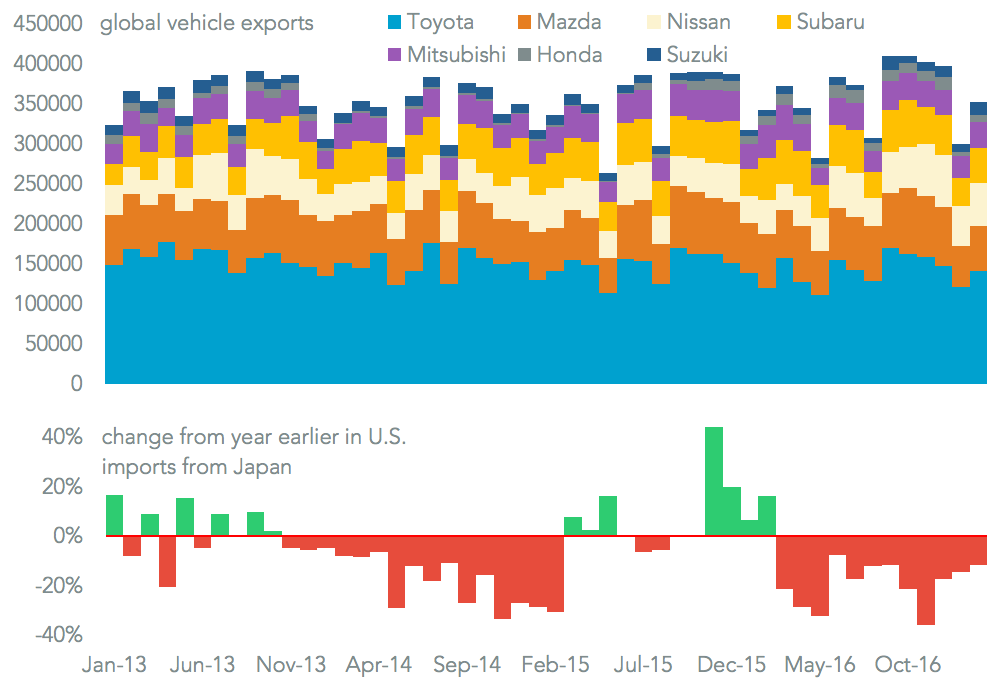

Exports by the Japanese automakers from their domestic market increased 2.9% on a year earlier in February, Panjiva analysis of company financial statements shows. Performance among the manufacturers diverged significantly, however, with Toyota expanding its shipments 17.1%. That was the first growth since August and only the third improvement in the past year. Nissan continued its streak of expansion, with a 25.6% growth rate representing the tenth straight improvement. That may also reflect shipments of the revised Micra/Note models.

Shipments by Mazda (15.3% lower), Mitsubishi and Subaru all declined, however. Supplies to the U.S. were a drag to the whole group, with Panjiva data showing an 11.7% drop on a year earlier. That was likely the result of the Japanese manufacturers increasing local production in the U.S., as well as losing import share to European manufacturers, as outlined in Panjiva research of March 2.

Source: Panjiva

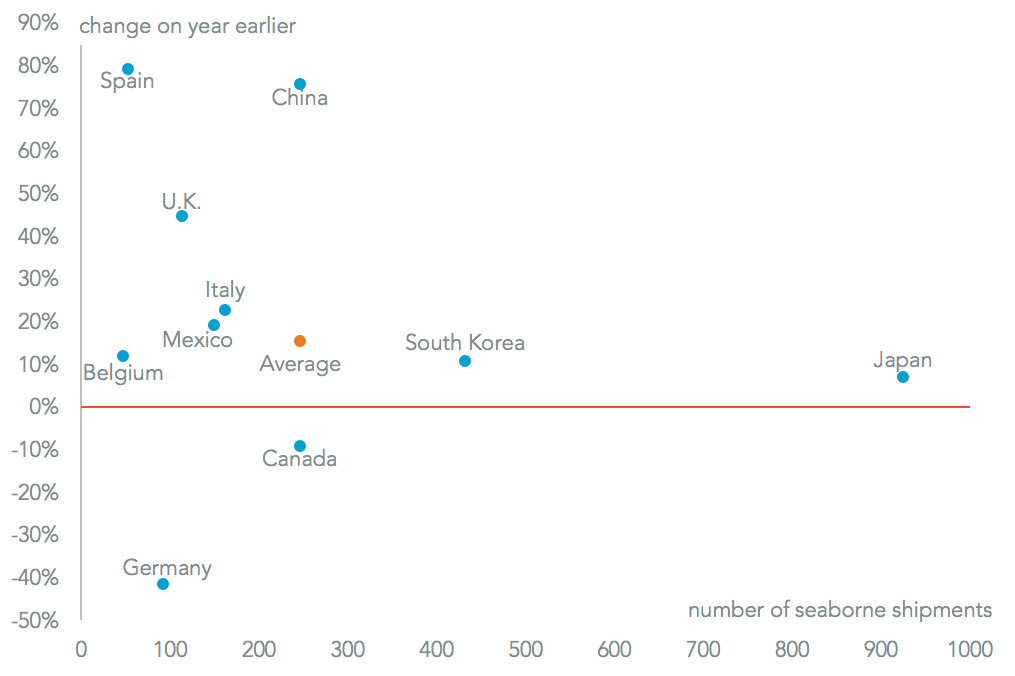

The outlook for March may be better. Imports for the first 23 days of the month show an 15.3% rise in seaborne shipments compared to a year earlier. Taking out imports from China, which jumped 75.7%, the remainder expanded 12.6%. That was led in volume terms by a 6.9% rise in shipments from Japan and 10.8% from South Korea. The main losers were manufacturers from Germany, which experienced a 41.4% decline. Preliminary data for U.S. auto sales is due from Ward’s Automotive a few days after the start of the following month.

Source: Panjiva