President Trump has raised the prospect of placing tariffs on EU autos and Chinese exports more broadly in retaliation for duties placed on U.S. exports of lobster, the Financial Times reports. The President has put China-hawk Peter Navarro in charge of the process referring to him as “the lobster king“. No formal schedule or trade investigation has been put in place though the two targets have been historic bug-bears for the Trump administration.

Panjiva’s analysis of World Trade Organization data shows that the EU applies a most-favored nation tariff rate of 11.3% to crustaceans while China applies an average rate of 6.3%. Both have applied higher duties on U.S. exports however. In the EU case that’s been due to retaliation against U.S. steel / aluminum duties while in China’s case it’s been part of the trade war.

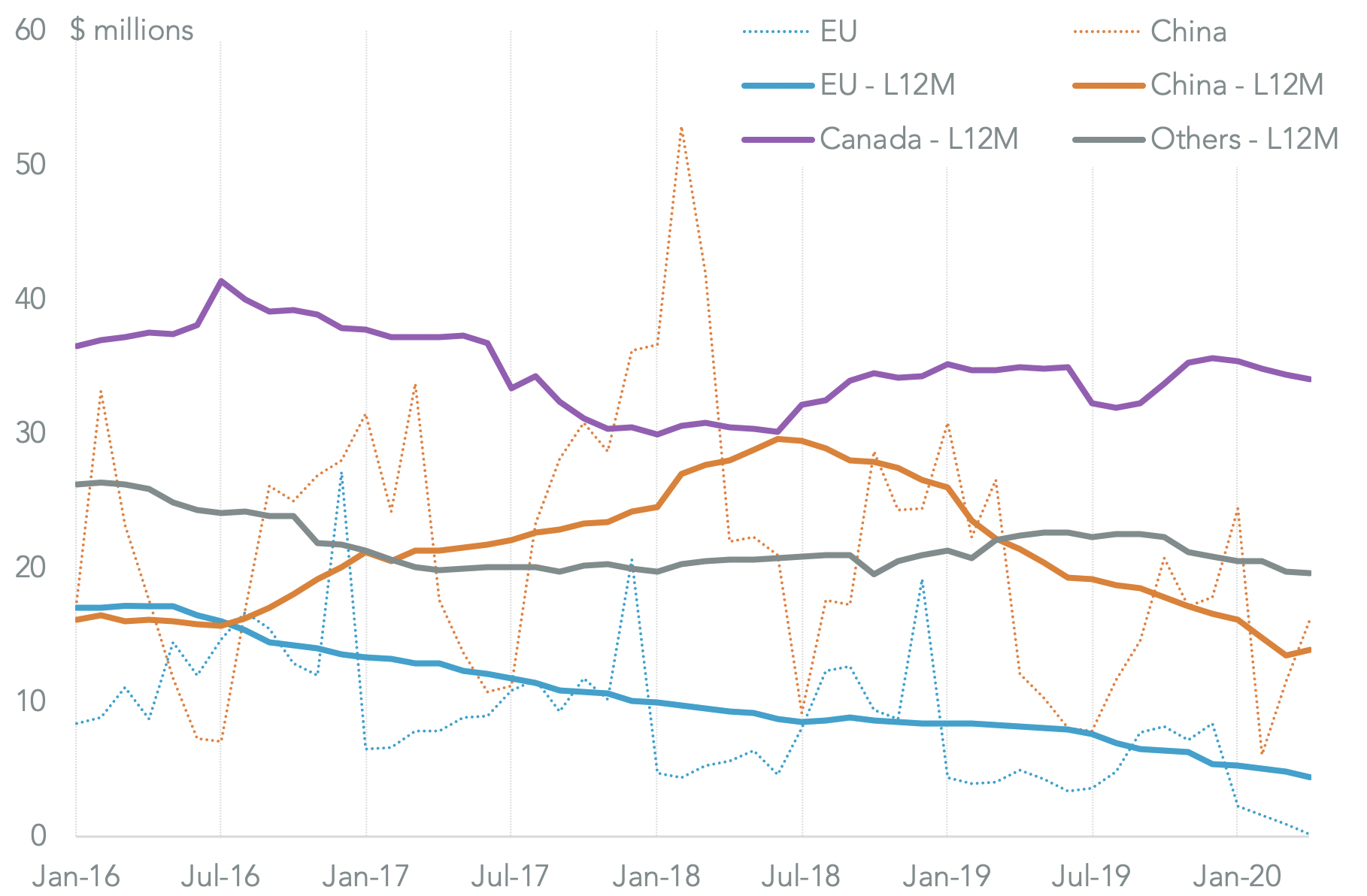

Panjiva’s data shows there’s certainly been a significant downturn in U.S. exports of crustaceans to the EU and China with declines of 46.8% and 35.2% year over year respectively in the 12 months to April 30 compared to a year earlier.

As a result the EU represented 6.1% of exports in the past 12 months while China represented 19.3%. The largest market is Canada which received 47.4% of exports from the U.S. in the past 12 months after a decline of 25.2%. Applying pressure now makes sense from a seasonal perspective with peak lobster exports normally occurring in the August through October period.

