Indoor pursuits retailer Gamestop has raised $1.13 billion of new equity capital via an at-the-market placement. The capital will be used for “general corporate purposes as well as for investing in growth initiatives and maintaining a strong balance sheet” and in part reflects recent retail investor interest in the stock, Reuters reports.

Meme-stock status aside, the firm’s supply chain activity is showing a marked recovery. U.S. seaborne imports linked to the firm increased by 197.1% year over year in the three months to May 31, Panjiva’s data shows. That’s continued with a 38.6% increase on a sequential basis (three months to May 31 versus three months to Feb. 28).

The more recent growth has been driven by rising shipments of games and toys of 43.2% sequentially. Imports of videogame consoles have declined by 11.5% sequentially, though that follows the initial launch of new consoles from Sony and Microsoft in Q4’20.

Source: Panjiva

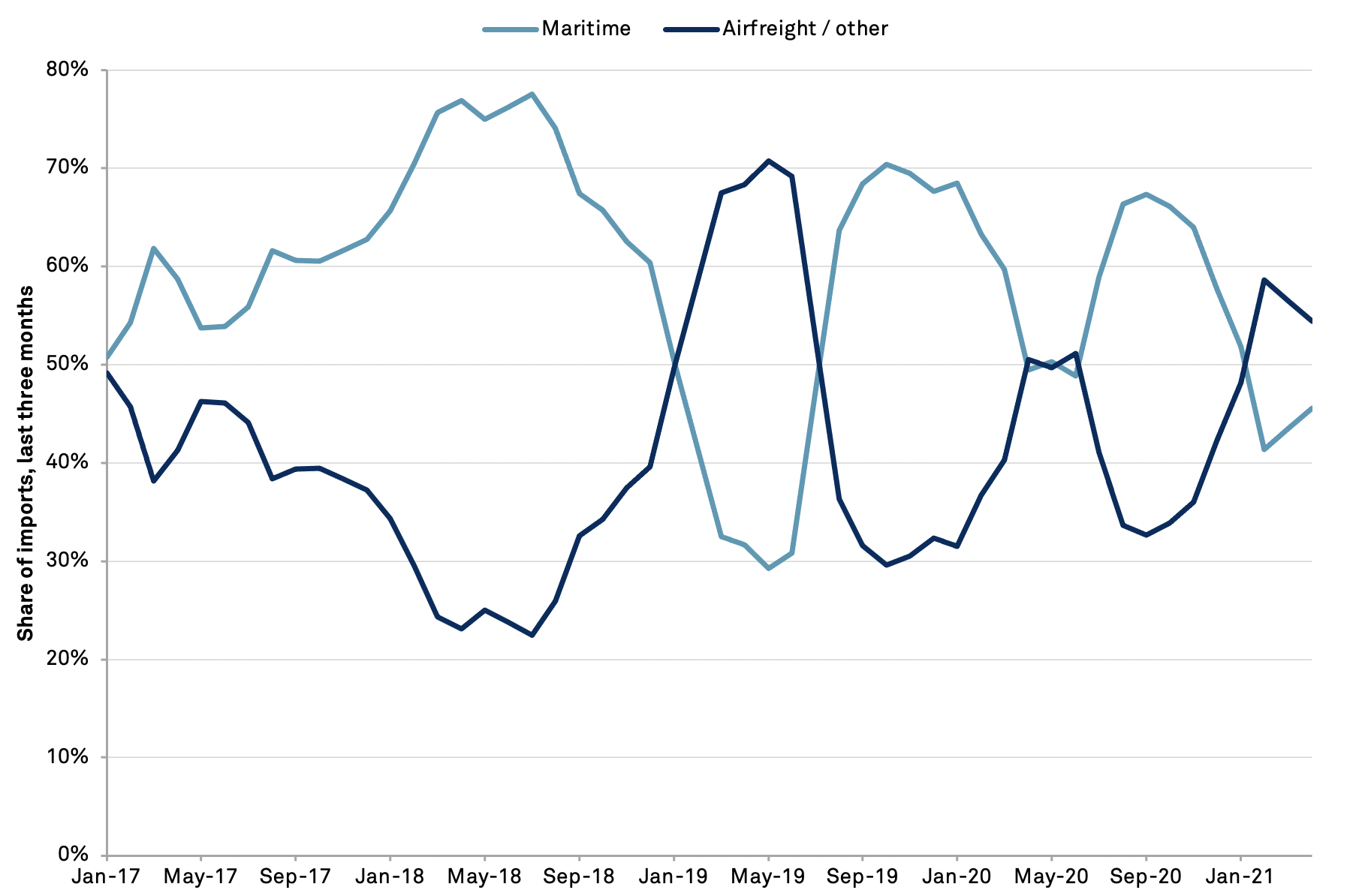

One challenge for the firm will lay in the shortage of those new gaming consoles, in part due to excess demand and in part due to parts shortages, as discussed in Panjiva’s May 17 research. Total U.S. seaborne imports of videogame consoles and accessories dipped 6.4% lower in the three months to May 31 sequentially.

