Orient Overseas could be acquired by COSCO Shipping, CMA CGM or Evergreen according to a report in Caixin. There have been a variety of rumors to that effect since the start of 2017, though this is the first story to indicate an auction will take place. COSCO Shipping would seem the most likely buyer. It recently secured $26.1 billion in financing lines from China Development Bank, partly to support “all kinds of financial servicing needs”. Like CMA CGM it has shown an appetite for major acquisitions, and all four companies are part of the Ocean alliance.

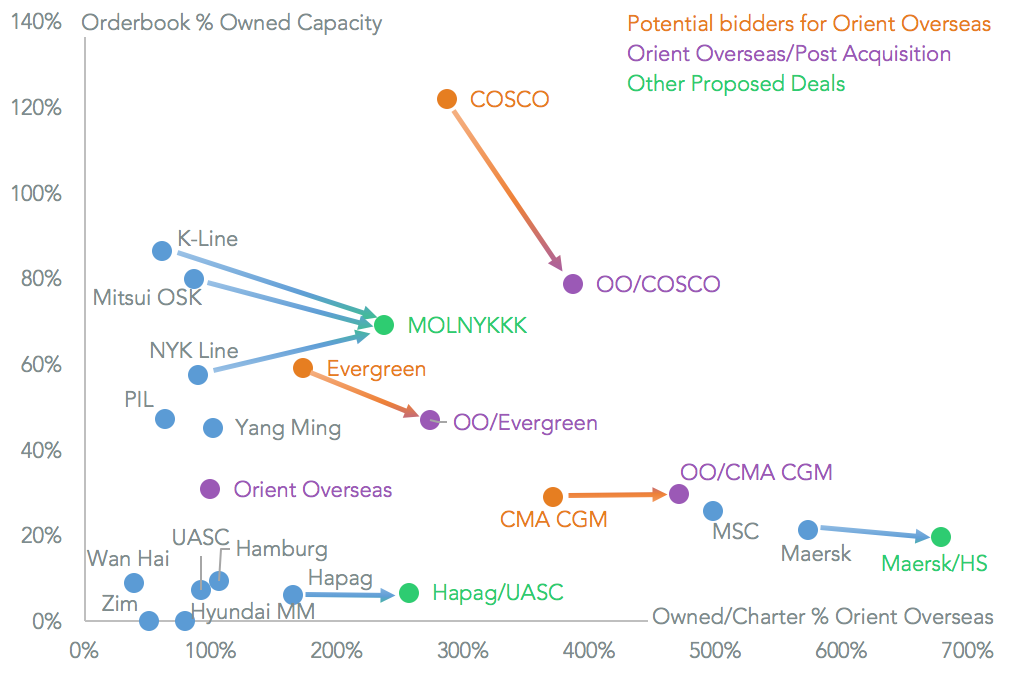

Further consolidation of the industry will only help profitability if it results in further discipline in capacity expansion – or ideally scrapping – as discussed in Panjiva’s Global Trade Outlook of January 4. Panjiva analysis of Alphaliner data shows COSCO Shipping currently has the largest orderbook as a proportion of owned capacity of the top 20 shippers. That suggests room to reduce either its or Orient Overseas’s combined 678,000 TEU of orders, equivalent to 78.6% of their owned capacity.

Yet, nothing formal has been announced by the company yet, so this could all amount to nothing. Additionally whomever wins an auction will face significant regulatory hurdles, as Maersk will with its acquisition of Hamburg Sud and the three Japanese shippers will with their merger.

Source: Panjiva