U.S. Commerce Secretary Wilbur Ross has stated the U.S. could start the 90-day consultation period for NAFTA renegotiations by March 24, Reuters reports. This is required by the T rade Promotion Authority rules so that President Trump can negotiate without having to first consult Congress. Secretary Ross’s comments follow previous interviews that suggested negotiations might not start until the “latter part of this year” as discussed in Panjiva research of March 8.

Presuming the TPA consultation is triggered within two weeks, that means NAFTA negotiations would start June 22. Even once a deal is agreed – which Secretary Ross hopes won’t take “substantially more than a year” – it still needs to be ratified by Congress. That would make Congressional discipline an issue, with the current passage of the American Health Care Act being a potential test.

Furthermore should a deal take a year to emerge, ratification may run into pre-election politics. U.S. midterm elections are due November 6 2018, with 34 Senate seats and all seats in the House of Representatives due to be elected. Furthermore, before that Mexico is due to hold general elections in July 2018.

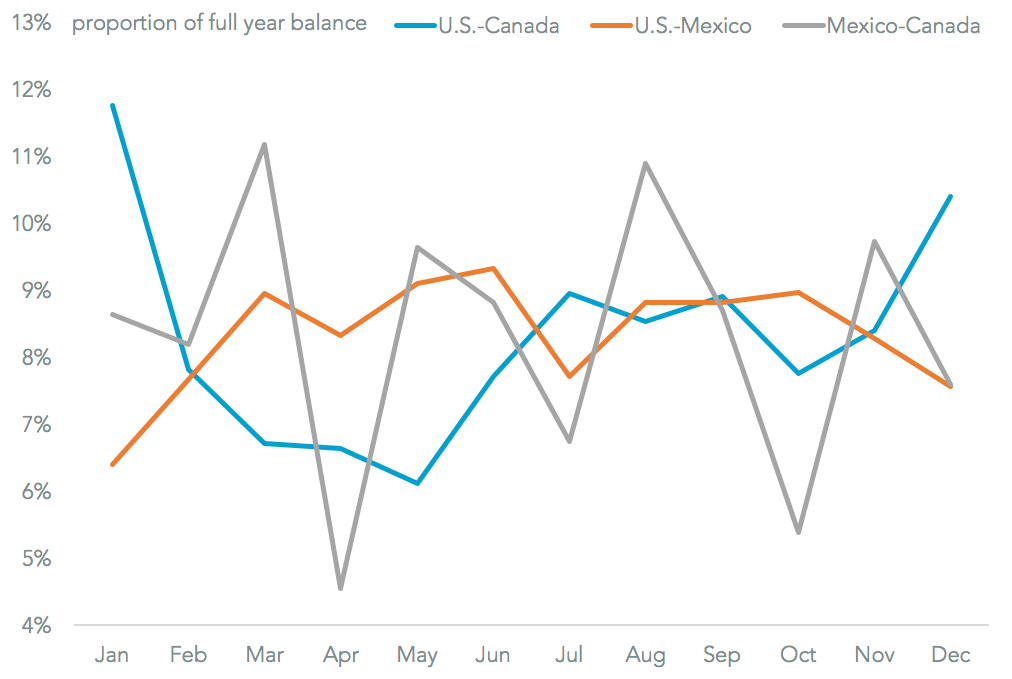

The U.S. negotiating stance includes a preoccupation with trade deficits. While positions should be taken on the basis of long-term balances, short-term rises (or dips) will have an effect. Panjiva’s analysis of U.S. imports and exports, and Mexican trade data, shows that the U.S.-Canada deficit tends to peak near the beginning / end of year while that with Mexico peaks nearer June. That may mean that higher-than-normal deficits for the U.S. vs. Mexico arrive just as negotiations start.

Source: Panjiva