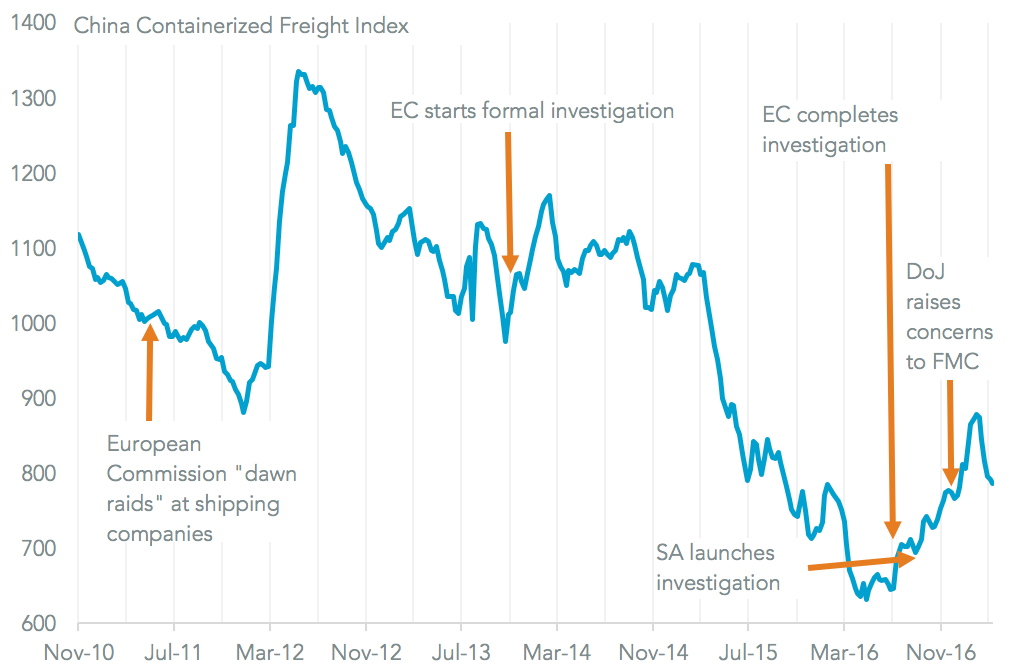

The U.S. Department of Justice has served subpoenas for information at a meeting of 20 container-lines including their CEOs, the Wall Street Journal reports. It is not clear whether the case relates to specific allegations, shipping alliances in concept or price setting in the shipping industry generally. It follows a European Commission investigation concluded in July that looked at the pricing communications by the shippers, as outlined in Panjiva research of July 7, as well as specific accusations of collusion by the South African authorities.

The timing is notable. The Department of Justice asked the Federal Maritime Commission to review the practices of the shipping alliances in late November, but the FMC approved THE Alliance nonetheless in mid-December. THE, along with OCEAN, starts operations at the beginning of April.

Container shipping prices, as measured by the Shanghai Shipping Exchange CCFI index, increased 38.2% at their recent peak of February 10 compared to their April 2016 lows. Yet, they have fallen for six straight weeks since then and are now 10.5% below that level. That may reflect concerns about a new cycle of capacity investment, which has colored recent outlook commentary from several management teams.

Source: Panjiva

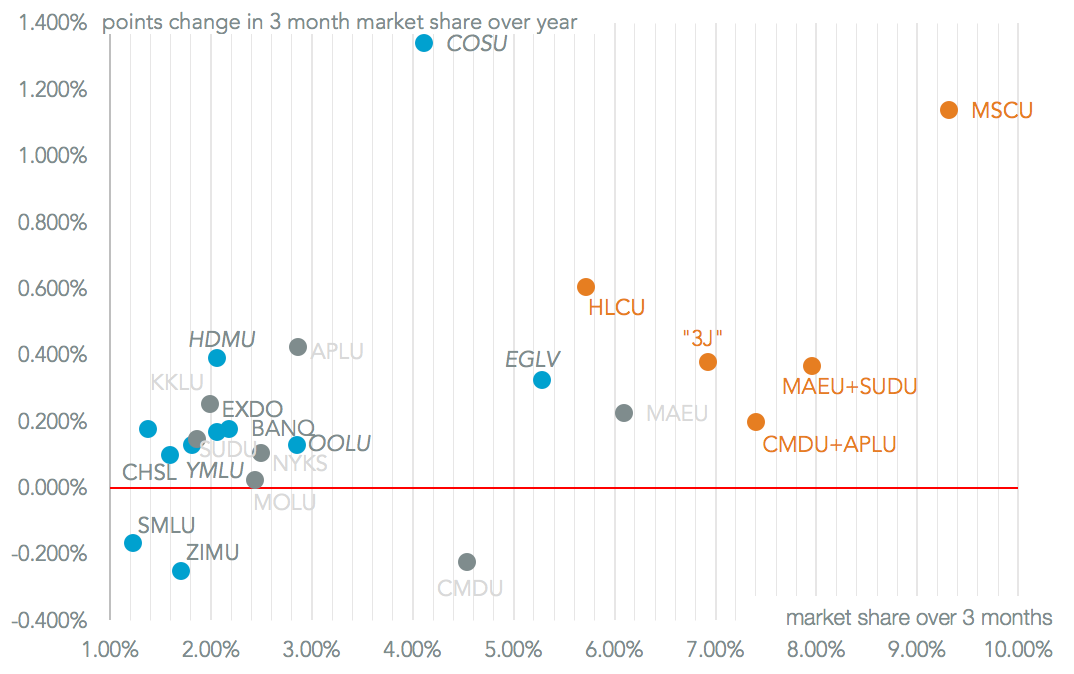

If anything the FMC has been supportive of alliances’ ability to lead to lower shipping costs overall, though there are still questions outstanding about further ownership consolidation. Maersk is currently in the process of acquiring Hamburg Sud, while the three Japanese shippers are in the process of merging. More deals are possible with CMA-CGM has having stated a desire to expand its U.S. market share by acquisition, and SM Group determined to reach a similar scale to Hanjin Shipping before its failure.

U.S. inbound traffic is an example of where consolidation is already occurring. Panjiva data shows that the “big 5” (MSC, Maersk/Hamburg Sud, “3J”, CMA-CGM and Hapag-Lloyd/UASC) would have had a 37.3% market share in the three months to February 28. That was up 2.7% points on a year earlier on a like-for-like basis. When counting their respective alliances this rises to 50.7%, with much of the remainder being handled by NVOCCs or smaller operators on specialized routes. While the DoJ may or may not investigate price setting or other matters this move could cast a pall over U.S. approval for Maersk’s bid and 3J’s merger.

Source: Panjiva