There’s also been an increasing reliance on airfreight which represented 54.4% of imports in the three months to April 30 (the most recent data) compared to 48.2% in the prior three months.

Source: Panjiva

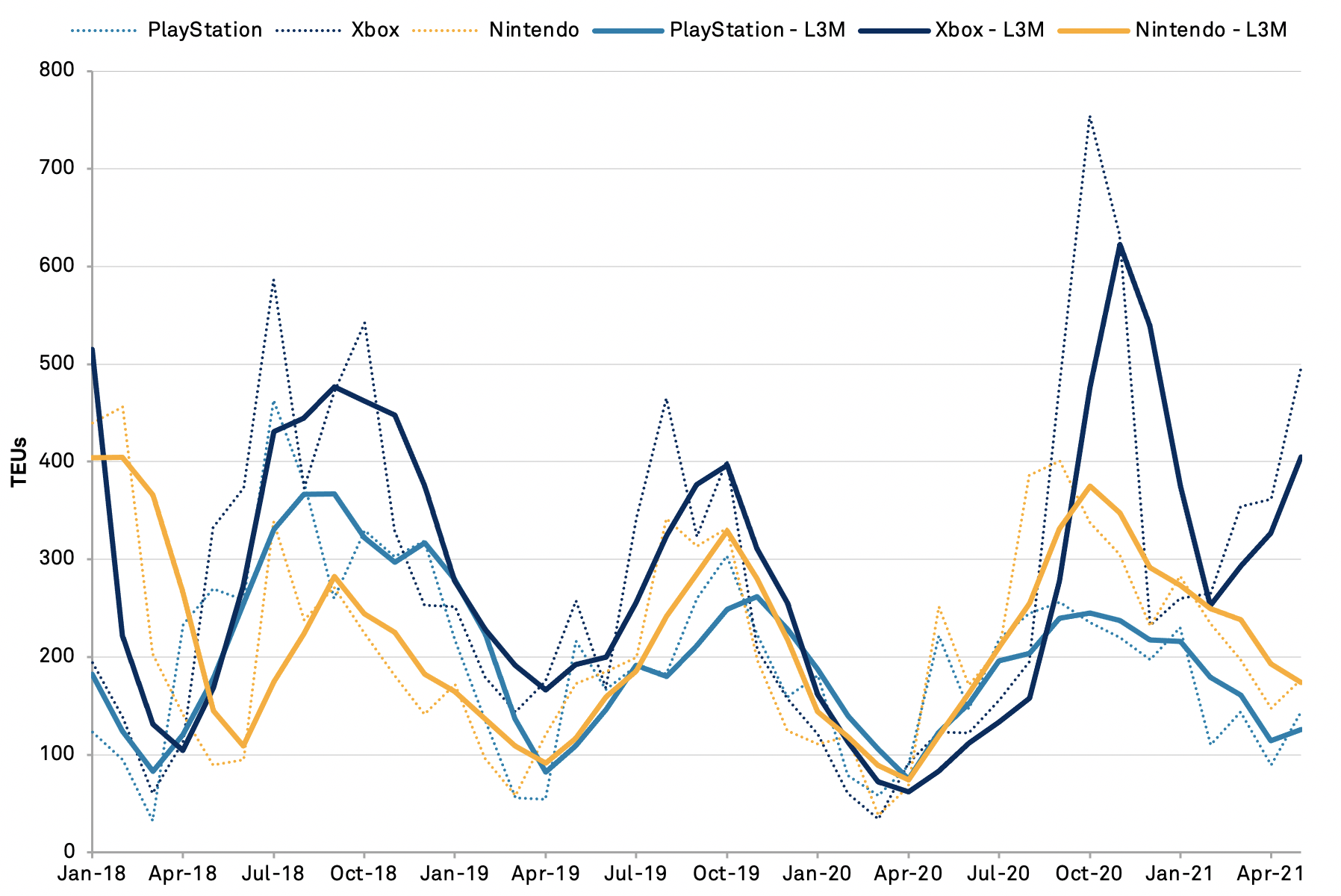

The fortunes of the big three console makers have diverged markedly. U.S. seaborne imports linked to Microsoft’s Xbox have surged 60.2% sequentially in the three months to May 31. Imports linked to Sony’s PlayStation and Nintendo’s Switch platform and accessories fell by 29.6% and 30.3% respectively. Shipments for all three were nonetheless higher than the same period a year earlier, led by a 4.9x increase in shipments linked to Xbox.

Source: Panjiva