Freight handler UPS is adding wine-shipment routes to its portfolio in response to growing global demand. This includes a significant multinational component – UPS note 43% of wine is consumed outside its country of origin. New routes added including China and Mexico.

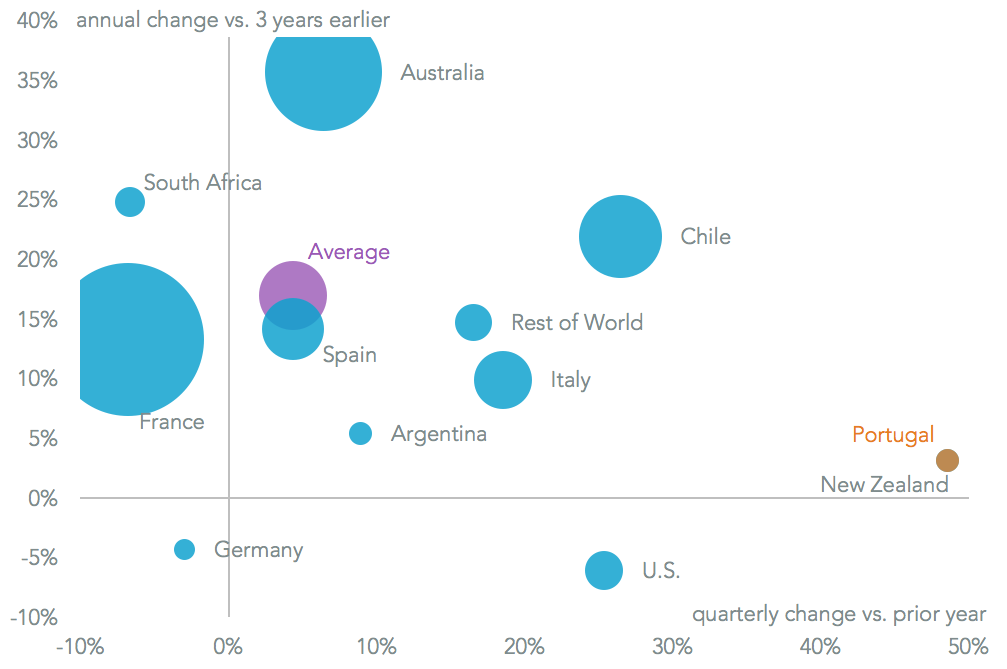

Chinese imports have climbed 17.0% in the 12 months to May 31 on an annualized basis, Panjiva data shows, to reach $2.18 billion. The biggest winners have been suppliers from Australia, which expanded 35.7%, though has seen a slowdown to 6.4% in the past quarter. The only regions to see sustained contraction were imports from the Germany and the U.S.

