The start to the peak shipping season for U.S. toy imports has been complicated by COVID-19’s impact on both supply chains and consumer demand. Indeed, total U.S. imports of toys have started to lag the wider recovery in consumer discretionary shipments.

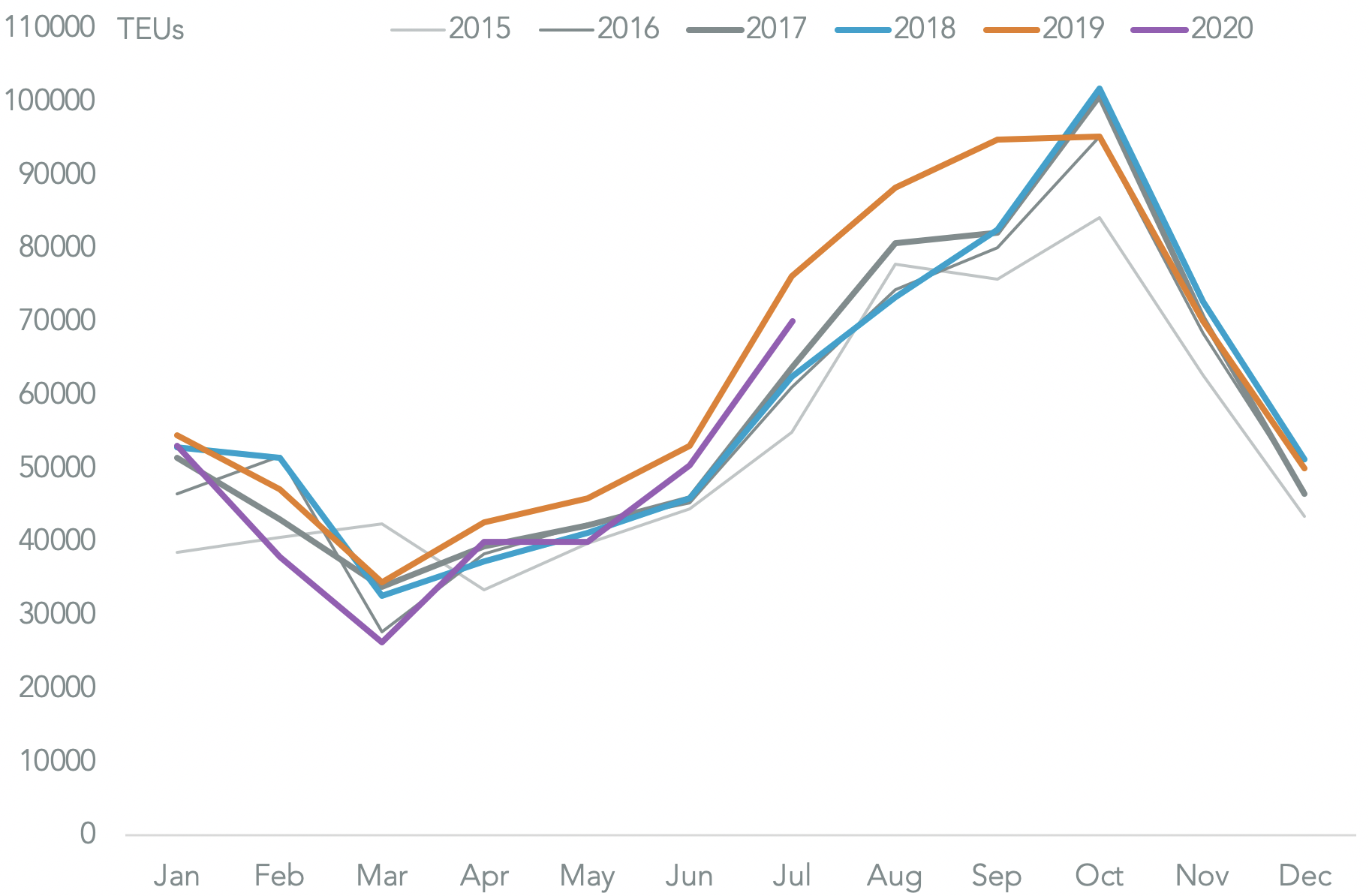

Panjiva’s data shows U.S. seaborne imports fell by 8.1% year over year in July which was both a faster rate than the prior month’s 5.1% as well as being well below the 0.7% increase in all leisure goods in July which includes sports equipment as well as toys.

Source: Panjiva

The peak season acceleration has also only been inline with the five year average with July shipments up by 38.8% versus June. That would suggest a COVID-19 related catch-up isn’t occurring.

Source: Panjiva

Most of the major toy companies have faced struggles recently. Hasbro has struggled with supply chain resilience during Q2, as outlined in Panjiva’s research of July 27, while smaller players including Spin Master and WowWee are highly dependent on delivering new products in the right volumes.

Baseline sales have also been weak as a result of store closures. Funko, maker of the Pop! Line of merchandise, saw revenues that dropped by 48.7% in Q2 including a 36.5% slide in sales in North America.

The firm expects only a “gradual recovery due to ongoing COVID-19 resurgences” and a “net sales decline of approximately 25%” according to CEO Brian Mariotti. Funko’s stock price dropped by 12.1% the following day according to S&P Global Market Intelligence data.

