Meetings between President Xi and President Trump were focussed on relationship building as much as firm measures. In briefings afterward Commerce Secretary Ross highlighted a 100 day program with “hopefully way stations of accomplishments” to improve the balance in trade between the two. The U.S. focus on reducing the trade deficit, including increased exports, is not a surprise, though China also wants to cut the surplus as it is distorting domestic monetary policy according to the Wall Street Journal.

While firm details of the 100 day plan have yet to emerge, they may include improved access for financial investments via a bilateral investment treaty and U.S. agricultural exports including beef, the Financial Times reports. The latter would be an example of a quick in within a 100 day program, particularly given recent declines in beef exports and lobbying by the industry as discussed in Panjiva research of March 28.

Another quick win could be in the energy sector, an area Foreign Minister Wang identified as an area for development. That may include increased shipments of U.S. oil and in particular liquefied natural gas. Panjiva data shows Chinese imports of LNG have been sporadic, with deliveries in only three of the past eight months since U.S. exports have gotten properly underway. Over the past year China accounted for 12.2% of U.S. LNG exports while the U.S. accounted for just 1.4% of Chinese LNG imports.

Source: Panjiva

There are plenty of ways the “100 day” process could be derailed however, particularly around issues of timing. So far no details of what the program will look like, or when it will start, have yet to be outlined. Significant development, or possibly even completion of the programme, would be needed before President Trump travels to China, which is due by the end of the year.

Near term a U.S. Treasury report into currency manipulation could damage negotiations. Similarly, a 90 day U.S. review of the drivers of the U.S. deficit could generate negative sentiment. Furthermore broader policies that may capture Chinese interests – for example an Executive Order on steel trade flagged by the New York Times may become an issue.

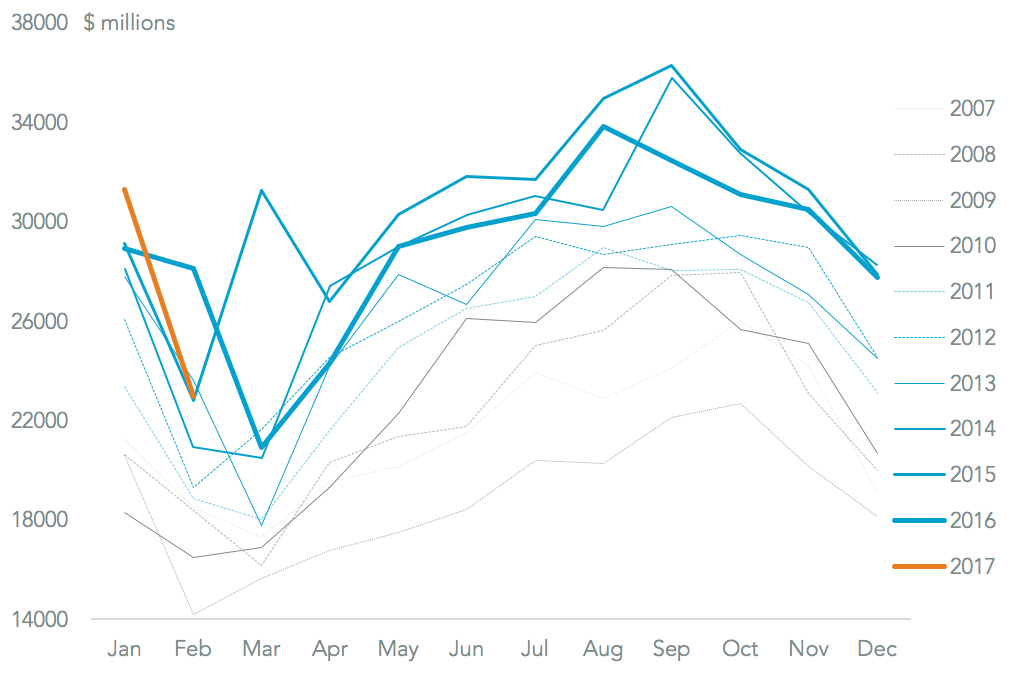

While the U.S. deficit vs. China fell 18.3% in February, early import data for March shows a marked rebound in Chinese shipments to the U.S. and hence the risk the deficit increases once more. Furthermore, Panjiva analysis shows the deficit (ie imports less exports) tends to peak around September or October each year. Assuming a “100 day program” is started by the end of May, the results in the form of a desired cut in the deficit could coincide with the seasonal peak. That may make it look less “successful” than it may otherwise.

Source: Panjiva