Source: Panjiva

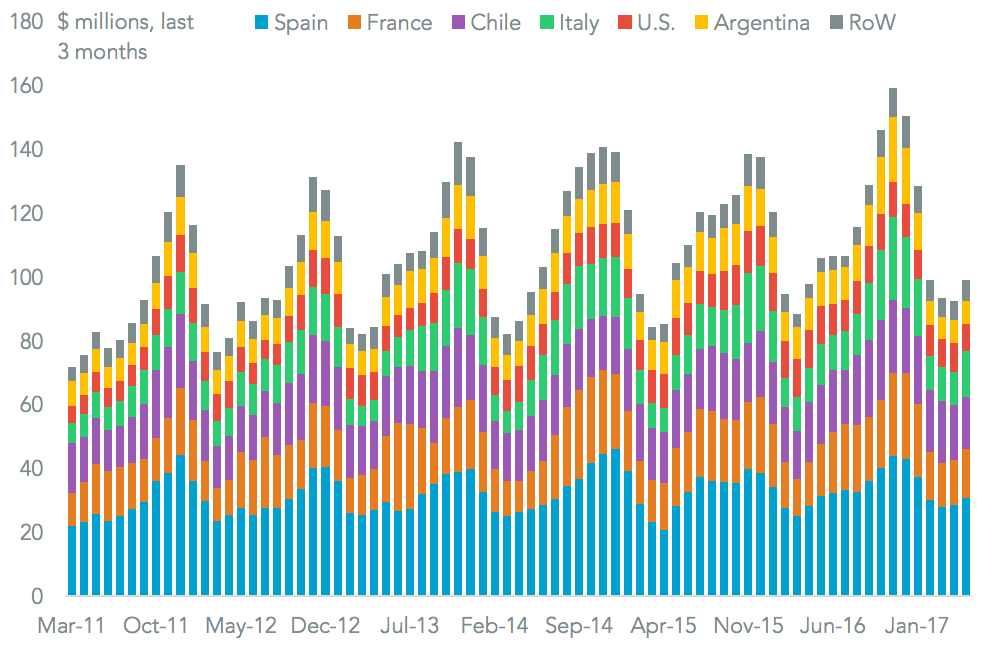

The growth in demand in Mexico has been modest, however, with growth of just 2.6% annualized over the past three years, and a contraction of 5.5% in the past quarter. Demand ius highly seasonal, peaking in October each year ahead of the All Souls and Revolution day holidays in November.

Wines from Spain (which accounted for 29.4% of the $474 million imported in the past year) did best in absolute terms, followed by a 5.4% rise in Italian products.

Imports from the U.S. meanwhile rose by just 1.9%, and have actually seen a 24.7% drop in the past quarter. The extra services from UPS may help buyers including the local division of LVMH and specialist distributor La Madrileña diversify their sourcing.

Source: Panjiva

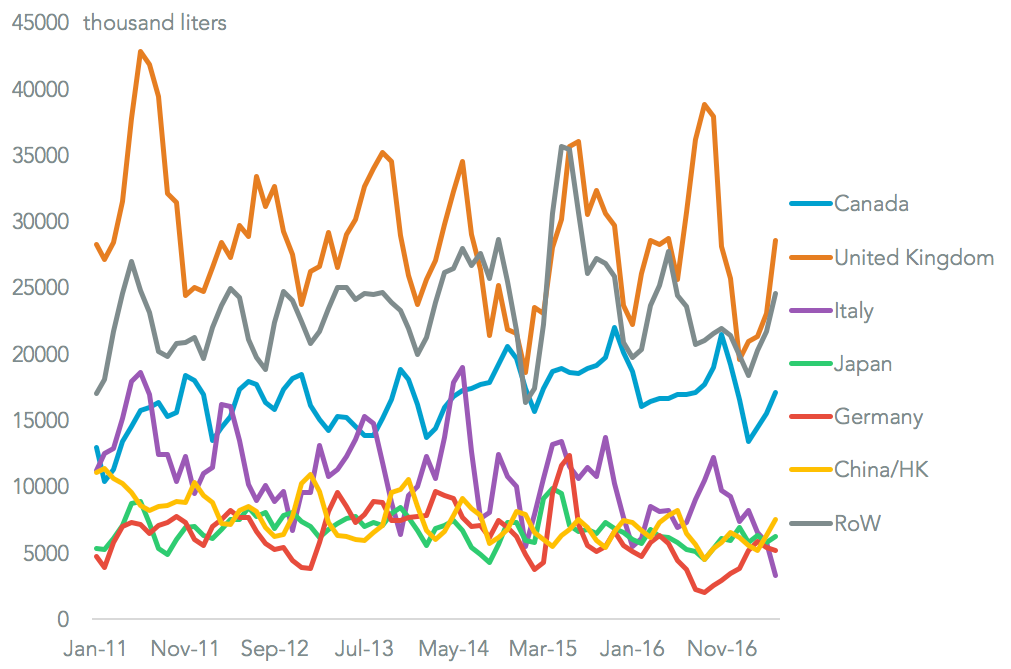

The move by UPS comes as U.S. wine exports have already been in the doldrums. Exports in the three months to May 31 were 8.5% lower than a year earlier. That’s part of a long-term decline that has seen volumes fall 5.1% annually over the past three years. That has been led by a collapse in shipments to Italy (16.1% lower annually) and Germany (22.3% down). Canada meanwhile has been an area of growth with a 3.0% expansion.

