An extended response to the coronavirus outbreak in Mexico could slash demand for natural gas used in electricity and industrial process settings, S&P Global Platts reports, with a new set of policies from the administration of President Andrés Manuel López Obrador due shortly.

There’s already been a slide in the value of natural gas imports to Mexico recently, alongside a slip in the value of refined oil imports discussed in Panjiva’s research of March 26.

Panjiva’s data shows total natural gas imports fell by 29.6% year over year in the first two months of 2020, following a 23.8% slide in Q4. Liquefied natural gas (LNG) imports have borne the brunt of that downturn with a 61.4% drop in the first two months of 2020 while pipeline gas sourced from the U.S. dropped by 26.3%.

Source: Panjiva

Mexico’s major natural gas importers will need to increasingly compete with buyers in China for U.S. gas supplies, especially as the Chinese government seeks to fulfill the terms of the phase 1 trade deal. Indeed, Panjiva’s data shows China’s imports from the U.S. in January were zero.

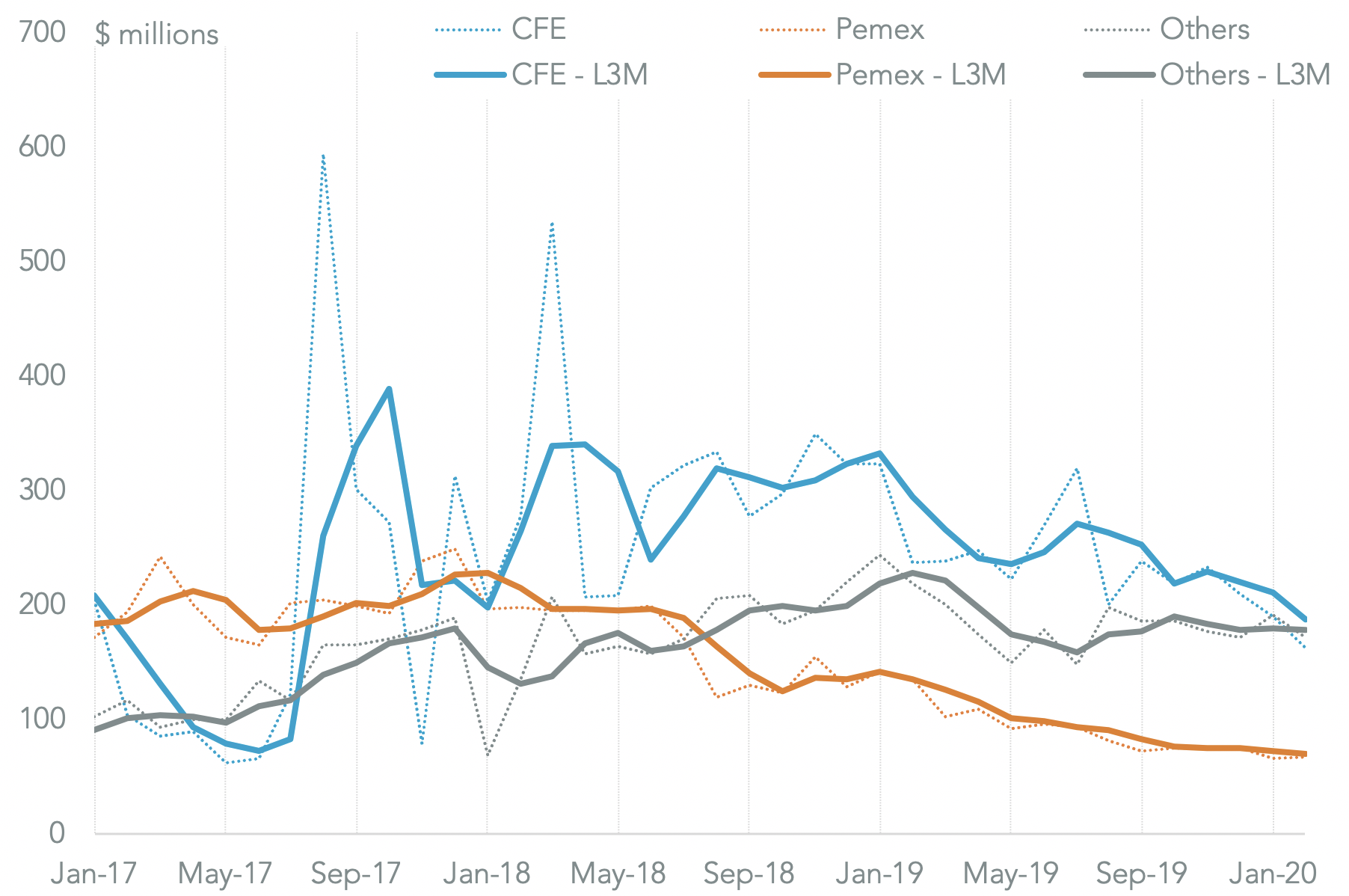

The natural gas import costs for major importers including electricity operator CFE and distributor Pemex are unlikely to rise though given the global collapse in oil prices which are a contributor to some LNG contracts.

The recent slide in gas imports has included a 37.1% drop in shipments linked to CFE while those associated with Pemex fell faster with a 52.0% slump. Shipments from other importers including Sempra LNG and BP meanwhile fell by a more modest 21.6%.

Source: Panjiva