This report is the first of three providing a guide to developments we expect for global supply chains in Q3 2020. The impact of COVID-19 has been the defining factor for supply chains in the first half of the year. Recovery will mark the second.

In prior research Panjiva identified four broad stages for corporate supply chains in tackling COVID-19. The first was supply chain disruptions centered on Asia and then more widely. The second was demand destruction in the large western markets. The third is the staggered reopening of markets while the fourth will involve long-term decisions around supply chain structure.

Stage 1: Supply chains break down

The struggle with the first two stages of disruptions caused by COVID-19 have been a defining feature of corporate decision making in Q2. The late second quarter and start of third quarter is absorbed with the reopening process, though there should be an evolution away from stage three reopenings to stage four long term planning decisions.

The major risk is a slipping back to industrial closures should the current increase in cases, particularly in the U.S., become unmanageable. While the Trump administration has committed to not returning to earlier lockdowns:

(a) the decisions are made at the state level as discussed in Panjiva’s June 29 report;

(b) other countries may restrict operations anyway, as shown by the later-and-harsher lockdown in Mexico, which can crimp longer supply chains such as those in the autos sector and;

(c) individual companies may choose to cut operations, disrupting supply chains on a more isolated basis as has been the case in meat processing.

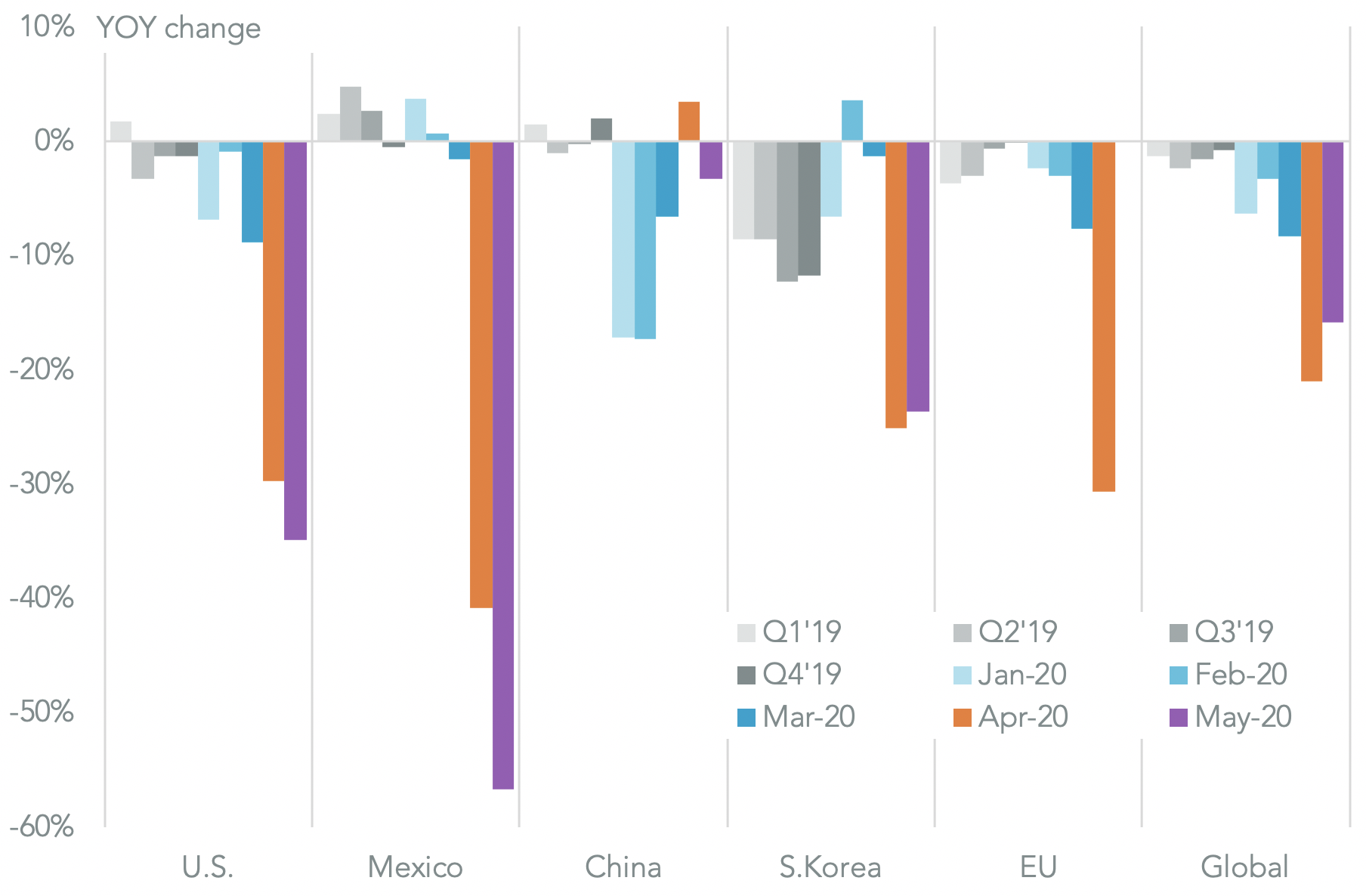

The first two stages of COVID-19’s impact can be clearly seen in global export data. Panjiva’s analysis shows global exports across 37 countries plus the EU dropped by 8.4% in March before slumping 21.0% lower in April. In May there’s a small improvement as some Asian markets reopen to a 15.8% decline. Some caution is needed though as May is skewed upwards by China’s export decline being just 3.3% as earlier orders were finally completed and delivered while data for the EU is not available until mid-July.

