U.S. President Donald Trump’s first overseas trip since his inauguration will include visits to Saudi Arabia, Israel, the NATO leaders conference and the G7 heads-of-state meeting. Most of the meetings will focus on national security, though the importance of trade policy to the President’s economic policy means it will also likely be discussed.

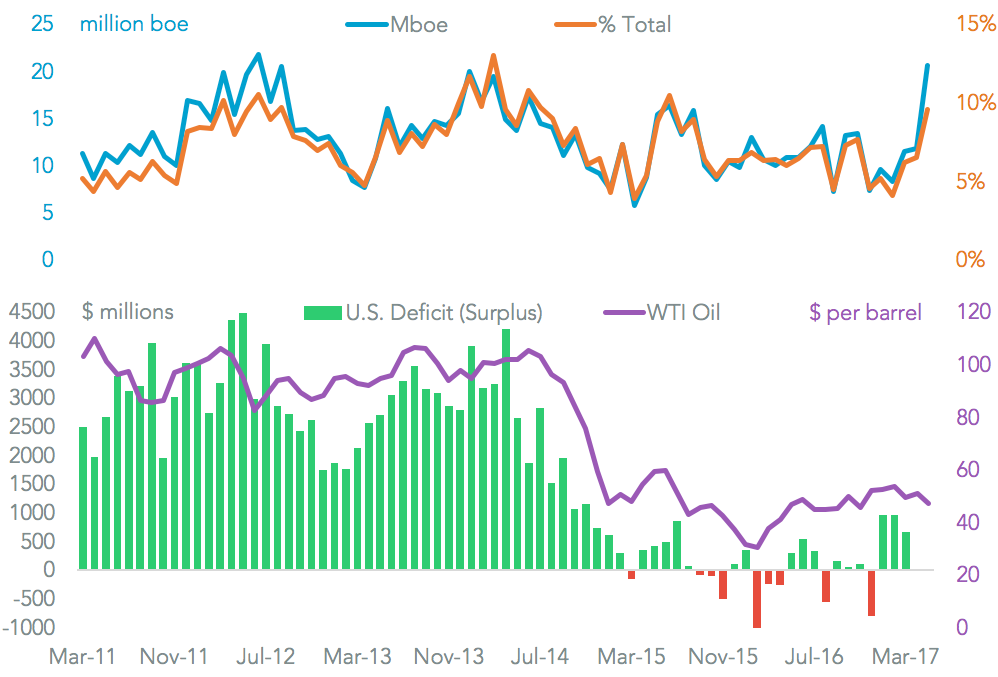

With regards to Saudi Arabia, the U.S. ran a $2.5 billion trade deficit in the past 12 months, Panjiva data for U.S. imports and exports shows. Oil made up 93.6% of Saudi Arabia’s exports to the U.S., with the result that there has been an 91% correlation between the oil price and the U.S. trade deficit over the past five years.

However, the Trump administration’s “ America First Energy Plan” First policy calls for “energy independence from the OPEC cartel”. In the 12 months to March 31 6.4% of U.S. oil imports were sourced from Saudi Arabia, Panjiva data shows. In March that figure rose to 9.6% as imports from Saudi Arabia reached their highest since June 2012. One offset may come from increased investment from Saudi Arabian authorities in U.S. infrastructure, which could reach $40 billion according to CNBC.

