The largest non vessel operating common carriers (NVOCCs) operating on U.S. inbound routes had another bumper month in August. Panjiva data shows the top 10 operators saw a 4.8% increase in shipments on a year earlier. That compares to a national average of 3.4% as outlined in Panjiva research of September 11.

Improvements were concentrated on Expeditors (number one operator, and 14.1% better than a year earlier) and DB Schenker (17.0% higher than a year earlier). Weather disruptions later in the month by Hurricane Harvey – and likely to occur again in September from Hurricane Irma – do not appear to have been a big issue generally. Panalpina did suffer outages in its facilities according to company filings, and saw a 4.2% drop in handling vs. the prior year as a consequence. It has an outsized exposure to Texan ports vs. the country in total. UPS shipping also saw a 12.5% decline.

DSV saw a 12.9% drop in handling when comparing to the pre-UTi deal entity from a year earlier. It may suffer too from Hurricane Irma – it was number three on Florida / Georgia routes in August compared to number eight overall.

Source: Panjiva

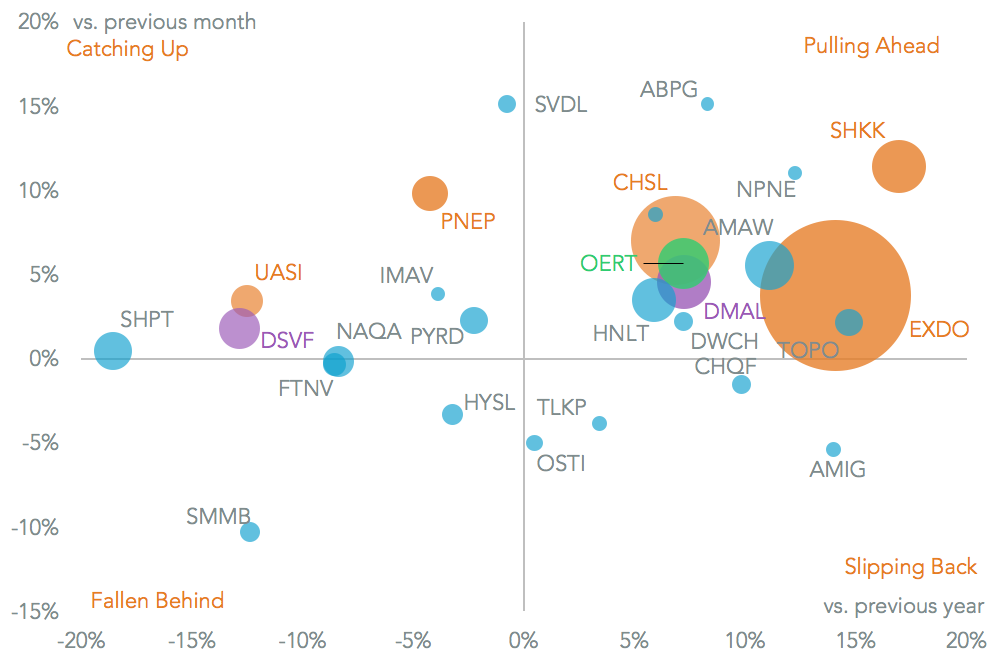

The increase in volumes handled by the big 10 shows a progress of organic market consolidation on top of acquisitions being made by larger operators. This could include the $1 billion-type acquisitions outlined by DSV, as well as smaller “bolt-on” deals shown by CH Robinson’s $50 million purchase of Milgram. There is significant room for consolidation from a geographic perspective.

Panjiva analysis of over 2,300 shipper-country pairs on U.S.-inbound traffic shows there is the potential for consolidation between Europe-dominated operators such as Panalpina or DSV with those that have strong market share in Asia and Latin America (Apex Shipping, Orient Express, Honour Lane and Pyramid Lines).

Source: Panjiva