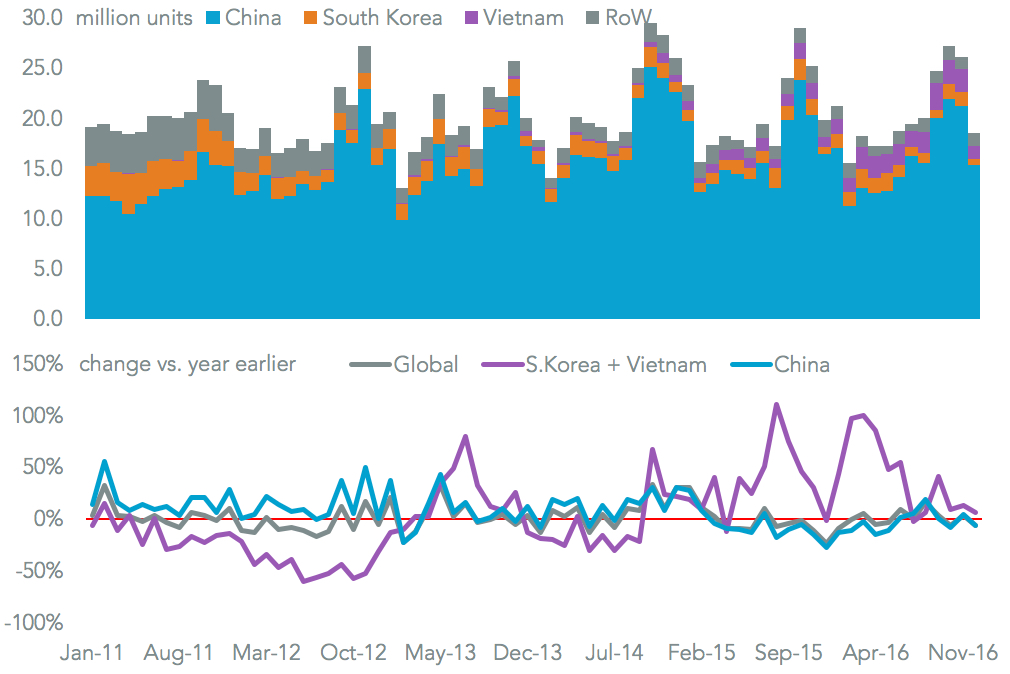

U.S. mobile phone imports fell 6.9% on a year earlier in December, according to Panjiva data, bringing the fourth quarter total to 71.7 million units, 3.0% lower than a year earlier. That marks a turnaround from the 5.6% growth seen in the third quarter, and may reflect lackluster demand for new handsets. It is also a contrast to IDC’s assertion that the U.S. ended the year “on a strong note” – though this relates to sales not imports.

Imports from South Korea and Vietnam – production hubs for Samsung Electronics’ and LG – increased by 5.8% for the month and 9.8% for the quarter. That suggests robust demand aside from the troubled Note 7 product line. Imports from China meanwhile, including those supplied to Apple and lower end brands such as Huawei and ZTE, dropped 6.3% for the month and 3.4% for the quarter.

Source: Panjiva

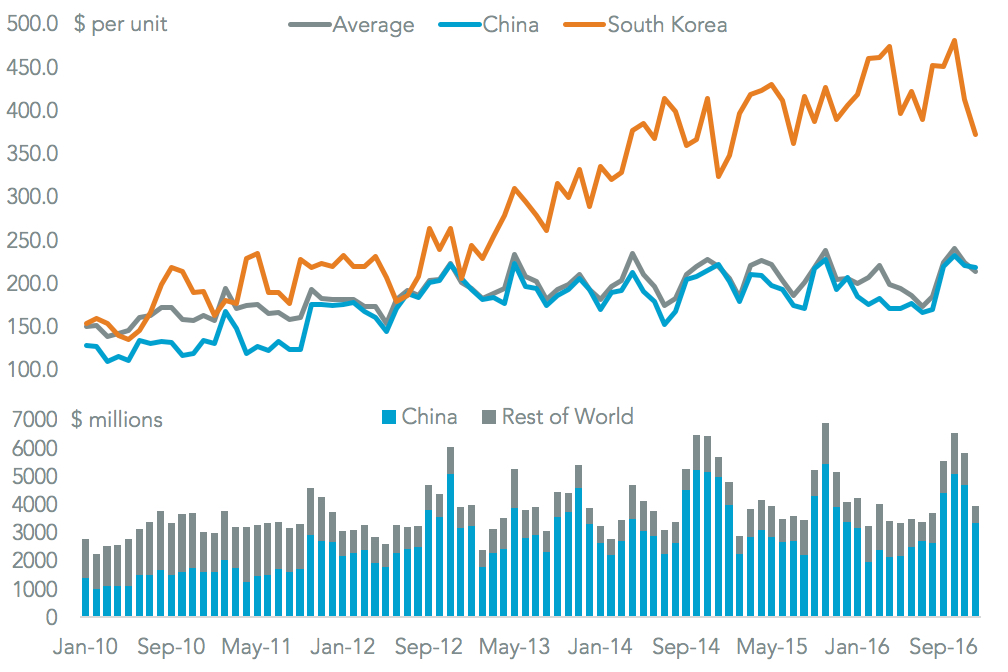

On a more positive tack though, the unit value of handset imports (based on total dollar value of imports) increased 4.1% in December on a year earlier, or 4.7% for the quarter as a whole. That included a 7.0% increase in the fourth quarter for import values from China to $224 per unit, possibly the result of an increased average value of iPhone imports after the launch of the iPhone 7 model. So far threats from the Trump administration to apply tariffs to imports from China, discussed in Panjiva research of January 5, have not materialized.

Source: Panjiva