Source: Panjiva

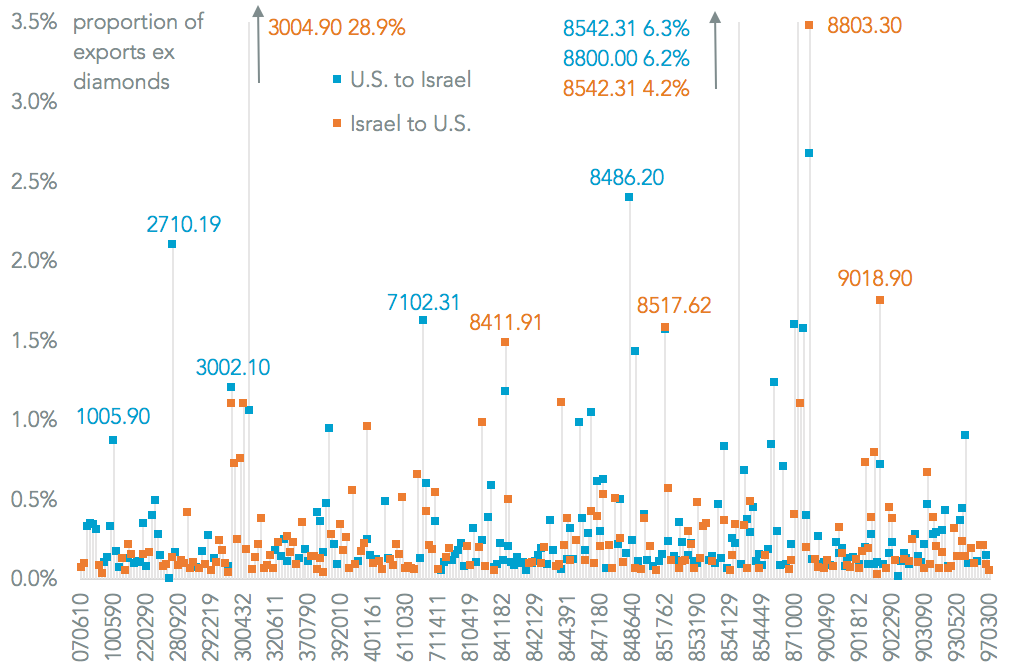

The President’s meetings in Israel will also likely focus on security, though it is worth noting that Israel ran a $9.57 billion trade surplus vs. the U.S. in the 12 months to March 31. Israel already has a free trade deal with the U.S., which is being reviewed as part of the performance review of trade deals, as outlined in Panjiva research of May 2. That suggests that, geopolitics aside, similar rhetoric deployed with South Korea should be applied to Israel if the President wishes to be internally consistent.

Putting aside diamonds (which account for 33.5% of bilateral trade and $2.2 billion of the U.S. deficit) top export lines from Israel are dominated by pharmaceuticals (28.9% of exports ex diamonds) and medical devices (1.8%), Panjiva analysis shows. That may mean the President’s aims to cut healthcare costs are discussed. There is significant bilateral trade in semiconductors (6.3% of Israeli exports, 8.7% from the U.S. including equipment) and aerospace (4.9% from Israel, 8.8% from the U.S. including parts), suggesting closely linked supply chains that may be difficult to unpick.

Source: Panjiva

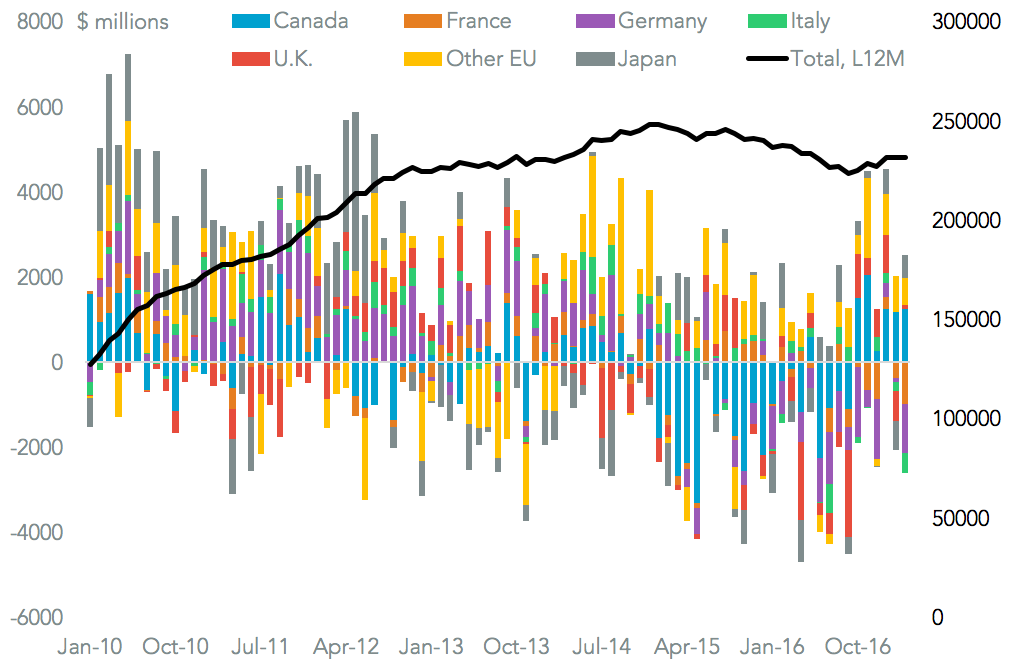

If the meetings with Israel and Saudi Arabia show the need to balance security and trade policies, the G7 summit will likely focus mostly on trade. The U.S. runs a trade deficit with all but one of the G7 members (the U.K.), which totalled $231.7 billion in the 12 months to March 31. That was 5.8% below its November 2014, largely as a result of a falling deficit vs. Germany being offset by a rising deficit with smaller EU states and Canada’s energy-driven surplus.

A trade dialogue has already been initiated with Japan. The tone of the debate will be key to understanding future trade dealings. The President’s meetings with the leaders of Japan, Canada and Germany have proven to be more collaborative than his rhetoric would suggest.

Source: Panjiva