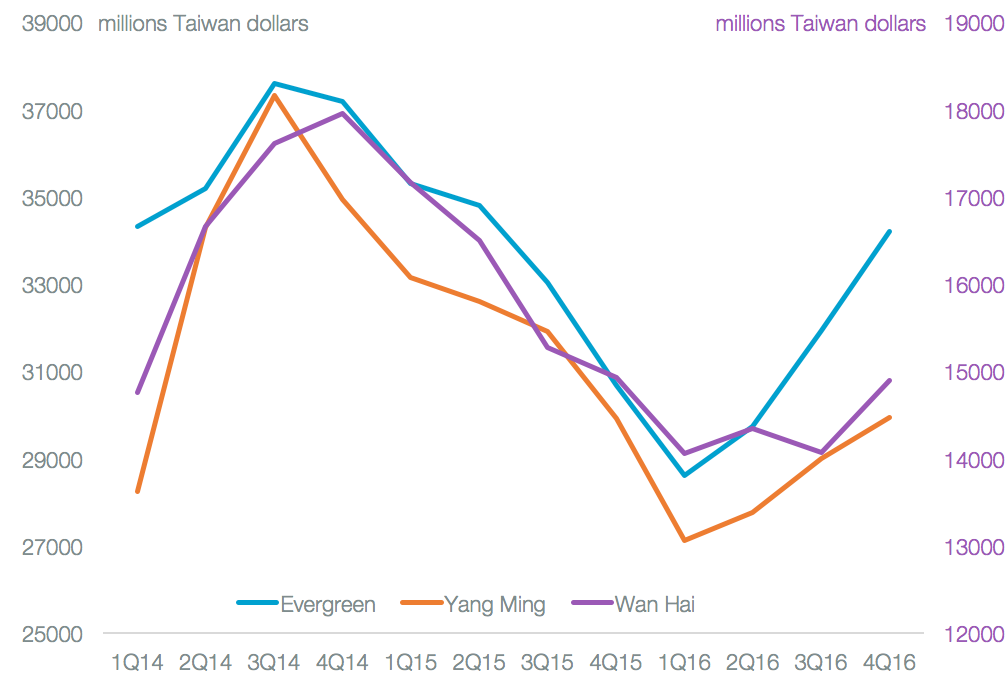

The Taiwanese shippers delivered fourth quarter earnings that were 5.4% higher on a combined basis than the third quarter. While Evergreen Marine turned in the fastest growth at 7.1%, it also lagged analysts’ estimates, gathered by Bloomberg, by 1.7%. Wan Hai by contrast expanded 5.8%, but had only been expected to grow by 1.0% while Yang Ming’s expansion was the slowest at 3.3%. The combined rate was somewhat slower than the combined Japanese shippers’ 6.2%, but just ahead of COSCO Shipping’s 5.5%, as outlined in Panjiva research of March 31. The narrow band of performance would suggest competition between the groups was not as aggressive in the past.

