The European Commission and Mercosur trade group including Argentina, Brazil, Paraguay and Uruguay have completed a framework trade agreement after nearly 20 years of negotiations. The deal will reportedly reduce bilateral duties by 4 billion euros ($4.52 billion) relating to the 91% of products traded between the two blocs.

It may be too early to count the benefits though. The agreement needs to be converted to a legal text – which can also be a matter of negotiation. Arguably the finalization / announcement has been rushed to ensure passage under the current European Commission.

The agreed text will then require passage through the four Mercosur countries’ parliaments as well as the 27 (assuming Brexit) EU member states’, the European Parliament and in some countries (such as Belgium) the regional parliaments too.

As was seen with the CETA trade deal with Canada, as outlined in Panjiva’s research of tktk, and the EPA deal with Japan this process can easily take a year to achieve, with tariff reductions often phased in over several years – for example the EU will cut its import duties over a period of 10 years.

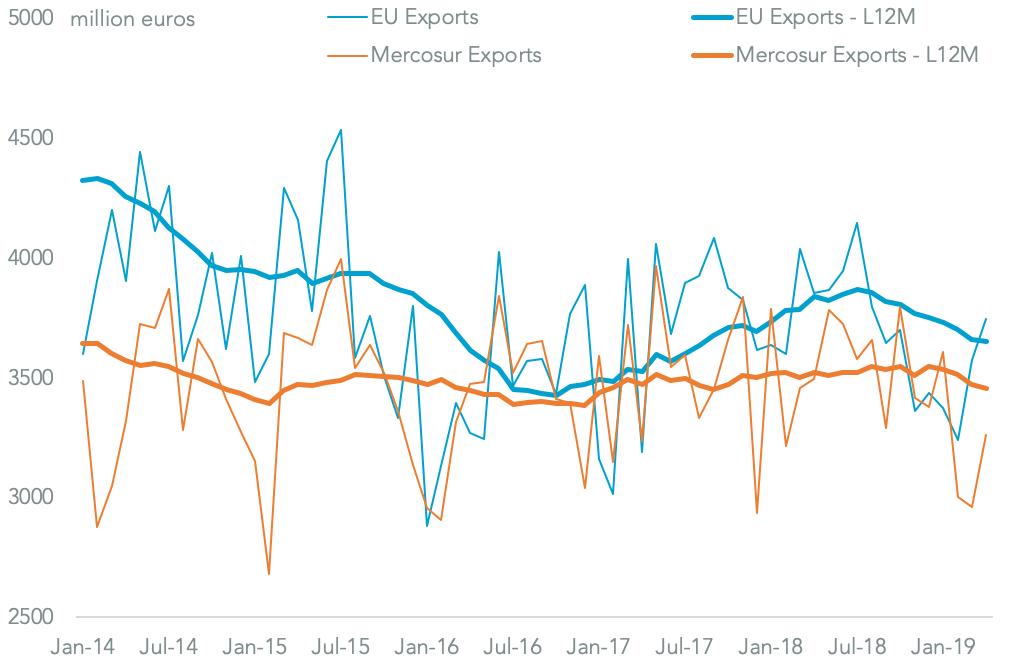

Panjiva analysis of Eurostat data shows total trade between the two regions was worth 85.3 billion euros in the 12 months to Apr. 30, down 3.5% year over year. The deal is essentially between Brazil and the EU though – the pairing accounted for 75.2% of the total bilateral trade, followed by Argentina with 19.6%.

Source: Panjiva

In many instances there will be quotas applied to imports – for example Mercosur will have a 50,000 vehicle quota on car imports. Panjiva data shows that most major automakers have already structured their supply chains for regional manufacturing. The leading shipper of vehicles to Brazil in the 12 months to Apr. 30 was Volkswagen with 32.9% of imports by mass from Mexico and Argentina.

BMW meanwhile was in second place with imports of SUVs from the U.S. and sedans via Belgium. Ford meanwhile shipped from Mexico and Nissan from Chile with Fiat-Chrysler rounding out the top five with shipments from Argentina.

Source: Panjiva

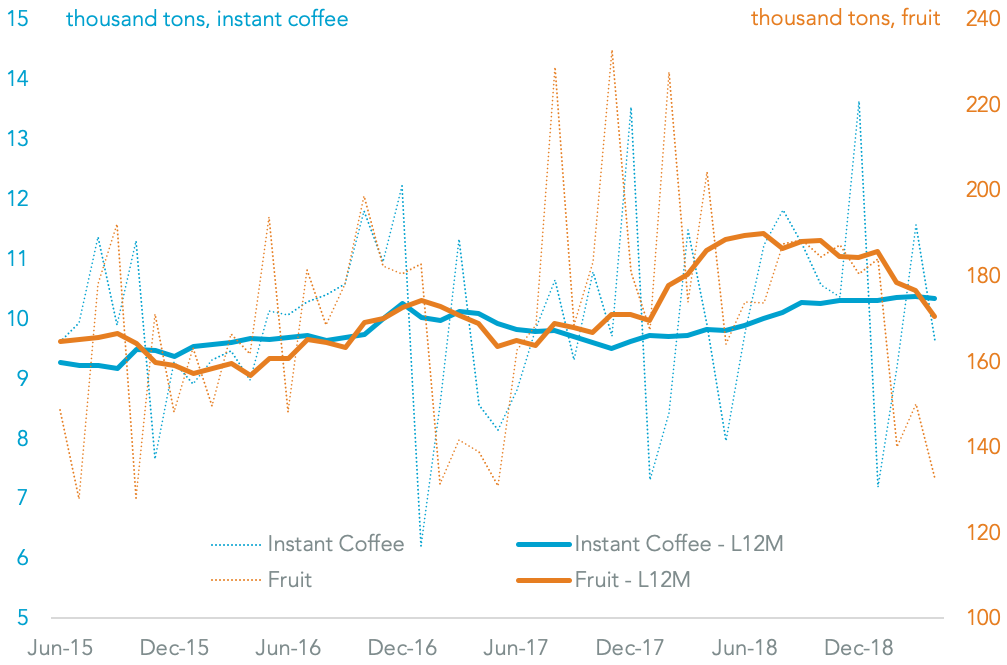

In terms of exports from Brazil the biggest winners are expected to be in instant coffee, according to the Wall Street Journal, as well as fruit and fruit products according to the Financial Times.

The largest buyer globally of instant coffee from Brazil in the past 12 months was tNestle with over 17% of the total followed by JM Smucker with 5.6%. As outlined in Panjiva’s research of Jun. 4 Brazil’s coffee exporters currently face a glut of raw coffee, though over the longer term exports have only increased by 2.8% annually in the three years to Apr. 30.

The largest shippers of fruits – including prepared products like juices – are aggregators including Netherlands-based Cutrale Contintental 16.8% of shipments and Citrus Products with 14.8% while drinks manufacturers – such as Coca Cola with 0.9% – tend to focus on niche products. The fruit juice industry has similarly only seen growth of 2.9% in the past three years.

Source: Panjiva