Source: Panjiva

The announcement was made during a visit by the President to Maine, the hub of U.S. lobster exports, raising the prospect that granular trade policy commitments may form part of Trump re-election campaign. It also comes as Vice President Biden has passed the threshold needed to obtain the Democratic Party nomination, kicking off the general election cycle.

As outlined in Panjiva’s March 13 report the U.S.-China trade war has had very different impacts at a state-by-state and district-by-district level, leaving plenty of room for micro-interventions in trade policy before November.

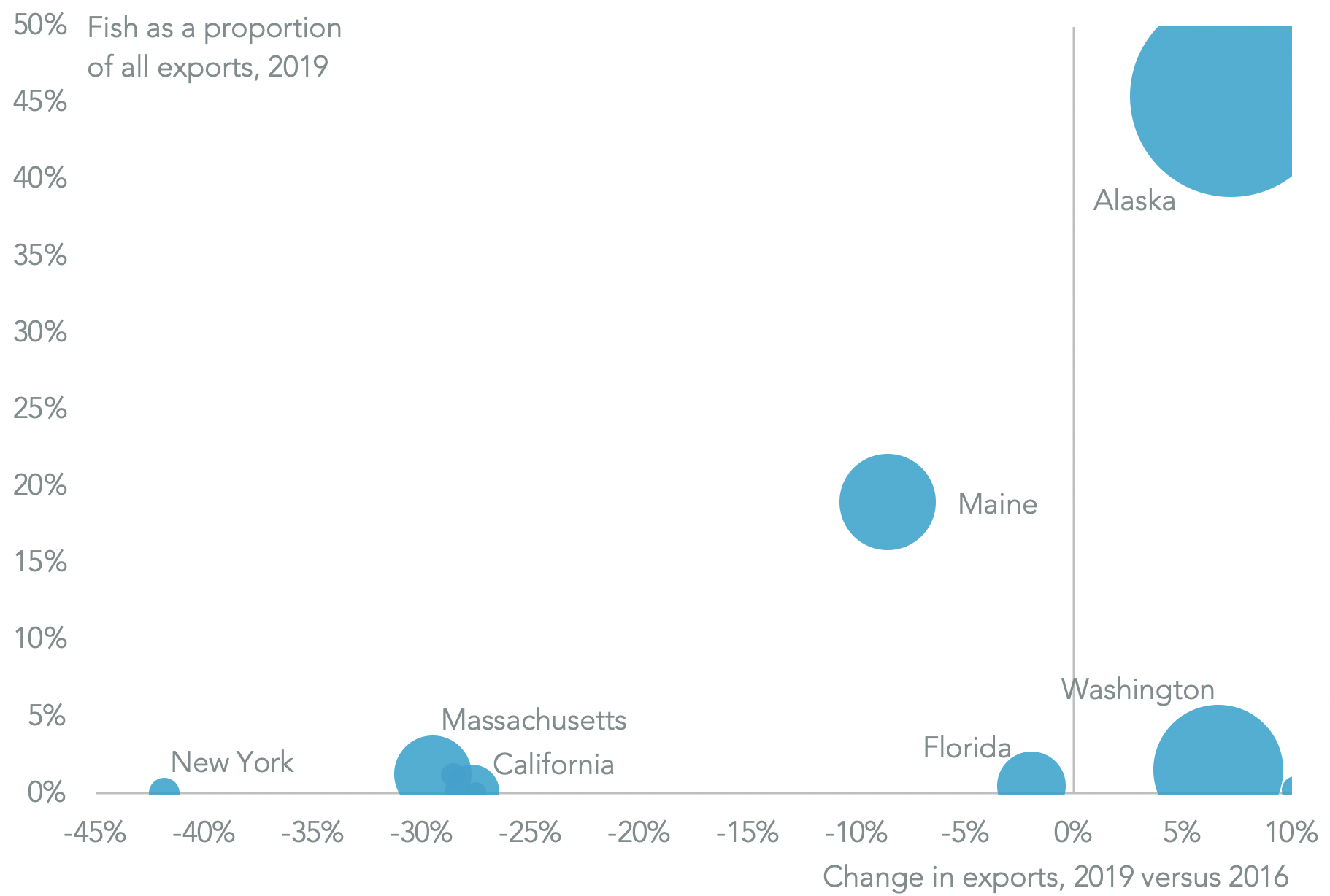

Fisheries more broadly have been a focus for the U.S. Commerce Department more broadly, with total U.S. exports of all fish products having declined by 1.7% year over year in 2019 compared to 2016. Maine is the second most exposed state to fisheries at 19.0% of all exports in 2019 after Alaska’s 45.5% and well ahead of Hawaii’s 5.7%.

The industry may also be a focus in other seaside states including Massachusetts and Washington which were the second and fourth largest exporters respectively. Exports from Maine of all fish fell by 8.6% in 2019 compared to 2016 while Massachusetts suffered a 29.5% slump while California’s fisheries have suffered a slump of 27.7%.

Fishery policies are unlikely to swing the Presidential election with the main states that have seen a drop in fisheries exports being solidly Democratic-leaning according to polling from FiveThirtyEight. There are, however, Senate and Congressional races to be considered including the Republican Senate seat held in Maine by Senator Collins.

Source: Panjiva