Source: Panjiva

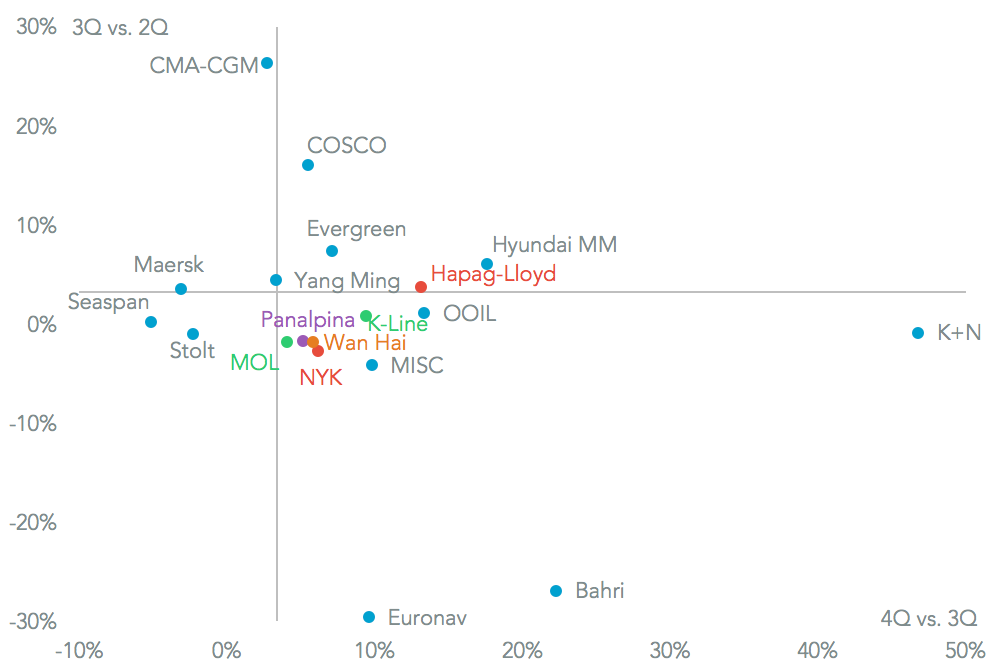

Taking the Taiwanese shippers’ results into account, revenues for the shipping industry overall likely increased 3.4% in the fourth quarter compared to the third. That followed 3.2% growth in the third quarter and 2.5% in the second, based on a cross-section of the 20 largest shippers, and including Hanjin Shipping’s demise. The acceleration from the third quarter from the fourth was common across the group except for Stolt-Nielsen (lower volumes), Seaspan (loss of business from Hanjin Shipping), Maersk (due to a 15.5% drop in oil revenues) and CMA-CGM (the prior quarter included the first consolidation of NOL).

Source: Panjiva

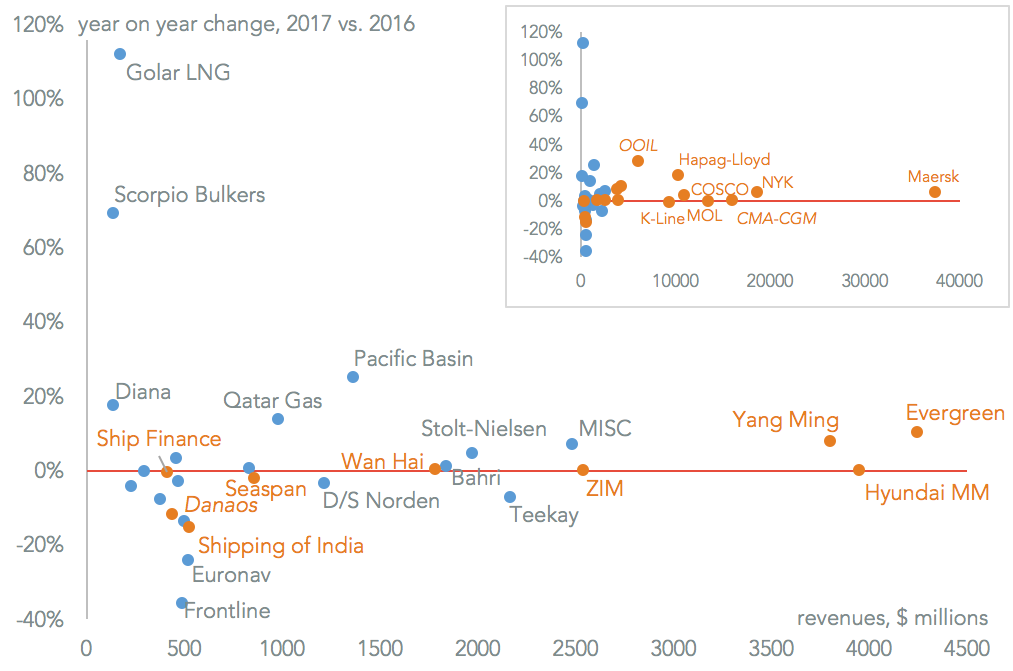

The growth is expected to continue during 2017, in-line with generally cautious management statements that refer to the need for continued discipline in pricing and new capacity. Panjiva analysis of analysts’ estimates for 35 shippers, gathered by Bloomberg, indicate expectations for growth of 4.5% for the year as a whole. There is significant diversity in performance, with 14 of the 35 companies surveyed expected to see a decline in revenues, though the major container-lines are all expected to grow revenues in the coming year.

In the first quarter this should be deliverable given average container rates were 7.5% higher in the first quarter than the fourth, while tanker rates were 7.0% better. There is a paradox faced by the bulkers – while rates reached their highest since 2014 during March the quarter overall was 5.9% lower than the fourth. The first quarter reporting season starts with Pacific Basin and Stolt Nielsen on April 6.

Source: Panjiva