Source: Panjiva

Stage 2: Destruction of demand

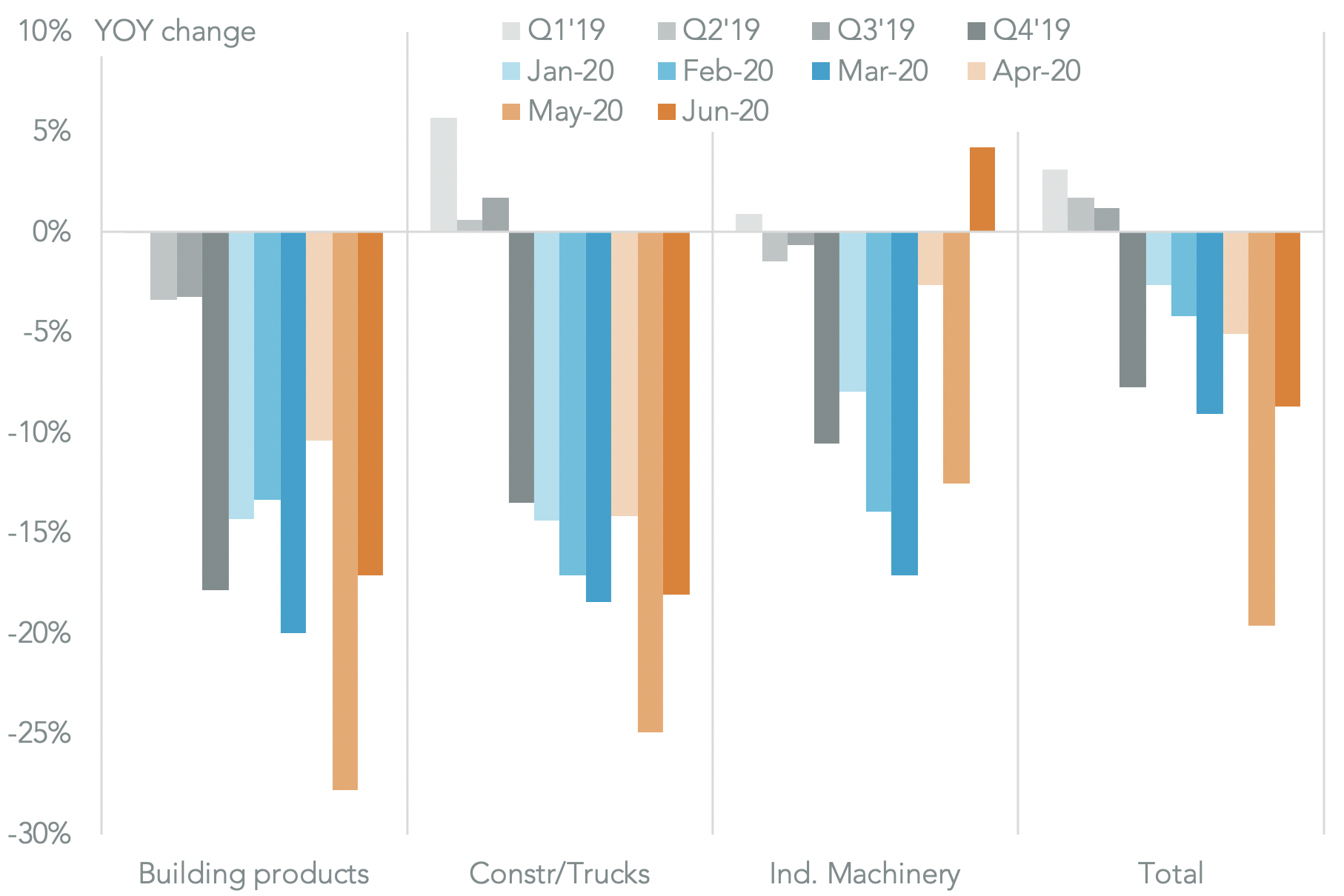

The second stage has been the destruction of demand both from consumers as well as non-manufacturing industrial demand, for example in capital equipment where investments have been suspended to protect cash flows. The worst performances have been in May with signs of recovery at the start of June.

In the consumer discretionary sector the worst performances have been in autos, shown by U.S. seaborne imports that fell by 34.6% year over year in the first half of June after a 36.6% drop in May, Panjiva data shows. Home furnishings, which have been hurt by store closures, fell by 12.3% in the first half of June after a 30.3% drop in May.

Among industrial imports, building products dropped by 17.1% in June after a 27.8% slide in May while construction machinery and heavy trucks dropped by 18.0% in June after 24.9% in May. Improving imports of electrical components and industrial machinery, which rose by 1.6% and 4.2% respectively in June, provide a sign of recovering industrial demand.

Source: Panjiva

Stage 3: Phased reopening of industry and commerce

The third stage of industrial reopenings, which started in China in March, much of Asia in late April, the U.S. in May and in Mexico and elsewhere in early June, is complicated by the different timings of the openings. Furthermore corporations may go faster or slower than regional rules depending on their own policies. Even local regulations can matter, as has been the case for Mexican automakers including Volkswagen, with potential knock-on effects across global supply chains.