Source: Panjiva

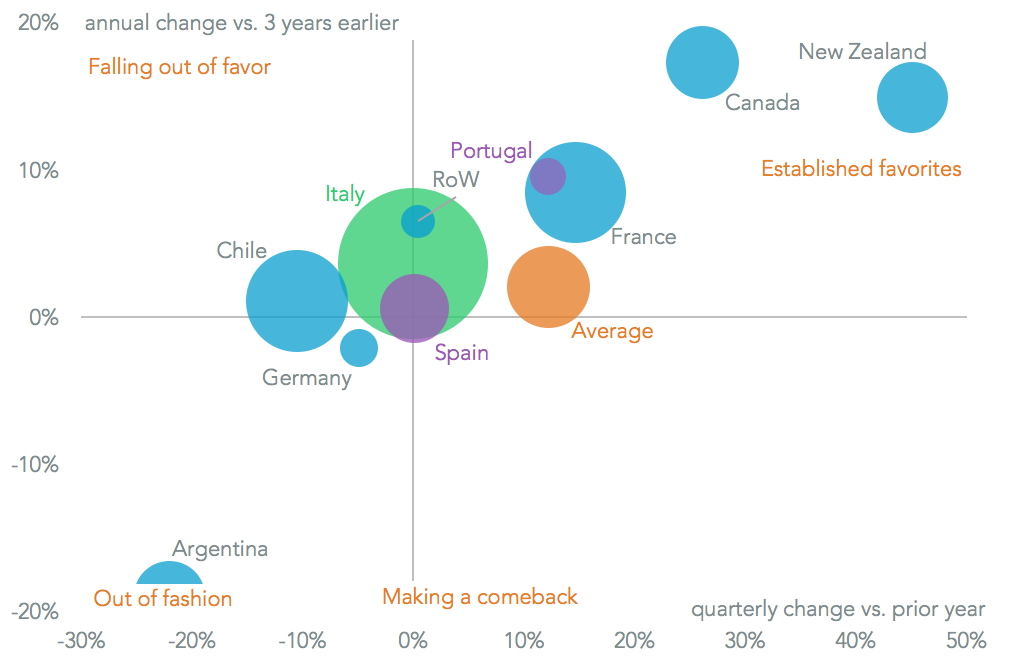

At the same time Americans’ taste for imported wine has increased, having risen 12.2% in the past quarter, with imports from France (the second largest provider after Italy) climbing 14.6%. Imports from south America have lost out, with shipments from Chile having declined 10.5% and those from Argentina slumping by 22.0%.

Source: Panjiva

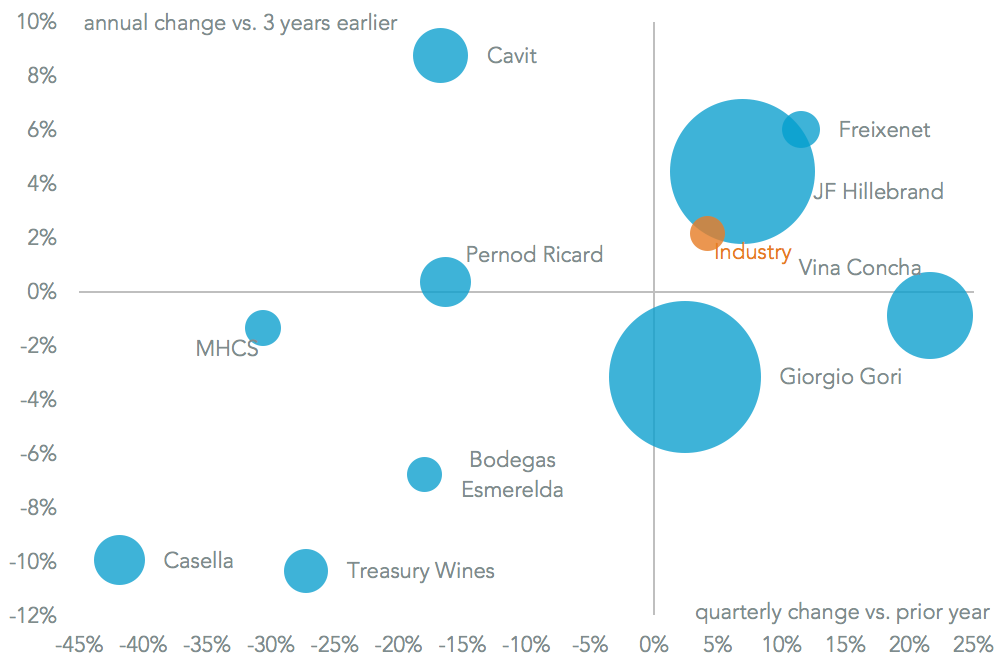

In absolute terms, number 2 shipper JF Hillebrand has expanded its shipments to the U.S. the most quickly, with a 6.9% rise in the second quarter. That outpaced number one exporter Giorgio Gori’s 2.4% improvement. Both may divert volumes (from France and Italy respectively) to other countries if UPS’s new service provides better access to more profitable markets.

Source: Panjiva