Funko has seen a surge in inventories relative to sales, suggesting a degree of overstocking / expectations of a rapid recovery. Panjiva’s data shows that U.S. seaborne imports linked to fell by 25.1% in Q2 compared to a year earlier. The firm’s inventory days at the end of Q2 reached 83.2 days compared to 57.1 days a year earlier.

Yet, there are signs that the firm has gotten supplies under control with shipments in July having fallen by 55.0% compared to a year earlier and by 37.6% sequentially.

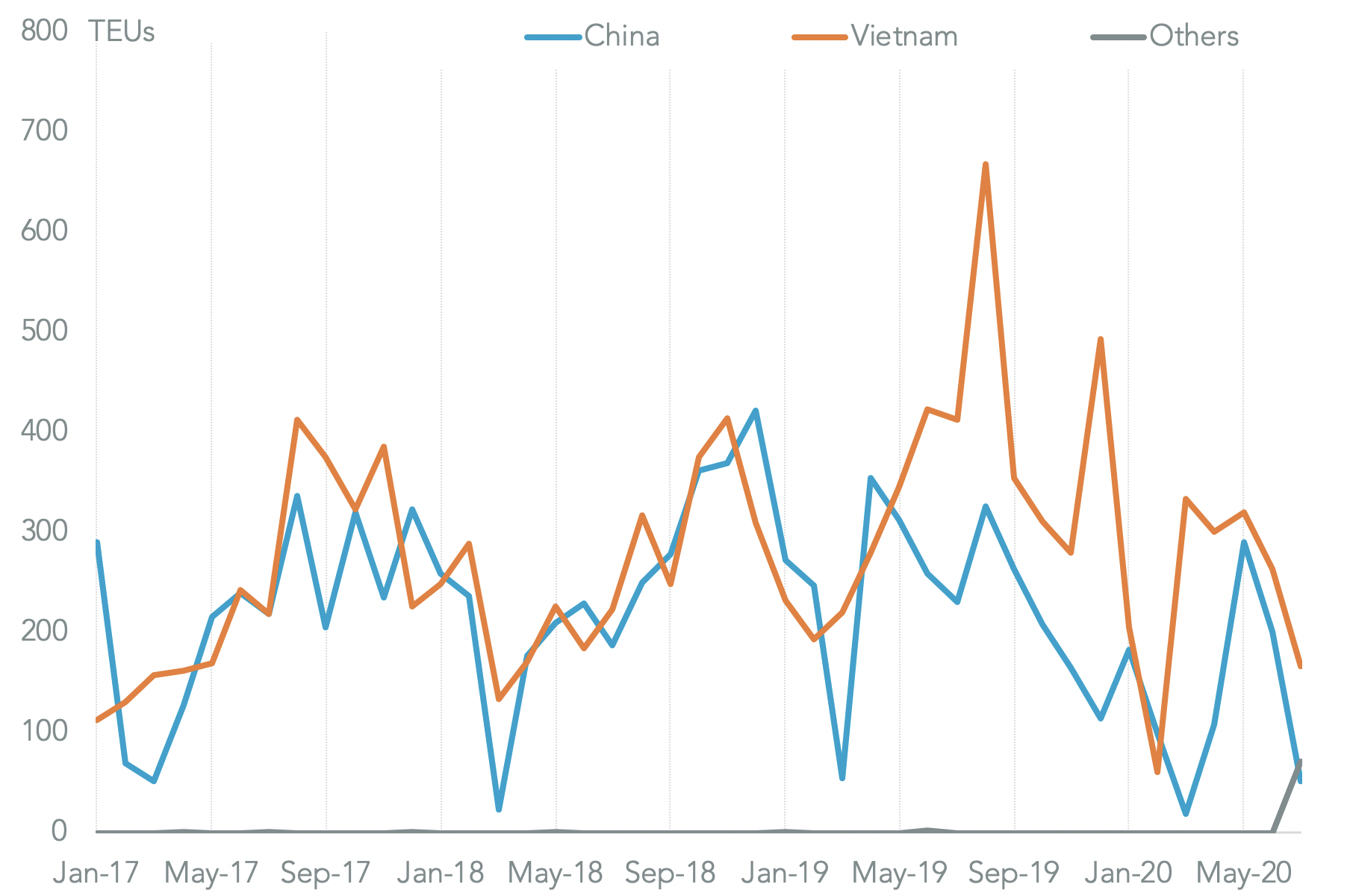

Funko has also rebalanced its supply chain away from China with shipments from Vietnam representing 64.1% of the total in the 12 months to July 31. That should provide some offset against the risk of widening tariffs.

Source: Panjiva

At the other end of the price-point scale videogame maker Nintendo reported revenue which surged 108% higher compared to a year earlier in Q2 and were 43.8% above analysts’ expectations. The firm sold 5.68 million Switch consoles in Q2’20 compared to 3.28 million in Q1 and 2.13 million a year earlier while software sales also surged.

The firm may struggle to continue that rate of growth in Q3 without having to increase its shipping costs. Panjiva’s data shows that U.S. seaborne imports linked to the firm surged by 4.2% year over year in July while Q2’s sales were met with a 45.7% burst of shipments in May.

Shipments linked to Sony’s PlayStation meanwhile have surged recently with a 32.9% year over year increase in July ahead of its PlayStation 5 console in December. It’s likely the current shipments are of peripherals though rather than the consoles themselves. Microsoft meanwhile has yet to see an uptick in Xbox related shipments – there’s yet to be a formal announcement of the Series X release date.

Source: Panjiva