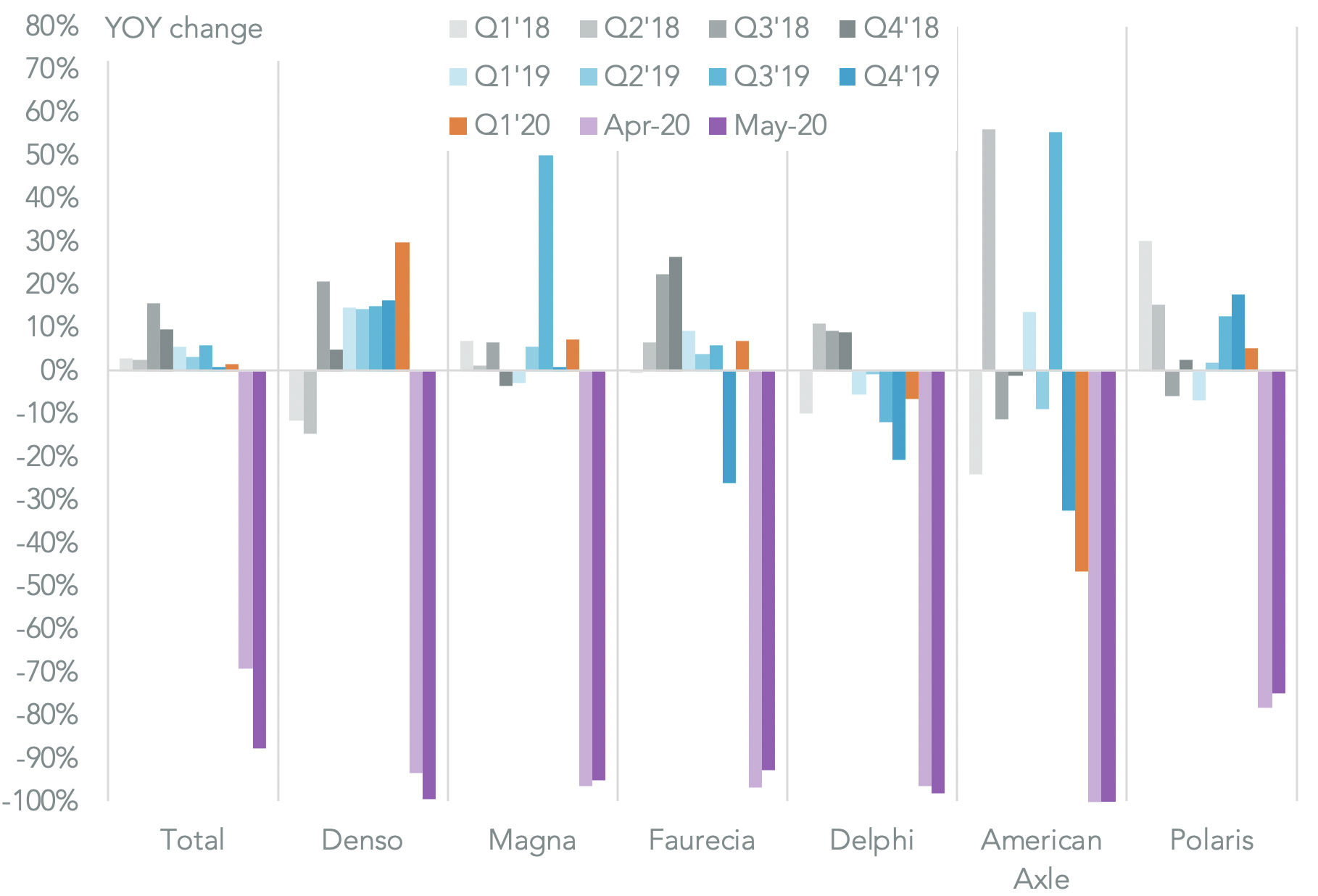

The strictness of Mexico’s lock-down, effectively outlawing operations of all non-essential manufacturing, can be seen in the auto components sector where shipments slumped 86.5% lower year over year in May after a 62.6% slide in April. With few exceptions most major auto parts exporters’ shipments to the U.S. dropped to zero. An added complication for the sector comes the implementation of USMCA from July 1 (see below).

While a resurgence of cases in many regions, including the southern U.S., may not lead to widespread disruptions in the short term the possibility shouldn’t be ruled out. Similarly, cooling weather in the northern hemisphere in the fall could lead to a further outbreak as flagged in S&P Global Market Intelligence’s recent Quantamental Research brief series.

Source: Panjiva

Stage 4: Long term planning decisions for supply chains

The fourth stage – assuming there isn’t a mass return to industrial lockdowns later in the year – involves the structuring of new, long-term supply chain restructuring plans. It’s unlikely that companies will begin to discuss these plans until operations are closer to normal, i.e. during the Q3 reporting season that won’t begin until October.

There’ll also be an overlay from government policies to support onshoring of manufacturing, particularly in critical industries, that may cause companies to pause before implementing new strategies. There’s already been hints of such policies in the U.S. including potential funding from the International Development Finance Corp. according to Reuters.

Government support for investments in medical supply chains is also likely given the widespread round of medical protectionism engaged in by many countries during the earlier part of the crisis. Panjiva’s seaborne data shows that U.S. imports of PPE only really started to surge in May and June. Pharmaceutical shipments only picked up markedly in the first half of June with a 42.6% year over year surge being driven by a doubling of imports from China, and acceleration in shipments from Europe to a 31.3% rise and a recovery of imports from India after two months of declines.

By contrast, ventilator shipments have actually declined, suggesting medical suppliers have yet to be able to attract imports from other countries that are aggressively investing in building up future treatment capacity.

Source: Panjiva

Companies’ options for their long-term supply chain decision making are similar to those relating to the trade policy upheaval caused by the U.S.-China trade war (more on which below) as well as shorter-term exogenous threats such as weather events, strikes and cyber-security breaches.

Options include:

– In-market, for-market strategies, the classical onshoring strategy which works best for large demand markets. A longer-term version of this has been driven by India’s “Make in India” strategy that has led to a shift in manufacturing of telecoms products. A similar approach could be used to guarantee against market reopening mismatches referred to in stage 4 above.

