Apparel retailer Guess is reacting to U.S. tariffs with a variety of strategic measures. In particular CEO Carlos Alberini has stated the firm is “shifting sourcing out of China as fast as we can, sharing impact of tariffs with vendors” according to S&P Global Market Intelligence. The firm has taken a confident stance in terms of its outlook as it “does not assume … any potential impact for the list for tariff increase on apparel and footwear imported into the U.S. from China and Mexico“.

As outlined in Panjiva’s research of May 21 the most significant risk for apparel retailers such as Guess? Would come from an extension of tariffs on Chinese exports to all imports from China. Such a move is unlikely to actually take effect until after July’s public hearings.

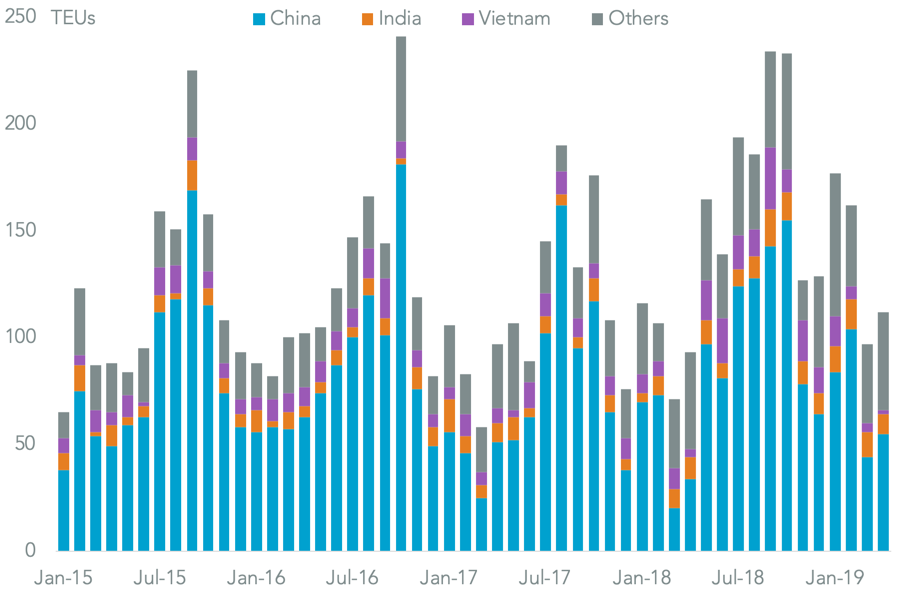

In the meantime Guess has seen a rapid rate of expansion in its U.S. seaborne imports. Looking at Guess’s key product lines growth has been quicker in apparel in the past 12 months with a 44.8% growth rate, Panjiva data shows, while footwear and luggage have increased by a lower, but still substantial 28.7%.

Source: Panjiva

Yet, there is little sign of it pulling out of China, which accounted for 59.9% of its imports in the past 12 months. Shipments have climbed 29.9% year over year in the 12 months to Apr. 30, while the growth rate has accelerated to 59.8% in the past three months.

Source: Panjiva