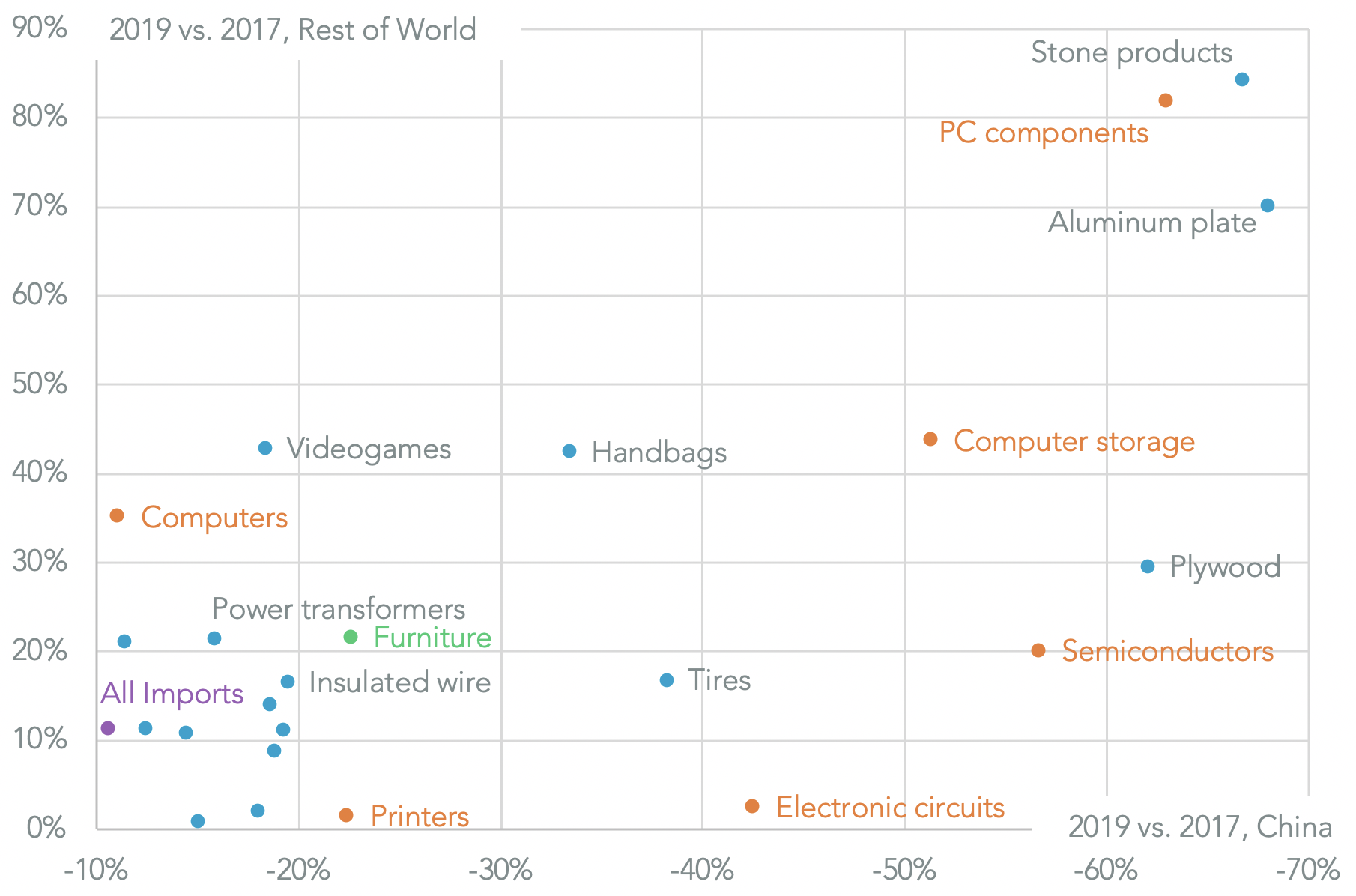

– Diversified overseas sourcing, also known as “China+n”, strategies. This has been the primary reaction to tariffs on U.S. imports from China. Panjiva’s analysis shows this approach has been used in PC components and furniture in response to tariffs. U.S. imports of PC parts from China fell by 62.9% year over year in 2019 compared to 2017 while those from the rest of the world surged 81.8% higher. In the case of furniture a 22.6% slide in imports from China was offset by a 21.7% increase in imports from elsewhere.

– Alternative logistics strategies including contracting for airfreight, access to equipment and so on. The logistics industries’ long-term push to differentiate on service may provide options here such as Hapag-Lloyd’s recently launched service guarantee package.

Source: Panjiva